How to Recover Your Unclaimed SBI Shares and Dividends from IEPF

Before looking at the process of claiming SBI unclaimed shares and dividends that are transferred to the IEPF, it's essential to understand why reclaiming these shares and dividends is crucial. Since its listing on the stock exchanges, SBI shares have consistently been among the top performers in the stock market. For instance, the price per share was around Rs. 18 in the year 2000, and it skyrocketed to Rs. 576 as of November 1, 2022. This appreciation does not even account for any bonus issues or stock splits that may have occurred.

Let's assume you purchased 250 shares of SBI in 2000 at a price of Rs. 18 per share.

Your Total Investment: 250 shares Rs. 18/share = Rs. 4500

On November 20, 2014, SBI executed a stock split in a 10:1 ratio. This means your 250 shares were converted into 2500 shares.

Now, let's look at the scenario as of November 1, 2022:

The current share price of SBI is Rs. 576.

Current Investment Value: 2500 shares Rs. 576/share = Rs. 14,40,000

In 2000, an investment of Rs. 4500 for 250 shares of SBI has now grown to a substantial value of Rs. 14,40,000. This transformation includes the impact of the stock split as well as the current market price of the shares.

If you haven't claimed your SBI shares and dividends, the growth in your investment should definitely motivate you to track down and recover those unclaimed shares and dividends.

The Legacy of the State Bank of India

State Bank of India (SBI) is an India-based, state-owned banking and financial services firm, classified as a Public Sector Bank (PSB). It is not only the largest PSB in India but also the country's largest bank overall, followed by HDFC Bank Ltd. SBI operates in various sectors, including Corporate/Wholesale Banking, Treasury, Retail Banking, and other financial/banking services.

The Treasury segment deals with trading in foreign exchange contracts, managing the investment portfolio, and handling derivative contracts. Corporate/Wholesale Banking involves lending activities for large corporate account groups, stressed asset resolution groups, and commercial client groups. It includes providing loans based on clients' credit history and transaction services for institutional or corporate clients. Retail Banking services cover all retail branches, mainly focusing on personal banking activities like providing capital loans to corporate customers with a reliable background and history with the bank. Additionally, SBI's other business segments manage the daily operations of its non-banking subsidiaries or joint ventures, excluding SBI General Insurance Co. Ltd. and SBI Life Insurance Co. Ltd. SBI has nearly 22,100 branches nationwide and operates 58,555 ATMs.

Since its inception, SBI has been a significant revenue generator for the Government of India. It has played a crucial role in financing government projects and welfare schemes. Despite facing various economic slowdowns, SBI has consistently emerged as the best PSB, thanks to its exceptional administration and skilled banking managers.

The COVID-19 lockdown in 2020 did not hinder SBI's growth. The company's shares increased by 10.63% in June, 7.28% in July, and 10.73% in August of that year. Although there was a price dip in September 2020, the shares maintained steady growth over the past five months.

SBI has a strong track record of paying generous dividends, enhancing its reputation for generating reliable profits for investors. In the early days, especially during the economic slowdown of 1992 when India was liberalizing its economy, SBI's shares traded at lower prices. Many investors bought shares at these lower prices and, thinking they wouldn't appreciate, forgot about their investments. However, even small investments in SBI shares back then would have grown significantly if the dividends were claimed.

In the following sections, we'll illustrate through a hypothetical calculation how even a modest investment in SBI shares in 1995 could have multiplied by 2021. This calculation will demonstrate why recovering unclaimed shares or dividends from SBI is a profitable endeavor.

Evaluating the Growth of SBI Shares

Imagine your grandfather purchased 500 shares of the State Bank of India (SBI) in November 1998. At that time, the price of each share was Rs. 14.19. Thus, the total value of his investment was:

500shares×Rs.14.19/share=Rs.7,095(Seven Thousand Ninety-five

While this amount seems modest, it’s possible that your grandfather may not have paid much attention to the dividends generated from this relatively small investment.

In 2014, SBI announced a stock split in a 1:10 ratio, meaning every share of Rs. 10 was split into 10 shares of Rs. 1. This move was aimed at making shares more accessible to smaller retail investors who might have found the higher price prohibitive.

After the split, the number of shares held by your grandfather increased from 500 to 5000. Despite the split, the value of the shares continued to rise. By February 2021, the share price had climbed to Rs. 390.15, making the total investment value:

5000shares×Rs.390.15/share=Rs.19,50,750(Nineteen Lakhs Fifty Thousand Seven Hundred Fifty)

Thus, a modest investment of Rs. 7,095 in 1998 would have grown to Rs. 19,50,750, reflecting an impressive growth of approximately 27,500%. This calculation only considers the increase in share price. Including dividends paid by the company over the past 23 years, the total returns could easily surpass Rs. 30 lakhs.

This example demonstrates how an investment in SBI two decades ago could have multiplied exponentially in value. Therefore, if you or your relatives have any dormant shares from old investments in SBI, recovering them could prove to be highly profitable. However, retrieving these shares through traditional methods, such as presenting physical share certificates, may no longer be feasible. The government has introduced new rules for claiming dividends older than seven years, so it's essential to familiarize yourself with these regulations before attempting to make a claim.

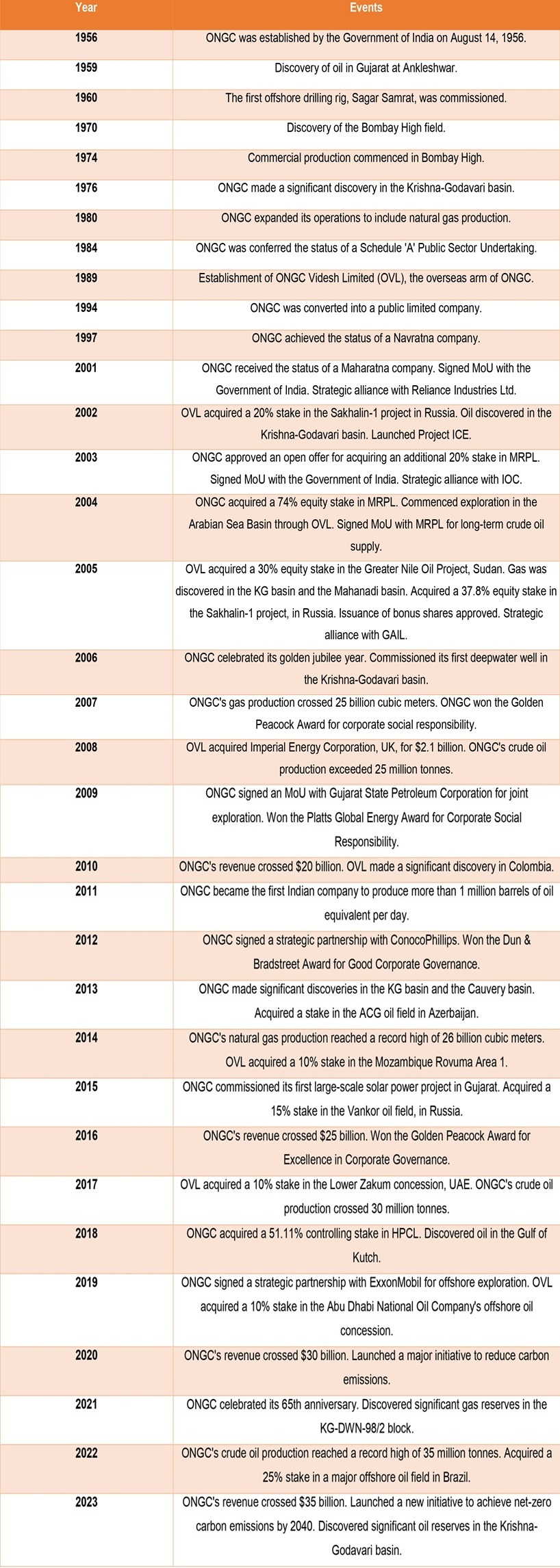

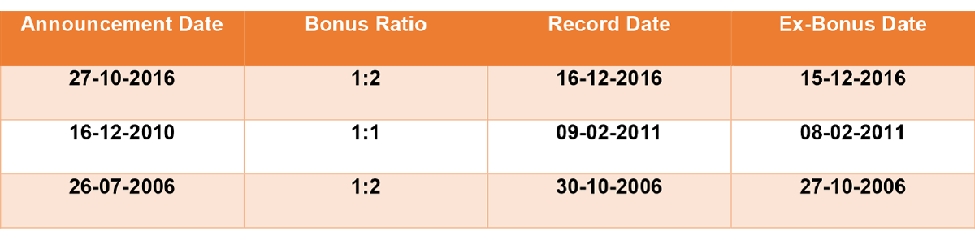

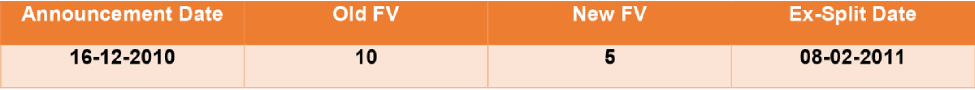

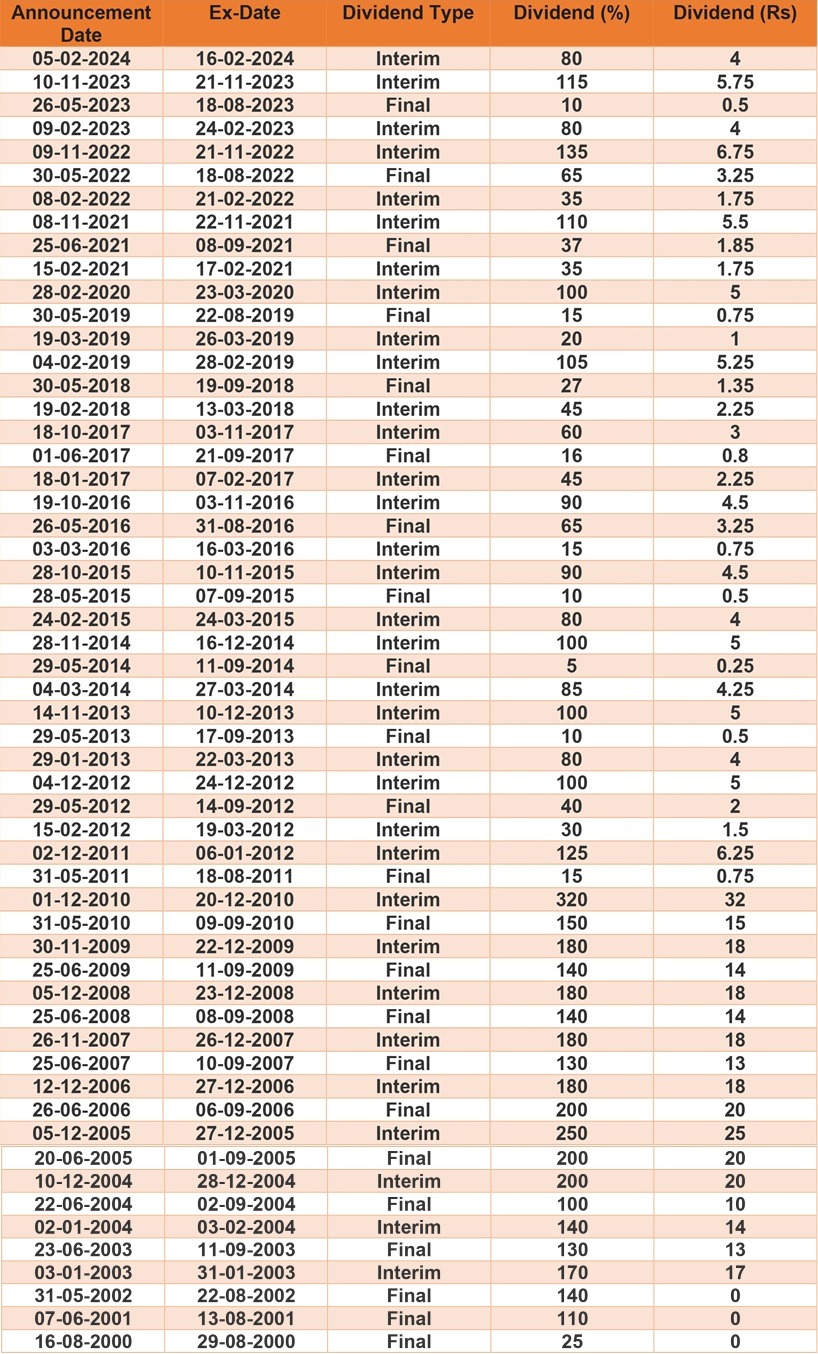

In the following sections, you will find data sheets and information detailing the dividends released by SBI over the past two decades, as well as information on unclaimed dividends. Review these sheets to better understand the dividends before learning about the process for getting a refund of unclaimed shares from the IEPF.

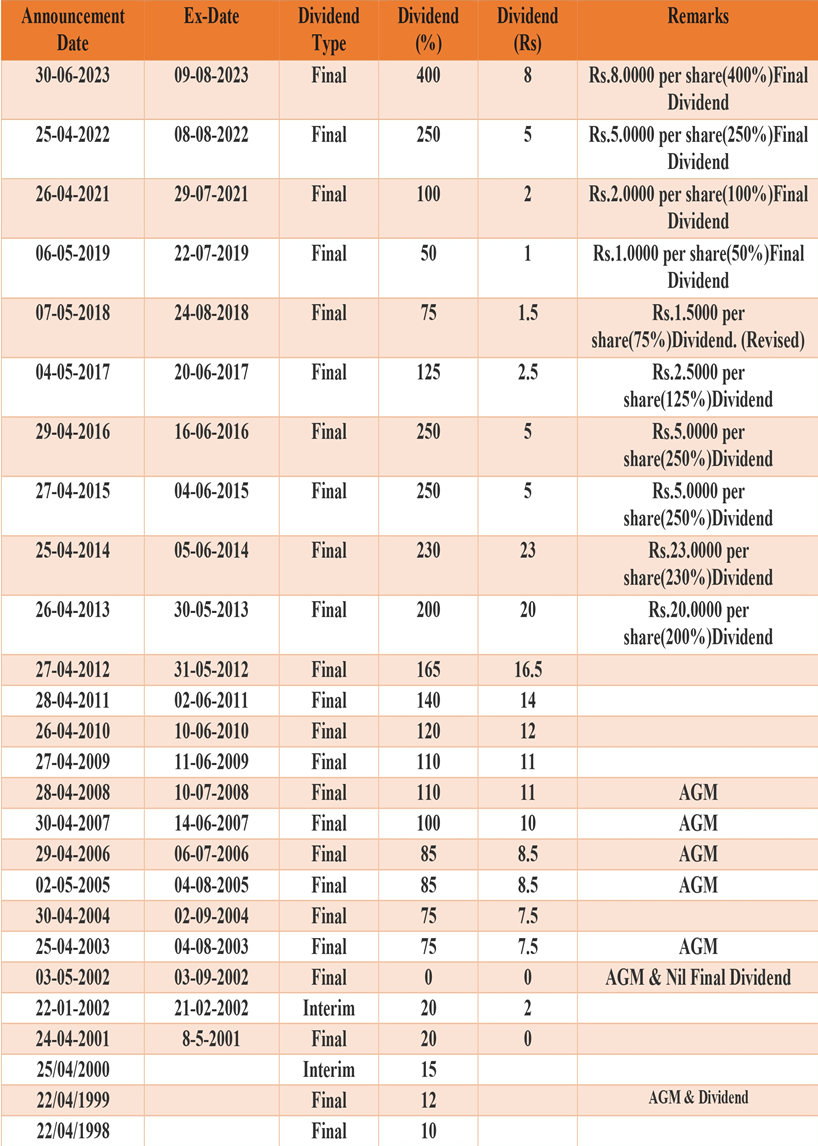

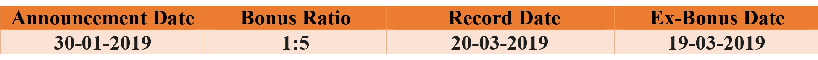

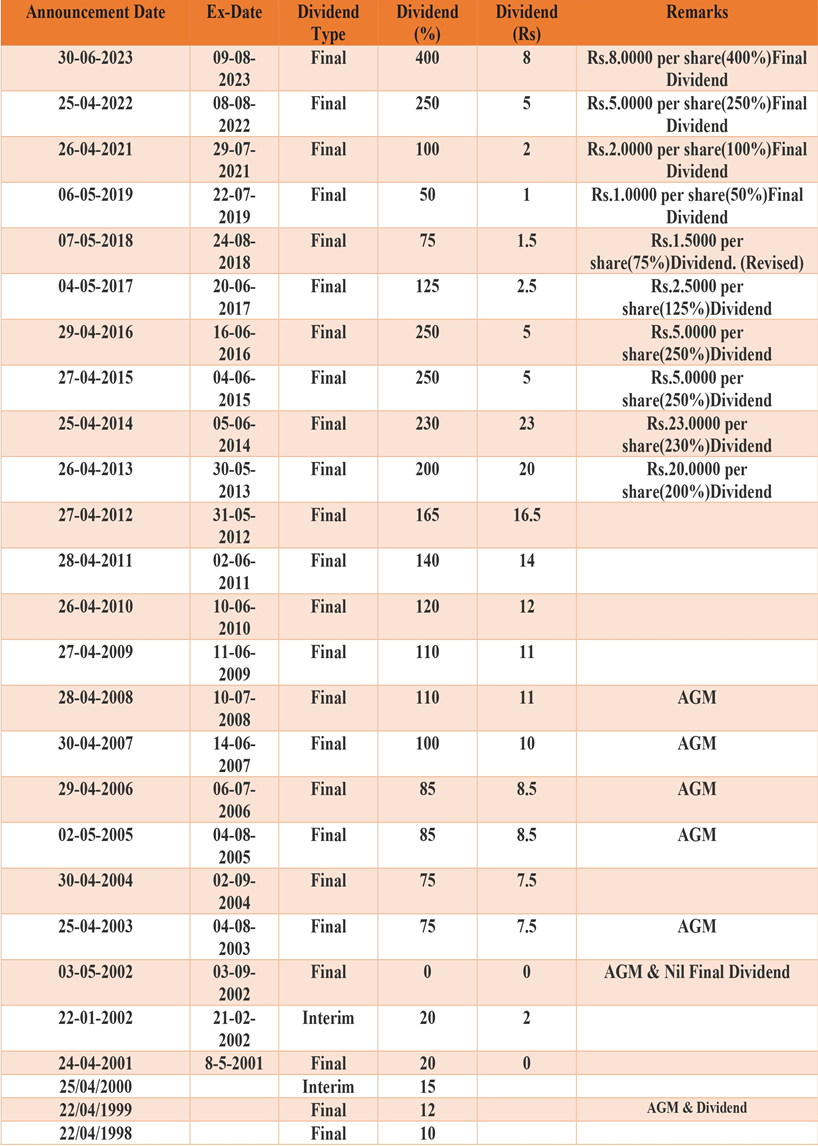

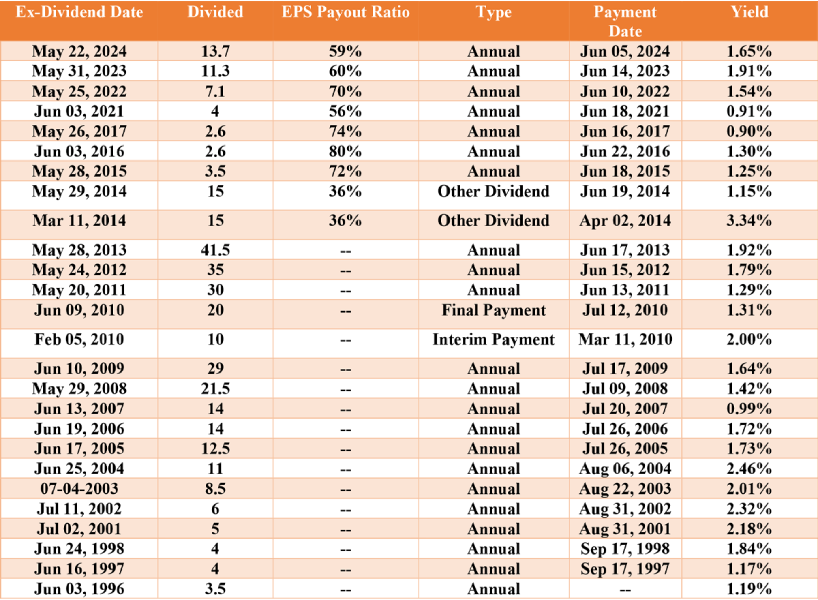

SBI Dividends Data

Source: https://in.investing.com/equities/state-bank-of-india-historical-data-dividends

How was IEPF Formed?

The Investor Education and Protection Fund (IEPF) was established by the Central Government in 2016 to tackle the growing issue of unclaimed or dormant shares and dividends. Small retail investors often overlooked their investments due to initially modest returns. Over time, as the returns grew significantly, these investors would eventually seek to reclaim their now valuable dormant shares.

Previously, there was no standardized process to handle such situations. Some companies would transfer unclaimed dividends to government welfare accounts to be used for public benefit, while others retained the dividends, anticipating that investors might return to claim them. However, this lack of regulation led to questionable practices, as companies could exploit these dormant funds for their own purposes.

To address this, the government established the IEPF Authority as a statutory body to manage and regulate dormant funds and unclaimed dividends. The authority employs fund managers who handle claims related to dormant funds and are responsible for creating rules and regulations governing the transfer of unclaimed dividends. This initiative aimed to regularize dormant funds and ensure they are managed transparently and fairly.

Understanding the Investor Education and Protection Fund (IEPF) and its Objectives:

Established under Section 125 of the Companies Act of 2013, the Indian government founded the Investor Education and Protection Fund and this regulatory framework aims to oversee and safeguard investor funds effectively.

The IEPF is tasked with various responsibilities, including facilitating refunds and reclaiming shares, matured deposits/debentures, and unpaid dividends. Additionally, it plays a crucial role in raising investor awareness and ensuring reimbursement for legal expenses incurred in legal proceedings.

Steps to Claim Dividends and SBI Shares via the IEPF:

- Access the IEPF-5 form on the MCA interface through the IEPF website. It's essential to carefully review and adhere to the instructions provided in the instruction package available on the website.

- Fill out and submit the form. Upon submission, you will receive a "Submit Request Number" as an acknowledgment (SRN). Keep this SRN for future reference when tracking the form's progress.

- Print the completed form along with the acknowledgment.

- Send the original copies of the indemnity bond, acknowledgment copy, share certificate, and IEPF Form 5 to the company's registered office's Nodal Officer (IEPF). Ensure to label the envelope as "Claim for a refund from IEPF Authority" and enclose a self-attested copy of your Aadhaar card along with the necessary information.

- The company's nodal officer will review the claim form before forwarding it to the IEPF authorities. Upon verification, the IEPF authorities will transfer any unclaimed shares and dividends to the client's account.

- Expect a response from the IEPF authorities within 60 days of receiving the company's verification report.

It's worth noting that since the IEPF has only one office located in Delhi, the process of obtaining a refund may take around 8 to 12 months.

Determining if the IEPF holds SBI Shares:

To check if your SBI shares are with the IEPF, follow these steps:

- Check the online portal to proceed.

- Enter the investor's details, including name, father's name, folio number, DP-ID, client ID, and account number.

- Click the search button to initiate the IEPF share search process.

Why Legal Assistance is Essential for Claiming SBI’s Dormant Shares

In previous sections, we examined how a small investment in SBI shares during the 90s has significantly increased in value today. We also reviewed the dividend data released by the company and the status of unclaimed shares according to the annual report. After understanding the role of the IEPF, it's crucial to explain why hiring a legal consultant is necessary before you proceed with claiming dormant SBI shares.

For shares that have been dormant for more than seven years, or those bought by your father or grandfather, the process of claiming these shares starts by filing Claim Form 5 on the IEPF’s website. Once the claim is raised, the claimant must send a printout of the completed form along with all relevant documents, including share ownership papers, to the designated transfer agent or registrar of SBI. The transfer agent verifies all the documents and prepares a verification report. This report, along with the documents, is then sent to the IEPF authority, which makes the final decision on sanctioning the claim.

You might have noticed that document scrutiny happens at both stages: first by the nodal officer or transfer agent, and then by the IEPF fund manager. If any documents are missing, the claimant will be asked to provide them. Any mistakes in the form will need to be rectified by the claimant. If there are any issues with the ownership documents or in proving heirship over the old shares, the application might be rejected entirely. This makes the process of claiming dividends or shares quite tedious and time-consuming for an average claimant. Finding time to furnish documents or meet in person to clear doubts or correct mistakes can be challenging. Proving ownership or heirship can also be difficult, especially if multiple heirs are involved.

These issues can be easily avoided by hiring a legal consultancy firm to handle the dividend claim from the IEPF. A consultancy firm, for a reasonable fee, will manage the entire process for you, including liaising with the authority or nodal officer regarding any document-related matters. Proving ownership of shares will also be more straightforward with the expertise of legal consultants. This is why having a legal consultancy firm by your side is essential before applying to claim funds from the IEPF.

Conclusion

We've explored how an investment in SBI shares made in 1998 could have yielded an impressive return of nearly 27,500%, and that’s without accounting for the dividends over the years. If this staggering figure doesn’t illustrate the value of claiming SBI shares from the IEPF, it’s hard to imagine what will. SBI shares have consistently proven to be profitable, reinforcing its status as one of India’s most esteemed banks. Alongside LIC and Indian Railways, SBI stands out as one of the most valued public sector undertakings of the Government of India. Hiring a legal consultant like Share Samadhan, to search unclaimed dividends should be seen as a small investment with the potential for substantial returns. Given the remarkable growth of SBI shares and the consistent, generous dividends, even recovering a modest amount from the past can be highly profitable.