- Sign In

- 8800 33 2200

- samadhan@sharesamadhan.com

- Sharesamadhan App

- Sharesamadhan App

Blog Details

Recover Your Siemens Limited Shares from IEPF

Siemens Limited, a leading engineering and technology firm, has shaped India’s industrial and technological journey for decades. A subsidiary of Siemens AG, Germany, Siemens Limited operates across energy, healthcare, infrastructure, and business sectors. However, like many large corporations with a long history, several investors have unclaimed dividends or shares, transferred to the Investor Education and Protection Fund (IEPF) due to inactivity.

If you or your family members have Siemens shares that remained unclaimed for over seven years, you can recover them through the IEPF claim process. Here’s a complete guide, yearwise, along with essential company milestones.

Siemens Limited: A Journey Through the Years

Early Foundation and Expansion (1957–1967)

-

1957: Incorporated on March 2 as Siemens Engineering and Manufacturing Company of India Private Limited.

-

1959: Acquired a workshop in Calcutta for manufacturing switchboards and electrical equipment.

-

1961: Took over East Asiatic Siemens-Reiniger-Werke AG’s operations in India.

-

1965–1967: Expanded shareholding with Siemens AG, West Germany, increasing foreign collaboration.

-

1967: Renamed Siemens India Ltd.

Name Change and Growth Phase (1967–1987)

-

1970: Siemens AG merged Siemens-Reiniger-Werke AG and Siemens-Schuckertwerke AG globally.

-

1971–1976: Issued bonus shares, increased public shareholding, and expanded manufacturing capabilities.

-

1981–1987: Launched several debentures; expanded into medical engineering and railway automation.

-

1987: Renamed again as Siemens Limited.

Industrial Innovation and Diversification (1988–2000)

-

1988–1990: Introduced microprocessor-based drives, digital UPS systems, and energy-optimizing AC Drives.

-

1991–1995: Focused on automation, renewable energy (windmills), and communication systems.

-

1996–2000: Diversified further into smart cards, solar technology (with Siemens Solar Industries), and hotel solutions.

Key Growth Milestones (2001–2010)

-

2001–2003: Expanded into mobile telephony; launched low-cost mobile models; partnered with AGI USA.

-

2004–2006: Expanded medical equipment division; strategic alliances with Bosch and Aethra.

-

2007–2009: Acquired iMetrex Technologies; started PETNET services in India; focused on gas-insulated switchgear manufacturing.

-

2010: Awarded contracts for India’s first Formula 1 track power systems; expanded renewable and metro rail projects.

Strategic Projects and Digital Transformation (2011–2023)

-

2011–2015:

- Major projects with Chennai Metro, Power Grid Bangladesh, and Indian Railways

- Launched the SIMATIC S7-1500 automation system.

- Installed India’s first wireless ultrasound system.

-

2016–2018:

- Smart building projects launched.

- Siemens Gamesa Renewable Energy expanded solar and wind projects. -

2019–2021:

- Set up MindSphere Application Centers for digital industries.

- Siemens Mobility expanded metro projects across India.

- Partnered with Switch Mobility Automotive for e-mobility projects. -

2022–2023:

- Established a rail bogie factory in Aurangabad.

- Awarded a landmark ₹26,000 crore locomotive contract.

Source: https://www.moneycontrol.com/company-facts/siemens/history/S#goog_rewarded

How to Recover Siemens Limited Shares from IEPF

Recovering shares from the IEPF is a structured process. Here’s how you can reclaim your rightful investments:

1. Check Eligibility

-

Siemens Limited shares are transferred to the IEPF after seven consecutive years of unclaimed dividends.

-

Only shareholders (or legal heirs) can file a claim.

2. How to Find Unclaimed Shares

-

Visit the IEPF website

-

Search using your name, folio number, or company name to locate the shares.

3. Submit IEPF Form-5

-

Fill and submit the IEPF-5 Form online.

-

Attach documents like PAN card, Aadhaar, original share certificates (or demat proof), and bank details.

4. Send Documents to Siemens Limited

- After online filing, forward the physical documents along with acknowledgment to Siemens Limited’s Nodal Officer for verification.

5. Verification by Company

- Siemens verifies the documents and forwards them to the IEPF Authority.

6. Refund Processing

-

Upon approval, shares will be credited back to your demat account.

-

Dividends, if any, are credited separately.

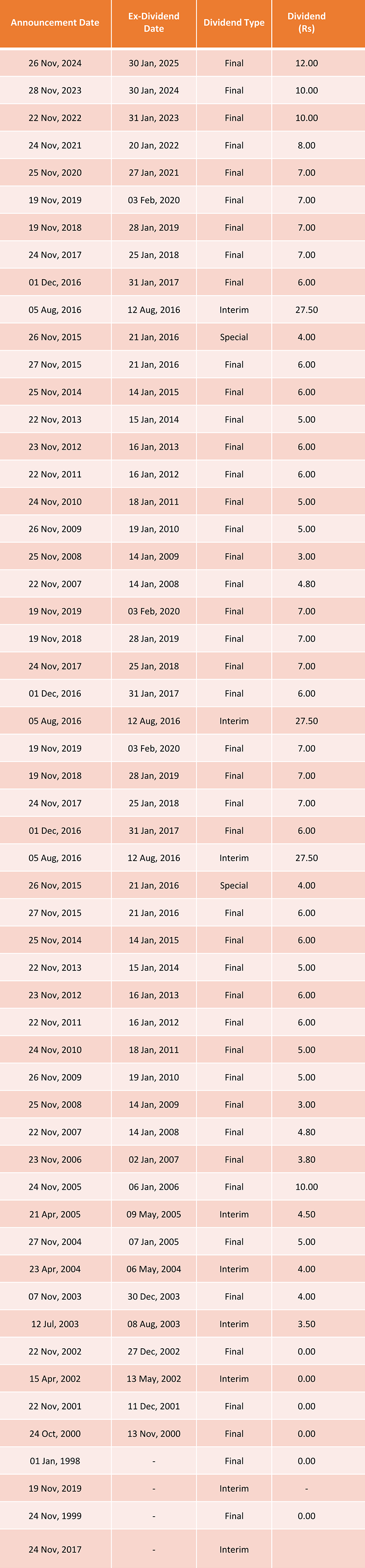

Placeholder for Dividend History Table

Source: https://www.moneycontrol.com/company-facts/siemens/dividends/S/#goog_rewarded

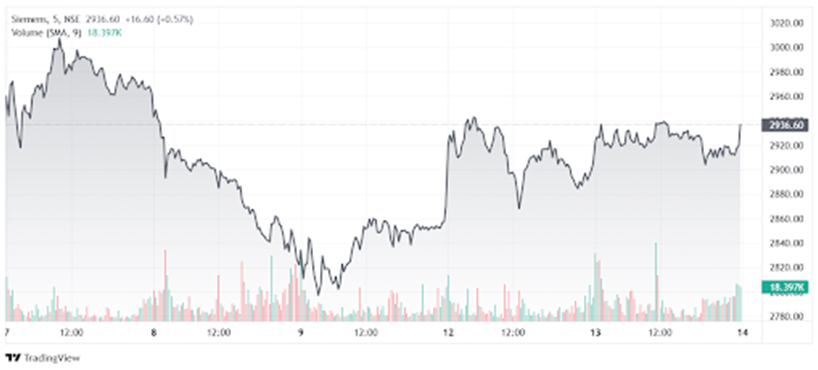

Placeholder for Share Price Graph

Source: https://www.moneycontrol.com/india/stockpricequote/infrastructure-general/siemens/S#google_vignette

Important Points to Remember

-

Claims must be filed carefully to avoid rejections or delays.

-

Legal heirs must produce a succession certificate if the shareholder has passed away.

-

Share certificates (if physical) must be intact; if lost, a duplicate issuance procedure will be needed.

-

Demat details are mandatory for receiving shares electronically.

About Siemens Limited Today

Siemens continues to serve vital sectors like healthcare, infrastructure, manufacturing, mobility, and energy. Its focus on digital industries, sustainability, and smart mobility solutions positions it as a future-ready corporation with a commitment to innovation.

Why Choose Share Samadhan for Recovering Siemens Shares?

Recovering shares from IEPF can be time-consuming and complex. Errors, missed steps, or lack of legal understanding can delay or even derail your claim. Share Samadhan offers expert help with:

-

Complete document preparation

-

Legal compliance and verifications

-

Coordinating with Siemens Limited and the IEPF Authority

-

Reducing time and errors

Our team of financial and legal experts ensures that your rightful investments are returned to you in the shortest possible time, without stress.

FAQs

Q1: Can NRIs reclaim Siemens shares from IEPF?

Yes, NRIs can reclaim shares by submitting additional identity and address proofs attested by Indian authorities.

Q2: What happens if the original share certificates are lost?

You will need to apply for duplicate share certificates through Siemens Limited before filing IEPF-5.

Q3: How long does the recovery process take?

Typically, 8 months–1.5 years, depending on document completeness and IEPF Authority processing time.

Q4: Is it necessary to open a demat account?

Yes, as shares are now credited only in demat form after IEPF recovery.

Q5: Can a nominee claim the shares if the shareholder is deceased?

Yes, but legal documents like a death certificate, a succession certificate, or a probate are needed.

Q6: I no longer have any records or documents of my Siemens shares from years ago. Can they still be located and recovered?

Yes. Even if you’ve misplaced all documents, your Siemens shares can still be traced using basic identifiers like your full name, father’s name, PAN (if available), and the address used at the time of purchase. Share Samadhan uses registrar records and company archives to locate and verify such long-lost investments.

Final Words

If you have Siemens Limited shares lying unclaimed or dividends unpaid, now is the time to recover them before they are lost forever.

Let Share Samadhan be your trusted partner in claiming back what rightfully belongs to you — safely, professionally, and efficiently.

India's largest & most trusted platform for recovery of unclaimed investments

Submit Your Query

Recent Posts

- Recover Your Godrej Consumer Products Shares from IEPF – A Complete Guide

- Lost PGCIL Shares to IEPF? Here’s a Step-by-Step Recovery Guide with Share Samadhan

- How to Recover Unclaimed HDFC Life Shares from IEPF

- Recover Lost Shares of DLF Limited from IEPF

- Have You Lost Your Tech Mahindra Shares? A Guide To Lost Share Recovery!

- IEPF Recovery & Transmission: How To Claim Eicher Motors Shares Of A Deceased Relative?