- Sign In

- 8800 33 2200

- samadhan@sharesamadhan.com

- Sharesamadhan App

- Sharesamadhan App

Blog Details

How to Recover Unclaimed HDFC Life Shares from IEPF

Unclaimed shares are more common than you might think. Whether due to a change of address, the death of the shareholder, or simple oversight, many investors find their shares transferred to the Investor Education and Protection Fund (IEPF). If you have lost your HDFC Life Insurance Company Limited shares, this comprehensive guide will walk you through the recovery process and explain how Share Samadhan can help.

About HDFC Life Insurance Company Limited

|

Aspect |

Details |

|

Company Name |

HDFC Life Insurance Company Limited |

|

Established |

2000 |

|

Parent Company |

HDFC Bank Limited (Post July 1, 2023) |

|

Headquarters |

Mumbai, Maharashtra, India |

|

MD & CEO |

Ms. Vibha Padalkar |

|

Branches |

498 |

|

Employees |

32,448 |

|

Market Cap |

₹1.37 Trillion |

|

Global Presence |

India, GCC & MENA Regions |

HDFC Life offers over 60 insurance products covering protection, investment, annuity, savings, pension, and health. With 498 branches and over 300 distribution partnerships, it ensures financial security for millions.

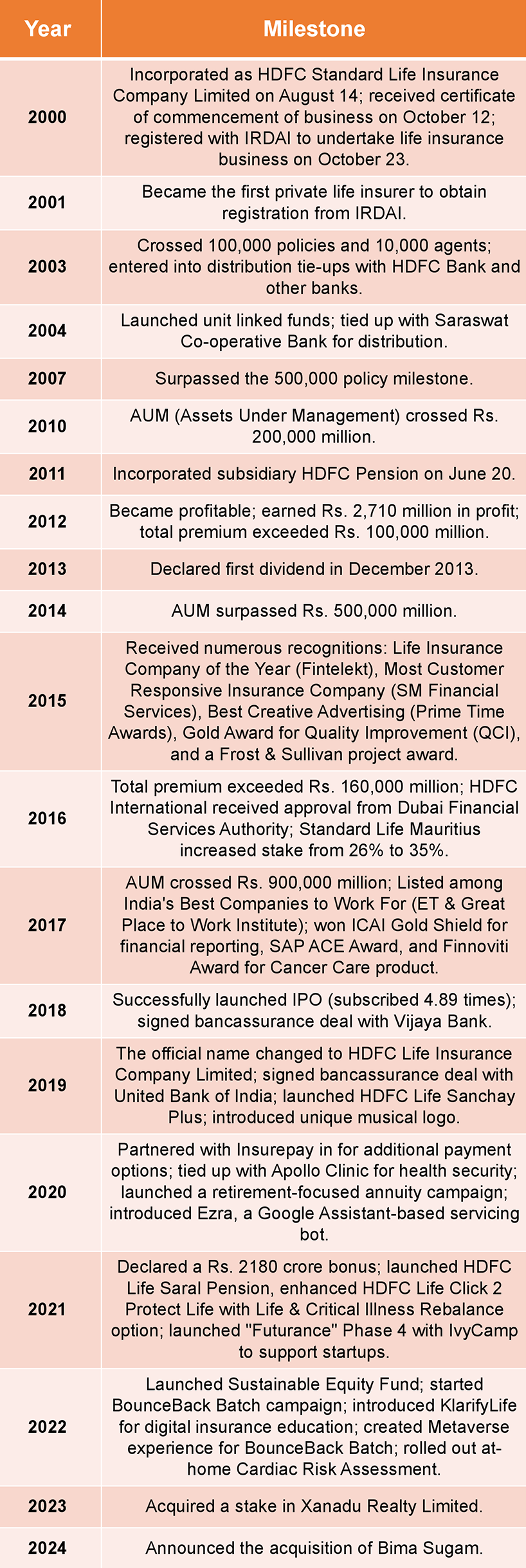

A Glimpse into HDFC Life’s Journey

Key Insurance Plans Offered by HDFC Life Insurance Company Ltd.

HDFC Life Insurance offers a diverse range of insurance products that address the evolving needs of policyholders — from protection and health to savings and long-term wealth creation. Below is an overview of some of the flagship offerings under its portfolio:

1. HDFC Life Click 2 Protect 3D Plus

A versatile term insurance plan that provides holistic financial protection against the three primary risks — death, disease, and disability. This plan offers multiple coverage options, allowing policyholders to select benefits tailored to their specific needs. With flexible premium payment modes and term options, it ensures financial continuity for the family even in the policyholder's absence.

2. HDFC Life Sanchay Plus

This is a non-linked, non-participating savings insurance plan designed to offer guaranteed returns and long-term financial stability. This plan is suitable for individuals looking for predictable income post-retirement or during key life stages, this plan ensures a dependable stream of benefits alongside life insurance coverage.

3. HDFC Life Sampoorn Samridhi Plus

An endowment plan that blends insurance protection with savings. It offers guaranteed additions, potential bonuses, and life cover, making it ideal for long-term wealth creation while ensuring family security. The plan allows flexibility in choosing the policy and premium payment terms to match one's financial roadmap.

4. HDFC Life Cancer Care

A specialised health insurance plan aimed at managing the financial strain associated with cancer treatment. It provides a lump sum payout upon diagnosis of early or major cancer, supporting quality care without compromising existing savings. This plan offers protection across all stages of cancer, promoting financial and emotional preparedness.

Dividend History of HDFC Life Insurance Company Limited

The table below outlines the dividend history of HDFC Life over the last several years, helping shareholders assess its payout performance and understand eligibility for dividend-related IEPF claims.

HDFC Life Share Price – Historical Performance

Below is a graphical overview of HDFC Life’s share price over time. This helps investors identify long periods of inactivity, which could indicate if their shares or dividends have moved to IEPF.

What Is IEPF and Why Are Shares Transferred There?

IEPF (Investor Education and Protection Fund) was created by the Government of India under the Companies Act to safeguard unclaimed dividends, matured deposits, debentures, and shares. If dividends remain unclaimed for 7 years or more, the shares and corresponding benefits are transferred to IEPF.

Once transferred, they are no longer accessible via the company directly. But don’t worry — they can still be reclaimed by following the IEPF procedure.

Step-by-Step: How to Recover HDFC Life Shares from IEPF

- Check Eligibility:

- You must be the rightful shareholder or legal heir of the original investor. - Filing the IEPF-5 Form

- Register and fill out the form at iepf.gov.in.

- Attach scanned copies of your PAN card, Aadhaar, and bank details, and share documents. - Print & Submit Physical Documents

- Download the auto-generated indemnity bond and advance receipt.

- Submit the printed form with original documents to HDFC Life’s Nodal Officer. - Verification by the Company

- HDFC Life verifies documents and forwards the claim to the IEPF Authority. - IEPF Refund Approval

- Upon approval, shares or unpaid amounts are credited to your account

A single mistake in the form or documents can delay or reject your claim.

How Share Samadhan Helps in HDFC Share Recovery

Navigating IEPF recovery on your own can be overwhelming. Here’s how Share Samadhan ensures a smooth process:

|

Challenges Faced |

How Share Samadhan Helps |

|

Incorrect documents |

Guides you in preparing accurate documents |

|

Complex legal heir cases |

Helps with succession and legal documentation |

|

Form submission errors |

Our experts fill out your IEPF-5 form correctly |

|

Delays & no response |

We follow up with HDFC Life & IEPF authority |

|

Tracking claim status |

Regular updates and real-time tracking |

Thousands of investors have already recovered their lost shares with Share Samadhan. You could be next.

Why It Matters to Reclaim Your Shares

Unclaimed shares are more than just numbers – they represent your rightful wealth. Here’s why reclaiming them is essential:

- Dividend Income: Accrued but unpaid dividends add up significantly over time.

- Ownership Rights: Voting, bonus issues, and corporate actions.

- Asset Consolidation: For estate planning and tax transparency.

- Peace of Mind: Your investments are back under your control.

Tips to Avoid Losing Shares Again

- Always update your KYC details and contact info.

- Link PAN and Aadhaar with your demat accounts.

- Track corporate actions and dividend payouts regularly.

- Nominate a trusted family member for your accounts.

- Maintain digital and physical copies of all investments.

Final Thoughts

HDFC Life Insurance Company Limited has earned a reputable name in the Indian financial ecosystem. However, even the most trusted names can have unclaimed shares transferred to IEPF due to investor oversight.

Don’t let your valuable investments stay lost.

With Share Samadhan’s expert guidance and IEPF recovery services, you can reclaim what’s rightfully yours — securely, efficiently, and with complete peace of mind.

Let us help you recover your HDFC Life shares today.

FAQs

1. How can I recover unclaimed HDFC Life shares from the IEPF?

-To recover unclaimed shares, you must file the IEPF-5 form online, attach supporting documents like your PAN, Aadhaar, and share certificates, and submit the originals to HDFC Life’s registered office. The company verifies the claim within 30 days, post which IEPF processes the refund.

2. Is it possible to track the status of my IEPF claim for HDFC Life shares?

- Yes, you can track the status of your IEPF claim by visiting the official IEPF website and using your claim ID. It is advisable to regularly check for updates or contact the nodal officer of HDFC Life for follow-ups.

3. What is the relationship between HDFC Bank and HDFC Life Insurance Company?

.After the merger of HDFC Ltd. and HDFC Bank in July 2023, HDFC Bank became the promoter of HDFC Life Insurance Company Limited. The name and logo rights of ‘HDFC’ are now under HDFC Bank.

4. How long does it take to recover shares or dividends from IEPF?

The time frame may vary based on the case complexity and document verification, but it typically takes 8 months to 1.5 years from the date of complete submission to receive your shares or dividend refund.

5. I no longer have the physical share certificate or policy documents of HDFC Life. Can I still recover my lost shares?

-Yes. Even if you've misplaced the original share certificates or policy documents, you can still recover your lost HDFC Life shares. With the help of identity proofs, old address details, and shareholding information (if any), Share Samadhan can assist in tracing the shares and initiating the process to obtain duplicate certificates through the company’s registrar.

India's largest & most trusted platform for recovery of unclaimed investments

Submit Your Query

Recent Posts

- Recover Your Godrej Consumer Products Shares from IEPF – A Complete Guide

- Lost PGCIL Shares to IEPF? Here’s a Step-by-Step Recovery Guide with Share Samadhan

- Recover Lost Shares of DLF Limited from IEPF

- Have You Lost Your Tech Mahindra Shares? A Guide To Lost Share Recovery!

- IEPF Recovery & Transmission: How To Claim Eicher Motors Shares Of A Deceased Relative?

- Lost Vedanta Shares? Here’s How You Can Get Them Back