- Sign In

- 8800 33 2200

- samadhan@sharesamadhan.com

- Sharesamadhan App

- Sharesamadhan App

Blog Details

How to Recover Unclaimed Dividends from ICICI Bank through IEPF

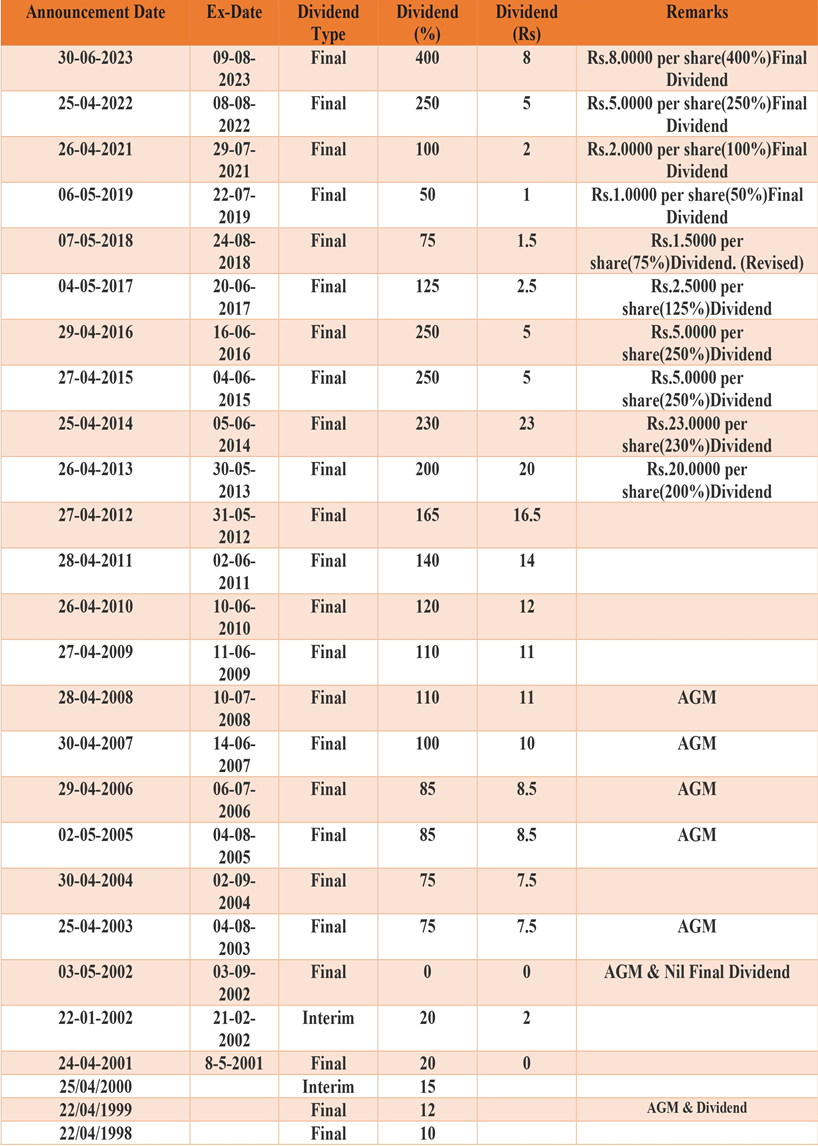

As of February 2, 2021, ICICI Bank's shares were trading at over Rs. 597.75 per share. ICICI Bank has demonstrated remarkable growth since its inception as one of India's largest private-sector banks. This impressive growth has also translated into substantial gains for its shareholders. To make its shares more accessible to retail investors, the bank has implemented stock splits over the years. However, the company's rapid expansion has also resulted in significant unclaimed dividends, which have been transferred to the Investor Education and Protection Fund (IEPF).

What do these facts tell us about ICICI Bank? The company's unprecedented growth has transformed early investors into millionaires today, provided they continuously claimed the dividends released by the bank. But what about those who invested a small amount years ago and then forgot about it, thinking it would never grow? There's good news for these investors too! They can still claim their dormant shares and associated dividends.

The Government of India has established the IEPF authority to manage dormant shares and unclaimed dividends. In this blog, we will explore the history of ICICI Bank and illustrate its growth with a hypothetical investment. We will also examine the data related to ICICI Bank's dividends and funds transferred to the IEPF over the years. Finally, we will explain how investors can claim their dormant shares and why seeking legal assistance can be beneficial in the process.

So, let’s begin by delving into the history of ICICI Bank.

The History of ICICI Bank

ICICI Bank Limited, initially known as the Industrial Credit and Investment Corporation of India, began its journey as a financial institution dedicated to providing credit to industries. Established in 1955, the parent company was a collaborative effort among the World Bank, Indian public-sector banks, and public-sector insurance companies. The primary goal was to offer project financing to Indian industries.

Originally a government-owned entity based in Baroda until 1994, the bank was eventually divested to operate independently and rebranded as ICICI Bank. The parent company merged with the bank, solidifying its transformation. In 1998, ICICI Bank pioneered Internet Banking services, marking a significant milestone in its digital transformation.

The same year, the parent company's shareholding in ICICI Bank decreased to 46% through an initial public offering (IPO). In 2000, the bank further expanded its international presence by offering American depositary receipts (ADRs) on the New York Stock Exchange. A year later, ICICI Bank acquired Bank of Madura Limited in an all-stock transaction, further enhancing its footprint. Between 2001 and 2002, the bank continued to sell additional stakes to institutional investors.

Throughout the 1990s, ICICI diversified its financial services portfolio, offering a range of products through its numerous affiliates and subsidiaries, significantly increasing its revenue base. In 1999, it made history as the first Indian company and bank outside of Japan in Asia to be listed on the New York Stock Exchange.

The transformative journey continued in 2002 with a significant reverse merger, consolidating major subsidiaries such as ICICI, ICICI Bank, ICICI Personal Financial Services Limited, and ICICI Capital Services Limited into one entity.

In 2008, during the global financial crisis, ICICI faced a challenging period with customers rushing to ATMs and branches due to rumors about the bank's financial health. The Reserve Bank of India (RBI) intervened to affirm the bank's stability, quelling the panic. In March 2020, ICICI Bank's board approved a Rs. 1,000 crore investment in Yes Bank Ltd., raising its stake to 5%.

Today, ICICI Bank boasts a network of approximately 18,210 branches, ATMs, and around 110 Touch Banking branches across over 30 Indian cities. Its international banking services cater to Non-Resident Indian corporate clients and leverage economic corridors between India and other nations. Additionally, the bank supports female entrepreneurs through the Self-Help Group (SHG) program, which is part of its microfinance initiatives.

Given its rich history and strategic growth, ICICI Bank has provided substantial returns for its investors. In the next section, we'll explore how a hypothetical investment made in ICICI Bank in 1998 would have appreciated over the years.

Calculation of ICICI Bank’s Share Growth

Imagine a shareholder in the year 2000 bought 800 shares of ICICI Bank Ltd. at a price of Rs. 10 per share. The initial investment would have been:

800shares×Rs.10per share=Rs.8000

This might seem like a modest investment. Often, such investments are made by parents or grandparents, who might then forget about them over the years. These shares can remain unnoticed, quietly growing in value.

Since 2000, the value of ICICI Bank shares has increased steadily. The bank announced a stock split in 2014 at a 1:5 ratio to make the shares more affordable for small investors. This means for every 1 share owned, investors received 5 shares. Here are the details of the split:

- Announcement Date: 09/09/2014

- Old Face Value: Rs. 10

- New Face Value: Rs. 2

- Record Date: 05/12/2014

- Ex-Split Date: 04/12/2014

As a result, the 800 original shares became:

800shares×5=4000shares

While the number of shares increased, the total value of the investment stayed the same at that moment, just divided among more shares.

By 2017, ICICI Bank continued to grow and announced bonus shares in a 1:10 ratio. For every 10 shares owned, investors received 1 additional share. Here are the details:

- Announcement Date: 03/05/2017

- Bonus Ratio: 1:10

- Record Date: 20/06/2017

The bonus shares added would be:

4000shares÷10=400bonus shares

So, the total number of shares after the bonus issue became:

4000shares+400bonus shares=4400shares

Now, let's calculate the current value of these shares. Suppose the current share price is Rs. 597.75. The total value of the investment now would be:

4400shares×Rs.597.75per share=Rs.26,31,100

Comparing this to the initial investment of Rs. 8000, the return is tremendous. And this doesn't even include the dividends received over the years. Adding those dividends would significantly increase the total returns, potentially reaching multi-million rupee values.

Imagine finding old share certificates from the early 2000s belonging to your grandparents. Even a small investment from that time could have grown substantially. But how do you claim these shares? What about the dividends? We'll explore the answers to these questions in the next sections.

About IEPF and its Relationship with Unclaimed Dividends

The establishment of the Investor Education and Protection Fund (IEPF) in 2016 marked a significant reform in India's financial regulatory framework. Before this, the Indian stock exchange lacked a statutory body to manage unclaimed dividends. The government introduced the IEPF authority and formulated regulations to address these issues. Below are the key changes and amendments introduced by the IEPF rules regarding the transfer of unclaimed dividends.

1. Claim Period for Dividends: -

Investors are required to claim their dividends within 30 days of the declaration.

2. Unclaimed Dividend Account: -

Companies must create a separate account for unclaimed dividends. If dividends are not claimed within 30 days, they must be transferred to this account.

3. Claiming Dividends Post-30 Days: -

Investors who miss the 30-day window can claim their dividends from the special account by contacting the company’s transfer or nodal officer and submitting the necessary documents.

4. Periodic Notifications: -

Companies must periodically inform shareholders that their unclaimed dividends have been transferred to the unclaimed dividend account and advise them to claim the dividends before they are moved to the IEPF.

5. Publishing Investor Lists: -

Companies are required to publish a list of investors whose dividends have been transferred to the unclaimed dividend accounts.

6. Individual Notifications: -

Companies should communicate directly with investors, via email or letters, about the transfer of dividends to the unclaimed dividend account.

7. Seven-Year Transfer Rule: -

If an investor does not claim the dividends from the company within seven years of the transfer to the unclaimed dividend account, the dividends are then transferred to the IEPF.

8. Annual Shareholder List: -

Companies must release an annual list of shareholders whose shares have been transferred to the IEPF.

9. Claiming Dormant Shares: -

After seven years, shareholders must apply directly to the IEPF to claim their dormant shares.

The Ministry of Corporate Affairs (MCA) implemented these rules to streamline and regularize the process of claiming dormant dividends. This ensures that the claim process is transparent and organized. Claiming dividends from the IEPF involves a thorough verification process to ensure that the dividends are given to the rightful owner and to prevent fraudulent claims.

The introduction of the IEPF has made it easier for investors to reclaim their unclaimed dividends and shares, providing a structured and secure method to do so.

The process to Claim Dividends of ICICI Bank from IEPF

Claiming dividends from the Investor Education and Protection Fund (IEPF) might seem complicated due to the number of documents and procedures involved. Here, we've simplified the steps to make the process easier to understand:

1. Contact the Nodal Officer: -

Begin by reaching out to the nodal officer of ICICI Bank. They will provide all necessary details about your shares and the claim process. The nodal officer will also give you a list of required documents for your claim.

2. Fill Out the IEPF Form: -

Visit the IEPF website and fill out the appropriate form with your details and information about your share ownership.

3. Print and Compile Documents: -

After submitting the form online, print a copy of the completed form. Gather all the required documents as specified by the IEPF website and the nodal officer.

4. Submit Documents to the Nodal Officer: -

Send your compiled documents and the printed form to the nodal officer. They will verify your ownership of the shares and check the details against the submitted form.

5. Verification Report: -

The nodal officer will prepare a claim verification report based on your documents. This report will be sent to the IEPF Authority’s regional fund manager within 15 days of receiving your documents.

6. Review by Fund Manager: -

The regional fund manager will review the claim verification report along with your form and supporting documents.

7. Possible Actions by Fund Manager: -

After reviewing your claim, the fund manager may:

- Request Additional Documents: If more information is needed, you or the nodal officer must provide the additional documents within 15 days.

- Reject the Claim: The claim may be rejected due to errors or missing documents that were not provided in time.

- Approve the Claim: If everything is in order, the fund manager will approve the claim and sanction the amount.

By following these steps, you can successfully claim your dividends from the IEPF. While the process may require attention to detail and timely submission of documents, these guidelines can help simplify the procedure.

Necessity of Legal Help to Claim ICICI’s Old Shares

As we've discussed, the claim process for dividends through the Investor Education and Protection Fund (IEPF) involves a thorough review by the nodal officer to prevent fraudulent claims. This involves detailed scrutiny of ownership documents and verification of the claim form. Even minor errors in the application can lead to delays or rejection of the claim.

Given the complexity and time-consuming nature of the process, it can be challenging for the average investor. To streamline this process and ensure accuracy, it is often beneficial to hire a reputable legal consultancy firm. These firms specialize in filing IEPF claims, significantly reducing the chances of errors in the application. They also handle all communications with the nodal officer and the IEPF authority, addressing any issues or missing documents on behalf of the claimant.

Here are the key benefits of hiring a legal consultancy firm:

1. Expertise and Accuracy: - Legal firms have expertise in the IEPF claim process, ensuring that the application is filled out correctly and all necessary documents are included.

2. Time-Saving: - By delegating the claim process to professionals, investors can save valuable time and avoid the tedious aspects of filing and following up on the claim.

3. End-to-End Service: - These firms provide comprehensive services, managing the entire process from form submission to liaising with the nodal officer and IEPF authority.

4. Error Minimization: - The likelihood of errors in the application is minimized, which helps prevent delays or rejections.

Considering these advantages, it is clear that recovering old ICICI shares can be a profitable endeavor for investors. It is worthwhile to check the investment portfolios of parents or grandparents for any dormant ICICI Bank shares. By hiring a legal consultancy firm such as Share Samadhan, investors can ensure a smooth and efficient IEPF claim process, allowing them to focus on their daily activities or core business operations without the stress of managing the claim themselves.

India's largest & most trusted platform for recovery of unclaimed investments

Submit Your Query

Recent Posts

- Recover Your Godrej Consumer Products Shares from IEPF – A Complete Guide

- Lost PGCIL Shares to IEPF? Here’s a Step-by-Step Recovery Guide with Share Samadhan

- How to Recover Unclaimed HDFC Life Shares from IEPF

- Recover Lost Shares of DLF Limited from IEPF

- Have You Lost Your Tech Mahindra Shares? A Guide To Lost Share Recovery!

- IEPF Recovery & Transmission: How To Claim Eicher Motors Shares Of A Deceased Relative?