- Sign In

- 8800 33 2200

- samadhan@sharesamadhan.com

- Sharesamadhan App

- Sharesamadhan App

Blog Details

Recover Your Adani Total Gas Limited Shares from IEPF with Share Samadhan

Have your shares of Adani Total Gas Limited (ATGL) been transferred to the Investor Education and Protection Fund (IEPF)? You're not alone. Many shareholders lose access to their investments due to inactivity, missed dividends, or inheritance issues. The good news is: your shares are not lost forever. With the right assistance, you can reclaim them.

This blog outlines the complete process of recovering Adani Total Gas shares from IEPF and how Share Samadhan helps investors—both in India and abroad—regain what is rightfully theirs.

Understanding Adani Total Gas Limited- Company Overview

Adani Total Gas Limited (ATGL), originally incorporated as Adani Gas Limited on August 5, 2005, is one of India’s leading city gas distribution (CGD) companies. Headquartered in Ahmedabad, Gujarat, ATGL supplies piped natural gas (PNG) to residential, commercial, and industrial sectors and compressed natural gas (CNG) to the automotive sector.

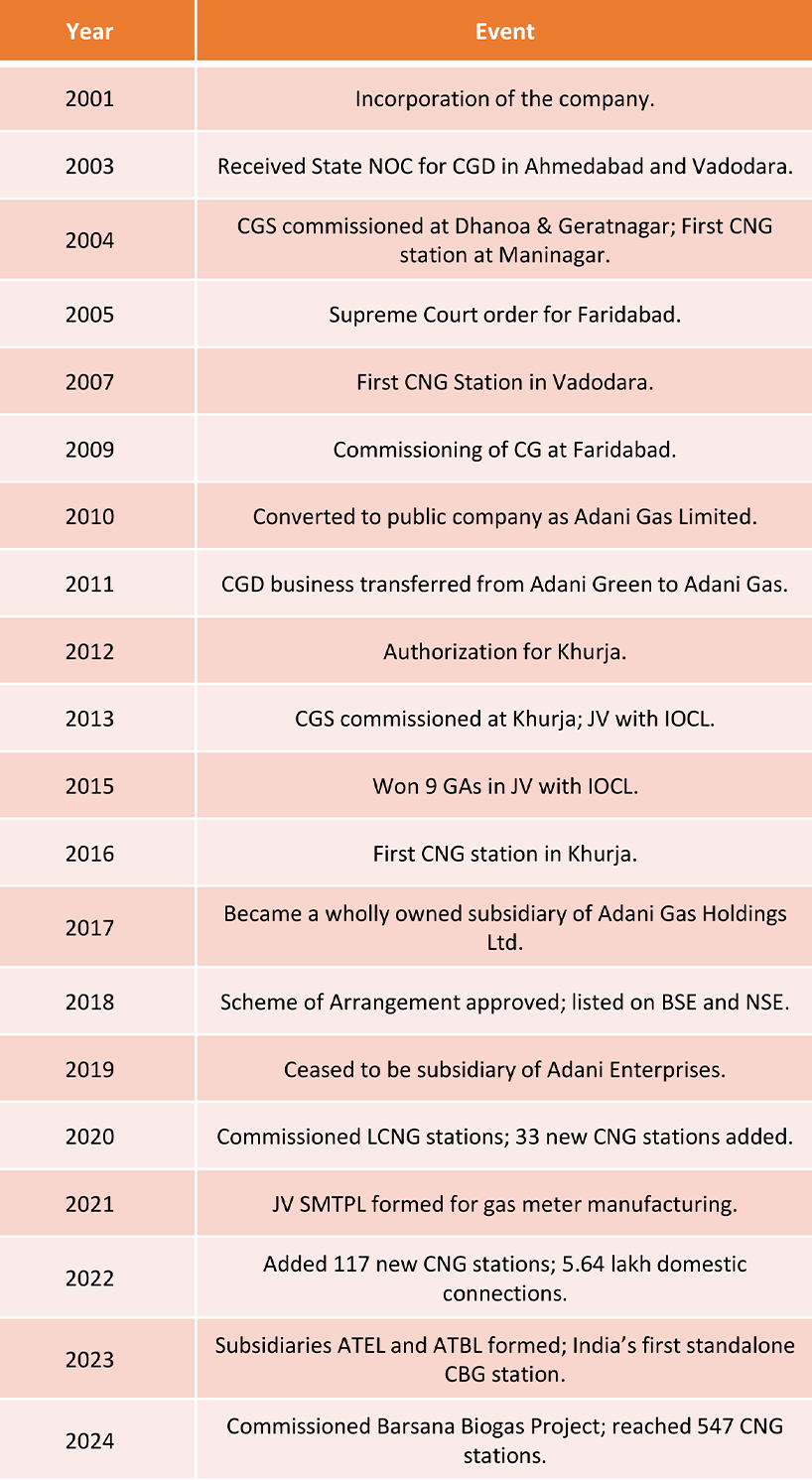

Key Milestones and History of ATGL

Why Shares of ATGL Get Transferred to IEPF

As per Section 124 of the Companies Act, 2013, any shares for which dividends remain unclaimed for seven consecutive years are transferred to IEPF. This typically occurs due to:

-

Failure to claim dividends.

-

Outdated KYC or contact details.

-

Death of shareholder without succession process.

-

Physical shares not dematerialized.

These shares, along with accrued dividends, can be legally claimed through a structured process.

How to Recover Adani Total Gas Shares from IEPF

Step 1: Confirm Eligibility

You must be the original shareholder or a legal heir. Dividends must have remained unclaimed for over 7 years.

Step 2: Search for Shares on IEPF Website

Visit iepf.gov.in and use shareholder name or folio number to search.

Step 3: Fill Form IEPF-5

Provide details of shares, bank and demat account, and PAN/Aadhaar.

Step 4: Submit Physical Documents

Send Form IEPF-5 and supporting documents to ATGL and its RTA. Required docs include:

Identity proof (PAN, Aadhaar)

-

Shareholding proof

-

Succession proof (if heir)

-

Cancelled cheque

-

Client Master Report (for Demat)

Step 5: Follow-up and Verification

IEPF and RTA verify claims. This may take 8 months - 1.5 years with regular follow-ups.

Step 6: Credit of Shares

Once approved, shares and any pending dividends are credited to your demat and bank accounts.

How Share Samadhan Helps You Recover Your ATGL Shares

Recovering shares can be time-consuming and legally complex. Share Samadhan makes it simple with:

-

Search Assistance: We help trace unclaimed holdings.

-

Legal Documentation: Drafting of affidavits, indemnity, and succession proof.

-

Form Filing: Accurate preparation and filing of IEPF Form-5.

-

RTA Coordination: Follow-up with ATGL and its registrar.

-

End-to-End Support: From demat accounts to dividend claims.

For NRIs, we offer:

-

POA and apostille documentation

-

Remote processing

-

Multi-jurisdictional coordination

Why You Should Act Now

-

Rising Share Prices: ATGL shares have gained value over time. Reclaim your rightful ownership.

-

Dividend Accruals: Unclaimed dividends may amount to lakhs.

-

Legacy Wealth: Recover inherited assets and consolidate family investments.

- Time Sensitivity: Delays can cause procedural complications.

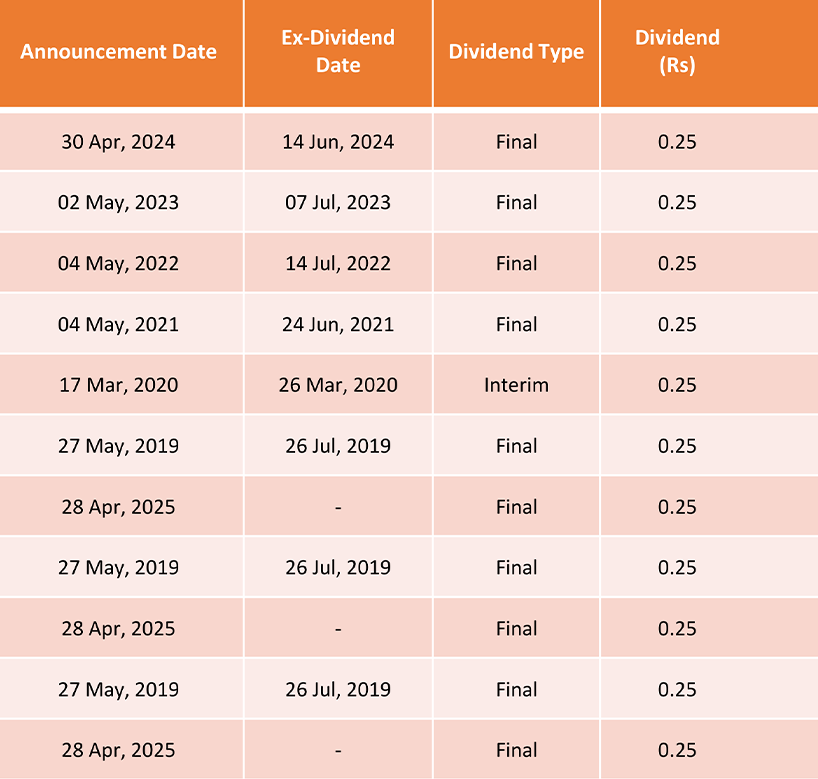

Dividend History Table

Source: https://www.moneycontrol.com/company-facts/adanitotalgas/dividends/ADG01/#google_vignette

Source: https://www.moneycontrol.com/company-facts/adanitotalgas/dividends/ADG01/#google_vignette

Share Price Growth Graph

Source: https://www.moneycontrol.com/india/stockpricequote/gas-distribution/adanitotalgas/ADG01

FAQs

Q1: Can I claim ATGL shares if I’ve lost the original share certificate?

Yes, you can still recover your ATGL shares even if the original physical certificates are missing. By submitting valid identity proof, PAN card, and demat account details—along with an indemnity bond and affidavit—you can establish ownership. Share Samadhan can assist in tracing your folio, drafting the required legal documents, and handling the verification with the RTA and IEPF authority to ensure a seamless recovery without delays or rejections.

Q2: I am an NRI. Can I recover my ATGL shares from abroad?

Absolutely. NRIs are eligible to claim shares transferred to IEPF from anywhere in the world. Share Samadhan offers complete assistance including demat account opening (NRO/NRE), notarization and apostille of documents, and preparation of Power of Attorney, so you never need to travel to India. Our team ensures that all regulatory and compliance procedures are met while coordinating with the IEPF Authority, Registrar, and ATGL to expedite your claim.

Q3: Can I recover dividends along with ATGL shares from the IEPF?

Yes. Any unpaid or unclaimed dividends linked to your ATGL shares that were transferred to IEPF can also be recovered. These dividends are released after the IEPF-5 form is approved and ownership is verified. Share Samadhan ensures accurate dividend tracing and helps you claim all associated benefits—including interest (if applicable)—from the date they were due until the shares were transferred to IEPF.

Q4: How long does it take to recover ATGL shares from IEPF?

The recovery process typically takes between 8 months- 1.5 years. The duration depends on various factors such as completeness of documents, legal heirship verification (in case of deceased holders), and IEPF Authority processing times. Share Samadhan minimizes delays by ensuring error-free documentation, proactive follow-ups with ATGL’s RTA, and expert handling of all procedural steps from IEPF Form-5 submission to demat credit.

Q5: What if the shareholder is deceased—can legal heirs claim ATGL shares?

Yes, legal heirs can recover the shares of a deceased shareholder through the IEPF claim process. You'll need a succession certificate, probate of will, or a legal heir certificate, along with identity proofs and a claim form. Share Samadhan simplifies the legal complexities by helping heirs identify unclaimed holdings, arrange the required documentation, and ensure that the rightful claim is filed and approved without unnecessary delays or legal hurdles.

Conclusion

Your investments in Adani Total Gas Limited are not gone—just misplaced. Whether it’s due to inheritance, inactivity, or paperwork delays, Share Samadhan can help you reclaim what’s rightfully yours. Our team ensures timely, accurate, and hassle-free share recovery, no matter where you reside.

Don’t let your legacy go unclaimed. Reach out to Share Samadhan today.

India's largest & most trusted platform for recovery of unclaimed investments

Submit Your Query

Recent Posts

- Recover Your Godrej Consumer Products Shares from IEPF – A Complete Guide

- Lost PGCIL Shares to IEPF? Here’s a Step-by-Step Recovery Guide with Share Samadhan

- How to Recover Unclaimed HDFC Life Shares from IEPF

- Recover Lost Shares of DLF Limited from IEPF

- Have You Lost Your Tech Mahindra Shares? A Guide To Lost Share Recovery!

- IEPF Recovery & Transmission: How To Claim Eicher Motors Shares Of A Deceased Relative?