- Sign In

- 8800 33 2200

- samadhan@sharesamadhan.com

- Sharesamadhan App

- Sharesamadhan App

Blog Details

Recover Your LTIMindtree Limited Shares from IEPF

LTIMindtree Limited, a leading global technology consulting and digital solutions company, has helped hundreds of enterprises evolve through innovation and strategy since 1996. With over 86,000 employees, 700+ clients across 40+ countries, and a current market capitalization of ₹1.78 lakh crore, LTIMindtree is a vital player in the Indian IT services sector. However, thousands of investors are unaware that their LTIMindtree shares or dividends may have been transferred to the Investor Education and Protection Fund (IEPF) due to inactivity.

If you or your family members held shares in LTIMindtree (formerly L&T Infotech or Mindtree) and haven’t claimed dividends for over seven years, this blog will help you understand how to recover them with support from Share Samadhan.

What is IEPF and Why Are Shares Transferred?

The Investor Education and Protection Fund (IEPF) is a fund established by the Ministry of Corporate Affairs under the Companies Act, 2013. According to IEPF rules:

-

If dividends remain unclaimed for 7 consecutive years

-

The corresponding shares and benefits are transferred to the IEPF

This includes:

-

Unclaimed dividends

-

Matured deposits and debentures

-

Application money is due for refund

-

Shares linked to those benefits

Once transferred, these shares can only be claimed back by applying with the IEPF Authority.

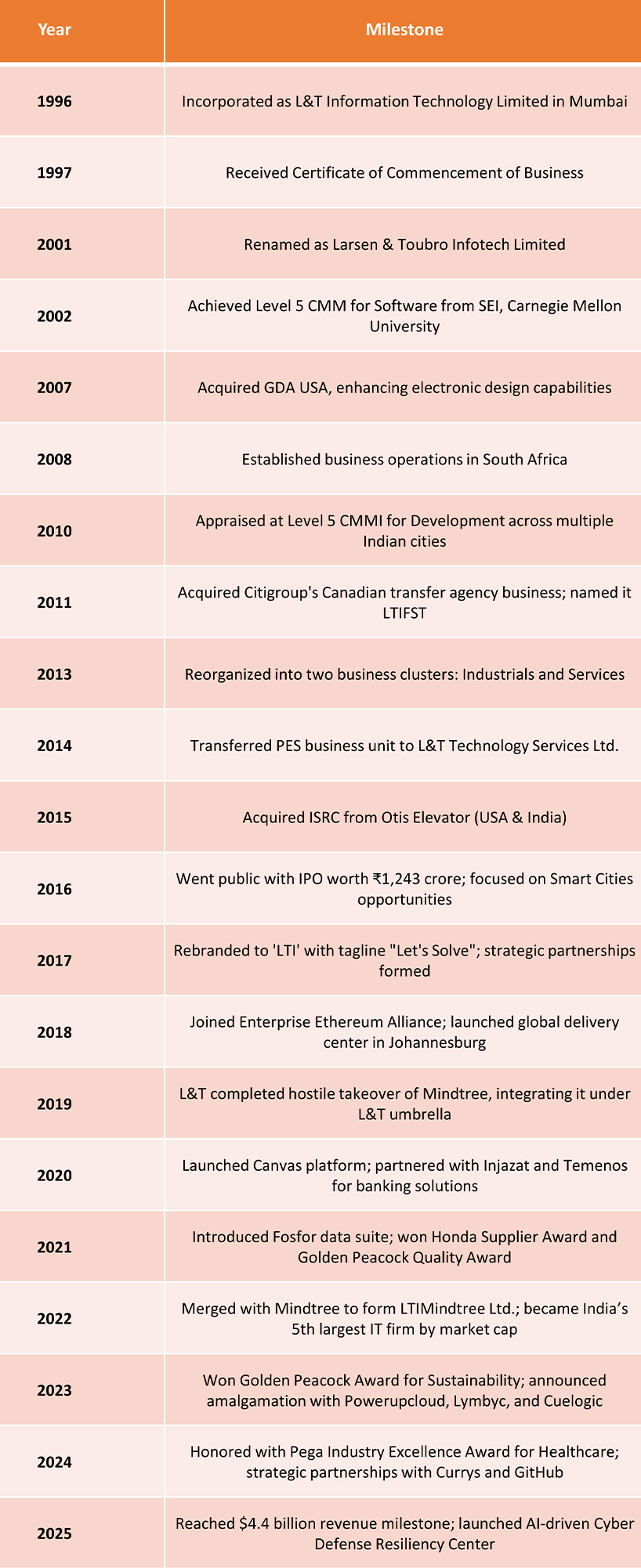

LTIMindtree Ltd: A 29-Year Legacy in Technology

Below is the complete year-wise history of LTIMindtree Limited, rewritten and organized in a tabular format:

Source: https://www.goodreturns.in/company/ltimindtree/history.html

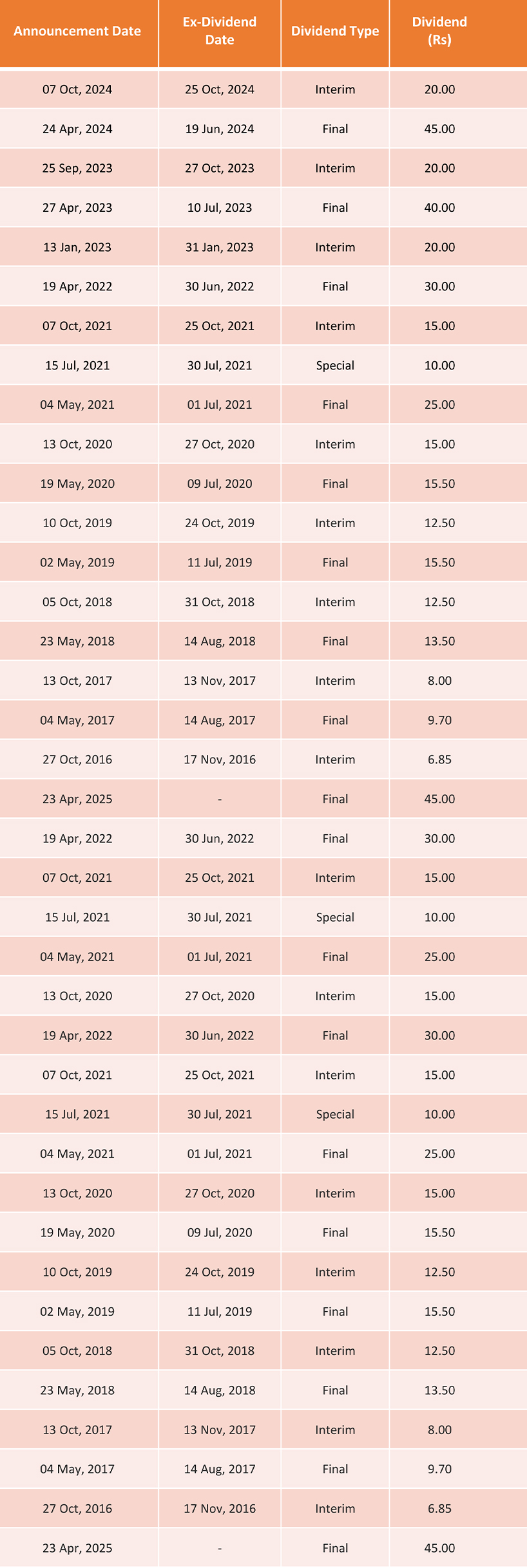

Placeholder: Dividend History Table

Placeholder: Share Price Graph

Source: https://www.moneycontrol.com/india/stockpricequote/computers-software/ltimindtree/LI12

Source: https://www.moneycontrol.com/india/stockpricequote/computers-software/ltimindtree/LI12

How to Recover LTIMindtree Shares from IEPF: Step-by-Step Guide

1. Check if Your Shares Are with IEPF

-

Visit iepf.gov.in

-

Click on the "View IEPF Claims" section

-

Search by investor name or folio number to confirm

2. Ensure Eligibility

-

Shares must have been transferred after 7 years of unclaimed dividends

-

The original shareholder or legal heir can apply

3. File Form IEPF-5 Online

-

Available at IEPF-5 Submission

-

Enter your PAN, bank account, demat account, and share details

4. Attach Necessary Documents

-

PAN and Aadhaar copies

-

Demat account statement or original share certificates

-

Bank passbook or cancelled cheque

-

Proof of entitlement (if claiming as a legal heir)

5. Download the Advance Receipt & Indemnity Bond

-

Download from the portal

-

Sign and notarize as instructed

6. Send Documents to LTIMindtree Limited's Nodal Officer

- After online submission, send the signed documents and acknowledgment to LTIMindtree’s registered office

7. Company Verifies and Forwards to IEPF Authority

-

Verification is typically completed within 30 days

-

Upon successful verification, the claim is sent to the IEPF Authority

8. Receive Refund

-

If approved, shares are credited to your demat account

- Dividends are transferred to your bank account

Common Mistakes That Delay IEPF Claims

-

Incomplete or incorrect form submission

-

Mismatched signatures or old address proofs

-

Missing documents like original certificates or succession proofs

-

Failure to follow up with the company post-submission

Even minor errors can lead to rejections. Double-check all details and consider expert guidance.

How Share Samadhan Helps

Share Samadhan is India’s leading service provider for recovering unclaimed investments. Our team ensures your LTIMindtree shares are recovered from IEPF with complete documentation support, legal assistance, and constant coordination with the company and IEPF Authority.

Our services include:

-

Document preparation and verification

-

Legal heir or nominee support

-

Liaising with LTIMindtree's Nodal Officer and IEPF

-

Monitoring progress and updates until resolution

With years of experience in handling complex IEPF recovery cases, Share Samadhan stands by your side as a trustworthy partner in wealth recovery.

FAQs

1. Can NRIs claim LTIMindtree shares from IEPF?

Yes, NRIs can apply with additional attested ID and address proofs issued by Indian authorities or the embassy.

2. What if I lost the original share certificates?

You will need to apply for a duplicate certificate from LTIMindtree before initiating the IEPF claim.

3. Is it necessary to have a demat account?

Yes, shares recovered from IEPF are credited only to a demat account.

4. What if the shareholder has passed away?

Legal heirs can apply with supporting documents like a death certificate, a succession certificate, or a probate.

5. How long does the recovery process usually take?

Typically 8 months to 1.5 years, depending on document accuracy and IEPF verification timelines.

6. I held LTIMindtree shares jointly with a family member, but I’m not sure who the primary holder was. Can I still recover them?

Yes. In joint shareholding cases, recovery is possible even if you're unsure who the first holder was. With basic information like both names, PAN numbers (if available), and the original purchase address, Share Samadhan can investigate through registrar records and help establish rightful ownership—ensuring the shares don’t remain forgotten due to uncertainty in documentation.

Final Thoughts

LTIMindtree shares may be high in value today, but unclaimed holdings are often forgotten due to a lack of awareness or documentation issues. If you suspect any LTIMindtree shares linked to you or your family are transferred to IEPF, don’t delay the recovery process.

With Share Samadhan, you don’t have to face the process alone. We bring years of professional experience, legal know-how, and a strong track record in recovering shares, dividends, and lost investments.

Your wealth is your right. Let us help you reclaim it.

India's largest & most trusted platform for recovery of unclaimed investments

Submit Your Query

Recent Posts

- Recover Your Godrej Consumer Products Shares from IEPF – A Complete Guide

- Lost PGCIL Shares to IEPF? Here’s a Step-by-Step Recovery Guide with Share Samadhan

- How to Recover Unclaimed HDFC Life Shares from IEPF

- Recover Lost Shares of DLF Limited from IEPF

- Have You Lost Your Tech Mahindra Shares? A Guide To Lost Share Recovery!

- IEPF Recovery & Transmission: How To Claim Eicher Motors Shares Of A Deceased Relative?