- Sign In

- 8800 33 2200

- samadhan@sharesamadhan.com

- Sharesamadhan App

- Sharesamadhan App

Blog Details

How to Find Unclaimed Shares & Dividends of ONGC from the IEPF

As one of India's largest Public Sector Undertakings (PSUs), the Oil and Natural Gas Corporation (ONGC) has long been a dependable asset for investors. This state-owned giant has played a crucial role in India's development since independence, consistently rewarding its shareholders with substantial dividends. This piece will explore ONGC's journey to becoming one of the nation's most profitable PSUs. We'll delve into a hypothetical investment scenario to illustrate how a modest investment in ONGC during the 1980s could yield significant returns today. Additionally, we'll examine the IEPF claim and the process of recovering old and ONGC unclaimed shares transferred to IEPF (Investor Education and Protection Fund).

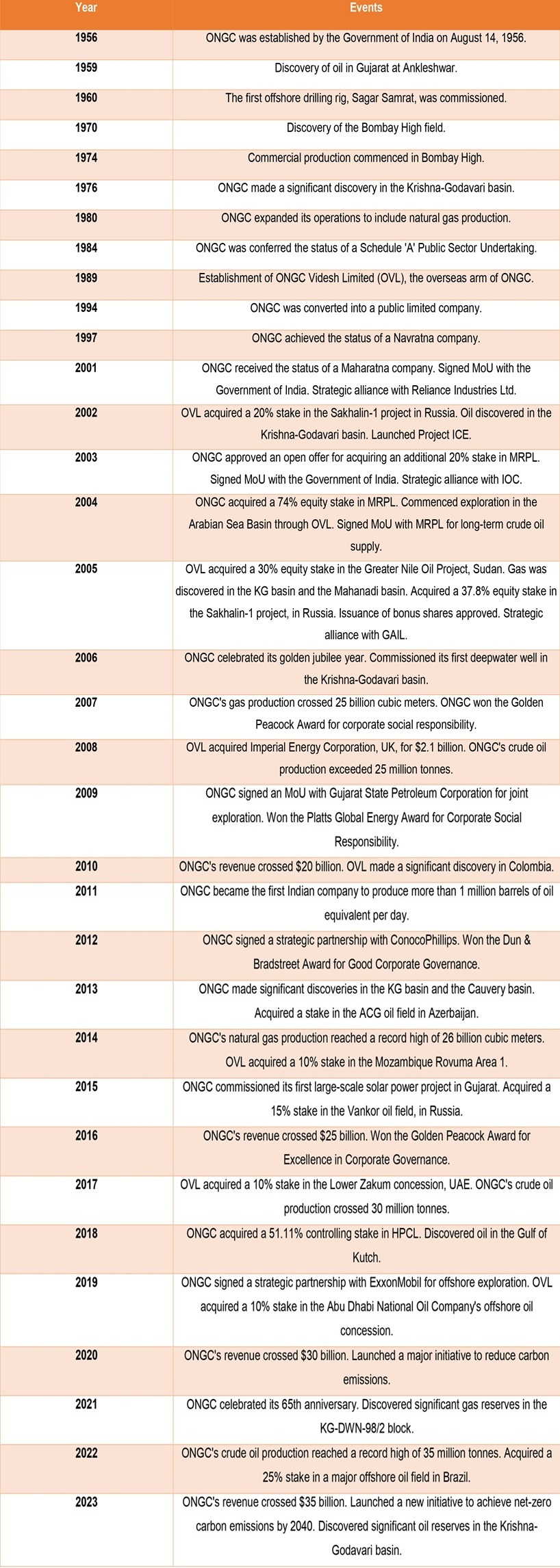

The Evolution and Impact of the Oil and Natural Gas Corporation

The Oil and Natural Gas Corporation (ONGC) is a state-owned entity specializing in oil and In 1956, the Ministry of Natural Resources and Scientific Research, Government of India, established the Oil and Natural Gas Commission (Commission) to advance oil and natural gas exploration and mining efforts in the country. By October 1959, the Commission evolved into a statutory body under the Oil and Natural Gas Commission Act, of 1959, with a mandate to plan, promote, organize, and execute programs for resource development, production, and sale of petroleum products.

The company, Oil and Natural Gas Corporation Limited was incorporated under the Companies Act on June 23, 1993, receiving the certificate of commencement on August 10, 1993. With the enactment of the Oil and Natural Gas Commission Act (Transfer of Undertaking and Repeal) Act, 1993, all assets, liabilities, and obligations of the Commission were transferred to the company on February 1, 1994.

Oil and Natural Gas Corporation (ONGC), a prominent public sector enterprise in India, has had a significant presence in the stock market. Listed on both the Bombay Stock Exchange (BSE) and the National Stock Exchange of India (NSE), ONGC is a key constituent of the BSE SENSEX and the S&P CNX Nifty indices, reflecting its influence in the Indian market. In 1996, ONGC issued 3,428,537,716 shares to the President of India, strengthening the government's stake in the company. Additionally, 1,076,440,366 equity shares were issued as bonus shares, demonstrating the company's robust financial health and its commitment to rewarding shareholders. However, 6,639,910 equity shares were delisted during this period. As of March 31, 2013, the Government of India held a substantial 69% equity stake in ONGC, underscoring its strategic importance. Over 480,000 individual shareholders collectively owned around 1.65% of its shares, with the Life Insurance Corporation of India (LIC) emerging as the largest non-promoter shareholder, holding a 7.75% stake. This extensive shareholding structure highlights the widespread trust and confidence in ONGC's performance and potential.

Source: https://en.wikipedia.org/wiki/Oil_and_Natural_Gas_Corporation#Listings_and_shareholding https://www.moneycontrol.com/company-facts/ongc/history/ONG

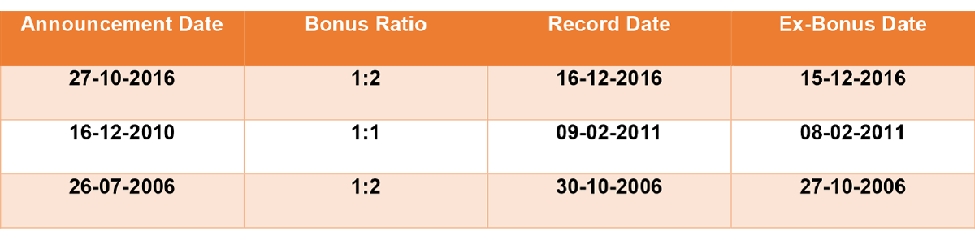

Bonus History:

Source: https://www.moneycontrol.com/company-facts/oilnaturalgascorporation/bonus/ONG

Split History:

Source: https://www.moneycontrol.com/company-facts/oilnaturalgascorporation/splits/ONG

ONGC Share Price Advanced Chart:

Calculations Related to ONGC Shares

Suppose your grandfather bought 500 shares of Oil and Natural Gas Corporation (ONGC) in April 1990.

- Bonus in 2006 (1:2 Ratio):

- For every 2 shares owned, the company gave 1 additional share.

- Original number of shares: 500

- Additional shares: 500 / 2 = 250

- Total shares after the bonus: 500 + 250 = 750 - Bonus in 2010-11 (1:1 Ratio):

- For every share owned, the company gave 1 additional share.

- Original number of shares: 750

- Additional shares: 750

- Total shares after the bonus: 750 + 750 = 1500 - Stock Split in 2010-11 (1:2 Ratio):

- Each share of Rs. 10 was split into 2 shares of Rs. 5.

- Original number of shares: 1500

- Total shares after the stock split: 1500 * 2 = 3000 - Bonus in 2016 (1:2 Ratio):

- For every 2 shares owned, the company gave 1 additional share.

- Original number of shares: 3000

- Additional shares: 3000 / 2 = 1500

- Total shares after the bonus: 3000 + 1500 = 4500 - Value of Shares in July 2024:

- Number of shares: 4500

- Current share price: Rs. 274.75

- Total value of shares: 4500 * 274.75 = Rs. 12,363,750

So, your grandparents’ initial investment of 500 shares has grown to 4500 shares, worth Rs. 12,363,750 in July 2024. This demonstrates a significant increase in value over the past 34 years. If we also consider the dividends received during this period, the total return on investment would be even higher.

Thus, an initial investment in ONGC shares would have grown tremendously, showcasing the company's strong performance and growth in the petroleum sector, both domestically and internationally.

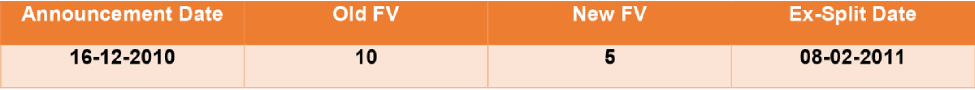

Dividend Summary

For the year ending March 2024, Oil and Natural Gas Corporation (ONGC) has declared an equity dividend of 245.00%, amounting to Rs 12.25 per share. With the current share price at Rs 276.30, this results in a dividend yield of 4.43%.

ONGC has a strong track record of dividend payments, consistently declaring dividends for the past five years.

Source: https://www.moneycontrol.com/company-facts/oilnaturalgascorporation/dividends/ONG

Formation of the Investor Education and Protection Fund (IEPF)

The Central Government established the Investor Education and Protection Fund (IEPF) in 2016 to tackle the growing problem of dormant and unclaimed shares. Historically, shares were often purchased at low prices and subsequently overlooked by shareholders, particularly when these shares showed minimal growth over five or ten years. However, as time passed and these shares appreciated significantly, shareholders would return to claim their dividends.

Before the IEPF's creation, there was no standardized mechanism to manage such scenarios. Companies faced challenges in verifying ownership and calculating dividends for dormant funds after many years. Some companies would transfer unclaimed dividends to the government's public welfare account, leaving no funds for returning investors. Others retained the dividends for years, utilizing the money for their own benefit while claiming they were waiting for shareholders to reclaim their dividends.

This lack of regulation led to the accumulation of black money. Companies often kept the unclaimed funds without detailed accounting, simply labeling them as dormant funds with no known claimants. To address these issues and bring transparency, the government established the IEPF Authority. This statutory body was tasked with enforcing regulatory norms for dormant funds and unclaimed dividends.

The IEPF Authority employed fund managers to handle claims related to unclaimed funds and framed rules for the transfer of dormant funds and unclaimed dividends. This initiative aimed to regularize the management of these funds and protect investors' interests.

IEPF Authority Rules on Dormant Funds

The IEPF Authority frequently updates its regulations concerning unclaimed dividends held by listed companies. According to the current rules, companies are required to publish a list of unclaimed dividends along with investor details on their websites every fiscal year. This practice ensures transparency in disclosing data related to unclaimed dividends.

Additionally, the IEPF mandates that companies appoint a Nodal Officer responsible for addressing and resolving complaints related to IEPF unclaimed shares and dividends. The Nodal Officer also manages the company's special unclaimed dividend account, which is a compulsory account under IEPF regulations. This account holds unclaimed dividends for seven years, starting 30 days after the dividends are declared. After these seven years, any remaining unclaimed shares are transferred to the IEPF.

The Nodal Officer must also send a verification report to the IEPF fund manager. This report, accompanied by other required documents, must be submitted within 15 days of receiving a claim application from the claimant. Failure to comply with these regulations can result in enforcement actions from the IEPF Authority.

Moreover, companies are required to inform the IEPF of any changes to the positions of the Nodal Officer or Deputy Nodal Officer to ensure continuous compliance with the regulations.

The Necessity of Legal Help to Claim ONGC’s Shares

In earlier sections, we examined how a modest investment in ONGC shares could grow significantly over time. We also reviewed the company’s annual reports to trace past dividend transfers to the IEPF and the yearly dividends paid to stockholders. Now, let's explore the process of claiming unclaimed shares from the IEPF and understand why legal assistance can be crucial.

If you have unclaimed ONGC dividends that have not exceeded seven years, you can inquire about the status of these funds through the company's nodal officer. Investors can search for their share details and contact ONGC’s appointed agent and registrar with proof of share ownership and relevant documents.

The nodal officer maintains comprehensive records of shares owned by investors, allowing even long-term shareholders to inquire about the status of their holdings. For shares dormant for more than seven years, the process involves the IEPF authority. Here’s a step-by-step guide to the process:

- Inquiry and Documentation:

- Request stock details from the nodal officer.

- Apply on the IEPF portal with these details.

- Download the filled application form and compile all required documents as specified by the IEPF. - Submission to Nodal Officer:

- Submit the compiled documents and application form to the nodal officer.

- The nodal officer verifies the documents and prepares a verification report within 15 days. - Final Verification by IEPF:

- The verification report and claim form are sent to the IEPF authority.

- The IEPF fund manager reviews the claim, potentially requesting additional documents, approving the claim, or rejecting it.

Given the stringent scrutiny by the IEPF fund manager, additional documentation is often required. Maintaining continuous communication with the IEPF throughout the claim resolution period can be challenging for individual investors. This is where legal and financial consultancy firms become invaluable:

- Expert Liaison: These firms have the expertise to liaise with the IEPF authority and nodal officer, ensuring all necessary documents are provided promptly.

- Comprehensive Support: They assist in verifying and compiling required documents, streamlining the application process.

- Handling Complications: If the original shareholder has passed away, these firms can help claim ownership on behalf of heirs.

- Efficient Resolution: Legal and financial consultants can expedite the process, reducing the burden on investors and increasing the likelihood of a successful claim.

In conclusion, while the IEPF and nodal officer play crucial roles in the claims process, the complexity and stringent requirements often necessitate professional assistance. Hiring a legal and financial consultancy firm ensures that all aspects of the claim are managed effectively, providing peace of mind and a higher chance of recovering the IEPF unclaimed shares.

In this piece, we’ve explored the necessity of hiring a financial and legal consultancy to claim unclaimed dividends transferred to the IEPF. We also delved into the remarkable growth of ONGC, highlighting its extensive progress since its inception, recent international collaborations for gas and petroleum exploration, and significant research into alternative energy sources. These factors underscore a promising future for ONGC, reflecting the increasing investor trust and the substantial dividends the company has consistently provided.

Given these reasons, recovering ONGC shares from the IEPF emerges as a highly profitable decision. Engaging a reputable financial consultancy can simplify this process significantly. Business owners and individual investors can save valuable time and effort by relying on these firms to handle interactions with nodal officers and the IEPF authority. The significant growth in ONGC shares presents a lucrative opportunity for those who have recently discovered old physical shares passed down from their grandparents or parents. We strongly recommend consulting a legal and financial advisory firm such as Share Samadhan promptly if you possess ONGC's old physical unclaimed shares transferred to the IEPF. This strategic move can unlock substantial capital and ensure a smooth recovery process.

India's largest & most trusted platform for recovery of unclaimed investments

Submit Your Query

Recent Posts

- Recover Your Godrej Consumer Products Shares from IEPF – A Complete Guide

- Lost PGCIL Shares to IEPF? Here’s a Step-by-Step Recovery Guide with Share Samadhan

- How to Recover Unclaimed HDFC Life Shares from IEPF

- Recover Lost Shares of DLF Limited from IEPF

- Have You Lost Your Tech Mahindra Shares? A Guide To Lost Share Recovery!

- IEPF Recovery & Transmission: How To Claim Eicher Motors Shares Of A Deceased Relative?