- Sign In

- 8800 33 2200

- samadhan@sharesamadhan.com

- Sharesamadhan App

- Sharesamadhan App

Blog Details

How to Find and Claim IEPF Unclaimed Shares of NTPC Limited

Diversification is an important strategy for mitigating stock price volatility. The goal is to select stocks that outperform an index fund. One company that has demonstrated this potential is NTPC Limited (NSE: NTPC). In the past year, NTPC shares have experienced a substantial increase of 92.04%, climbing to ₹372.95. However, the long-term picture is less impressive, with the stock declining by 0.6% over the past three years. To determine if the underlying business performance aligns with long-term shareholder returns, examining the company's fundamentals is essential. Although share prices frequently mirror investor sentiment rather than fundamental business performance, markets remain effective pricing mechanisms. By analyzing changes in earnings per share (EPS) and share price, we can gain insight into how investor perceptions of a company have evolved. Over the past three years, NTPC has achieved an EPS growth of 18.40% and a revenue growth of 16.97%. In the trailing twelve months, the company generated a revenue of ₹17,85,009 crore, marginally surpassing the revenue of the most recent fiscal year. Additionally, investors should be aware of IEPF unclaimed shares that might be transferred to the Investor Education and Protection Fund. If you have unclaimed dividends or shares, it is essential to initiate an IEPF claim to recover these assets. By staying informed about your investments and understanding the process to claim any unclaimed shares, you can ensure that your financial portfolio remains robust and beneficial.

The Calculation You Must Pay Attention To:

Before understanding the process of claiming NTPC Limited's unclaimed shares and unclaimed dividends transferred to the IEPF, it’s important to understand why claiming your shares and dividends is crucial. Since its listing on stock exchanges, NTPC Limited has consistently been one of the top-performing stocks in the market. In 2004, the price per share of NTPC Limited was approximately Rs. 80, and as of July 5, 2024, it has risen to Rs. 376, excluding any bonuses or splits.

If you're wondering how to find unclaimed shares, it's crucial to follow the proper steps and guidelines provided by the IEPF. The IEPF unclaimed shares represent a significant value that you should not overlook.

Let's say that you purchased 100 NTPC Limited shares in 2004 at Rs. 80 per share.

Total Investment = 100 * 80 = Rs. 8,000

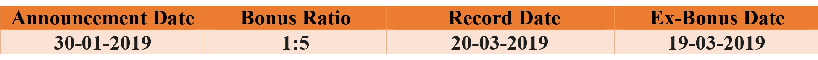

There was a bonus share issuance on March 19, 2019, with a ratio of 1:5.

Number of Shares after Bonus = 100 + (100 / 5) = 100 + 20 = 120 shares

Therefore, if you purchased 100 shares in 2004, you now own 120 shares after the bonus.

Current Market Price of NTPC Limited (as of July 5, 2024) = Rs. 376 per share

Total Value of Investment Now in 2024 = 120 * 376 = Rs. 45,120

To initiate an IEPF claim, you need to follow specific steps and procedures to ensure that your unclaimed assets are returned to you.

Understanding why claiming your unclaimed shares and unclaimed dividends transferred to the IEPF is crucial and can help you make informed decisions. By reclaiming your shares, you ensure that you are not missing out on potential financial assets that belong to you.

Considering Dividends

When evaluating investment returns, it's essential to distinguish between total shareholder return (TSR) and share price return. TSR is a comprehensive metric that includes the value of cash dividends, assuming that any dividends received were reinvested, as well as the estimated value of any deferred capital raising and spin-off transactions. Consequently, TSR can often be significantly higher than share price returns for companies that distribute substantial dividends.

For NTPC, the TSR over the past year was 32%, surpassing the previously mentioned share price return. This higher TSR can be attributed to the dividends paid out by the company, highlighting the importance of considering dividends when assessing overall investment performance. If you have an unclaimed dividend from NTPC, you should learn how to claim unclaimed dividends to ensure you benefit from these returns. You can start by conducting a search for unclaimed dividends on the IEPF website.

A Different Perspective

It's heartening to see that NTPC shareholders have experienced a total shareholder return (TSR) of 32% over the past year, which includes dividends. This recent performance indicates an improvement, as the one-year TSR is significantly higher than the five-year TSR, which stands at an annual rate of 4%. This upward trend may signal genuine company momentum, suggesting that now could be an excellent time for further investigation.

Examining the share price as a long-term indicator of company success is intriguing, but it's essential to consider additional data for a comprehensive understanding. For example, we've identified two red flags for NTPC, one of which is particularly concerning. It’s crucial to be aware of these potential issues before making an investment decision.

If you have dividends that you haven't claimed, they may have been transferred to the Investor Education and Protection Fund (IEPF). Knowing how to claim dividends and initiating an IEPF claim can help you recover these funds. The process of how to claim unclaimed dividends involves submitting the necessary forms and documents to the IEPF authority. This ensures that your IEPF unclaimed dividends are returned to you, enhancing your overall investment returns.

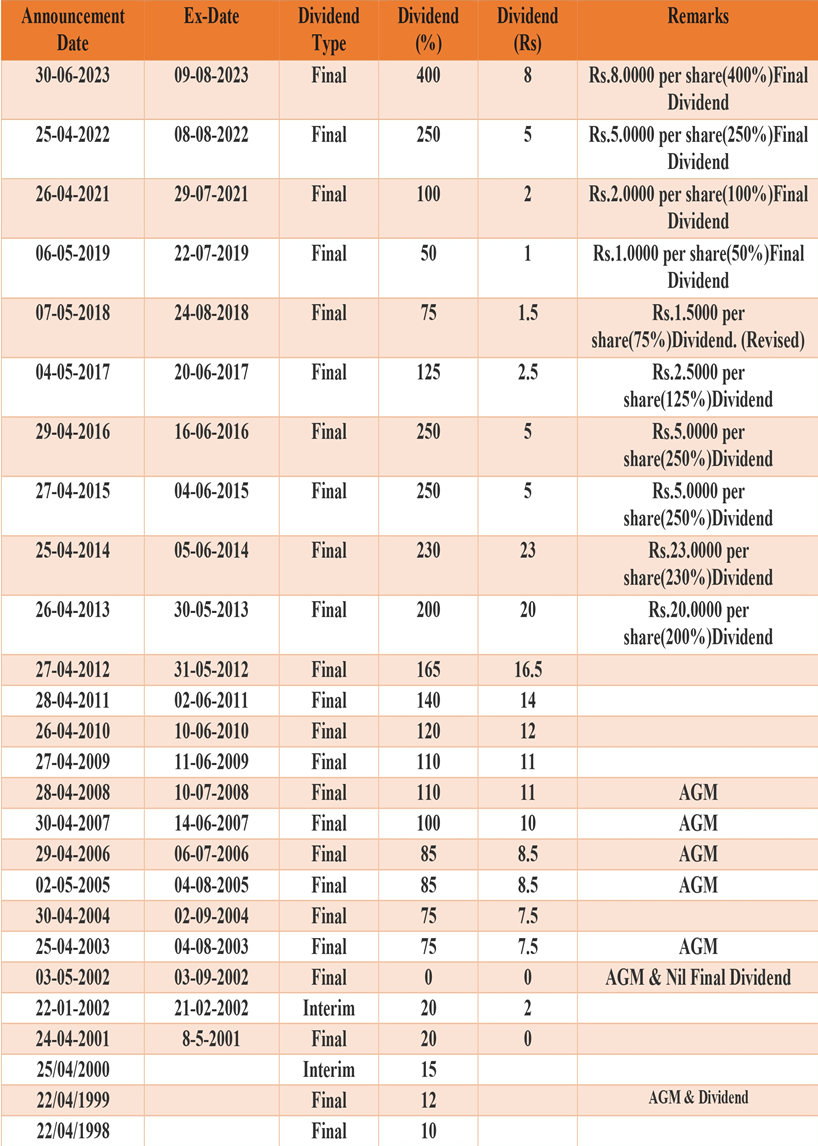

Dividend History from the Beginning

Source: https://www.moneycontrol.com/company-facts/ntpc/dividends/NTP

Bonus History:

Source: https://www.moneycontrol.com/company-facts/ntpc/bonus/NTP

Why Have Your NTPC Limited Unclaimed Shares Gone to IEPF?

According to government regulations, dividends on shares that remain unclaimed for seven or more consecutive years must be transferred to the Investor Education and Protection Fund (IEPF) by the respective company. If a dividend remains unclaimed for seven consecutive years, the company is obligated to transfer the associated shares to the IEPF. In the past, companies could take advantage of investors' unawareness by keeping the unclaimed dividends. To tackle this issue, the government created the IEPF, where companies need to transfer shares that have remained unclaimed for seven years to the fund.

What is IEPF and Its Purpose?

IEPF (Investor Education and Protection Fund) was introduced by the Government of India in the year 2016 on September 7, under the provisions of Section 125 of the Companies Act, 2013. The IEPF serves as a regulatory framework aimed at safeguarding and managing the funds of investors.

IEPF's responsibilities include:

- Refunding and recovering shares, matured deposits/debentures, and unclaimed dividends.

- Promoting awareness among investors.

- Reimbursing legal expenses incurred by depositors in pursuing legal actions.

By fulfilling these roles, the IEPF ensures that investors are protected and informed about their investments.

How to Claim NTPC Shares from IEPF

- Eligibility to Claim: Anyone can claim shares transferred to the Fund, including unclaimed dividends, matured deposits, matured debentures, application money due for refund, interest on these amounts, and sale proceeds of fractional shares.

- Submission of Claim Form: The claimant must complete and sign Form IEPF-5 and submit it along with the required documents listed in the form to the relevant company at its registered office for verification.

- Verification by Company: Within fifteen days of receiving the claim, the company must verify the claim and submit a verification report, along with the supporting documents provided by the claimant, to the Authority.

- Confirmation of Eligibility:

- For monetary claims: The Authority and its Drawing and Disbursing Officer will issue a bill to the Pay and Accounts Office for electronic payment as per the rules

- For share claims: With the consent of the Competent Authority, the Authority will issue a refund sanction order and credit the shares to the claimant's DEMAT account. - Record-Keeping: The Authority must record all payments made under these rules.

- Response Time: The Authority must respond to a properly verified refund claim within sixty days of receiving the company's verification report. If there is a delay beyond sixty days, the Authority must document the reasons for the delay and inform the claimant in writing or electronically.

- Deficiency Notification: If the application is deficient or not approved, the Authority must notify the claimant and the relevant company of the deficiencies.

- Transmission Process: If the claimant is the legal heir, successor, administrator, or nominee of the registered shareholder, they must ensure the transmission process is completed by the company before submitting any claims to the Authority.

- Verification of Documents: The company must verify all necessary documents for registering the transfer or transmission and issue a letter indicating the claimant's entitlement to the security. This letter must be furnished to the Authority.

- Consolidated Claims: The claimant can only submit one consolidated claim per company per fiscal year.

- Indemnity: The Authority is not liable to indemnify the security holder or company for any discrepancies in the verification report leading to litigation or complaints. The company must indemnify the Authority in case of any disputes or lawsuits arising from inconsistencies in the verification report.

This process ensures that shareholders can reclaim their IEPF unclaimed shares and unclaimed dividends while maintaining a clear and regulated procedure.

How to Claim a Dividend

Follow these steps to claim your dividend:

Converting a Physical Share Certificate into Demat

- Open a Demat Account: Claimants must open a Demat Account with a depository institution to receive shares released by the IEPF Authority in their favor.

- Download Form IEPF-5: Visit the IEPF website (http://www.iepf.gov.in) and download Form IEPF-5. Before filling out the form, review the instructions provided on the website, the instruction package, and the e-form.

- Complete the Form: Fill out the form by entering the required information, save it to your computer, and then upload the completed form following the website’s instructions.

- Acknowledge Submission: After successfully uploading the form to the MCA Portal, you will receive an acknowledgment with the SRN (Service Request Number). Keep the SRN safe for future reference and tracking.

- Print Documents: Print the properly completed IEPF-5 form and the acknowledgment received after uploading the form.

- Prepare Additional Documents:

- Indemnity Bond: On plain paper, prepare an indemnity bond. Refer to page 8 of the instruction kit for the format and stamp duty details.

- Advance Stamped Receipt: Prepare an advance stamped receipt with signatures from the claimant and two witnesses. The format is described on page 7 of the instruction package. - Compile the Required Papers: Gather the following documents:

- The printed IEPF-5 form and acknowledgment

- The self-attested electronic form

- Any other documents specified in Form IEPF-5, including:

=> For Indian citizens: A copy of the Aadhaar card and proof of entitlement (e.g., original security certificates, interest warrant applications)

=> A canceled check leaf

=> For foreign nationals: A copy of the passport, OCI (Overseas Citizen of India), or PIO (Person of Indian Origin) card

Following these steps ensures that you complete the process accurately and efficiently, allowing you to claim your unclaimed dividend successfully. For quick and best results, get in touch with the expert team associated with Share Samadhan.

India's largest & most trusted platform for recovery of unclaimed investments

Submit Your Query

Recent Posts

- Recover Your Godrej Consumer Products Shares from IEPF – A Complete Guide

- Lost PGCIL Shares to IEPF? Here’s a Step-by-Step Recovery Guide with Share Samadhan

- How to Recover Unclaimed HDFC Life Shares from IEPF

- Recover Lost Shares of DLF Limited from IEPF

- Have You Lost Your Tech Mahindra Shares? A Guide To Lost Share Recovery!

- IEPF Recovery & Transmission: How To Claim Eicher Motors Shares Of A Deceased Relative?