How to Recover Unclaimed Shares and Dividends of Axis Bank Limited from IEPF

If you happen to own shares of AXIS Bank from 25 years ago, you have a reason to be very happy. Those shares have grown tremendously in value. Searching these old shares, the unclaimed dividends, and claiming them from the Investor Education and Protection Fund (IEPF) could make you wealthy quickly. In this article, we’ll answer all your questions about the IEPF and explain how these dormant shares of AXIS Bank can significantly boost your wealth. The large number of unclaimed shares and dividends AXIS Bank has transferred to the IEPF might inspire some people to review their investment history to see if they have any unclaimed shares.

Before diving into the process of claiming your unclaimed AXIS Bank shares and dividends from the IEPF, let's discuss why it’s crucial to do so. Since its listing on stock exchanges, AXIS Bank shares have been among the top performers in the market. Axis Bank issued its shares for the first time in India through an Initial Public Offering (IPO) in December 1998. The face value of each share at that time was ₹10. In the year 2000, the price per share of AXIS Bank Limited was approximately Rs. 38. By June 7, 2024, this price had soared to Rs. 1171.55 per share, without accounting for any bonuses or stock splits.

Calculation According to Stock Split:

Let’s suppose you purchased 100 shares of Axis Bank Limited in 2000 at Rs. 38 per share. Total Investment = 100 *38 = Rs. 3800

a) Stock Split on 28 July 2014 in 5:1

Number of Shares after Split = 100 *5 = 500

Therefore, if you purchased 100 shares in the year 2000, you now own 500 shares after the Stock Split.

Current Market Price of Axis Bank Limited (as of 07.06.2024) = Rs. 1171.55 per share Total Value of Investment Now in 2024 = 500 *1171.55 = Rs. 585,775

100 shares invested in Axis Bank Limited shares in 2000 would be about Rs. 585,775. If your unclaimed shares have been transferred to the IEPF, imagine your current net worth, including bonus shares and dividends. With such impressive figures, who wouldn’t want to check for unclaimed shares and dividends of AXIS Bank Limited?

The Growth of AXIS Bank Limited

AXIS Bank Limited has evolved into a prominent depository financial institution, providing a wide range of banking and financial services. These services encompass commercial banking, retail banking, project and corporate finance, capital finance, insurance, venture capital, private equity, investment banking, broking, and treasury products and services. The bank’s operations are divided into several business segments: Retail Banking, Wholesale Banking, Treasury, Other Banking, Life Insurance, and General Insurance, among others. With a vast network of approximately 18,210 branches and ATMs, and about 110 Touch Banking branches across over 30 cities, AXIS Bank is well-established across India. Its international banking operations cater to the global banking needs of its Indian corporate clients, leveraging economic corridors between India and the rest of the world. Additionally, the bank supports women entrepreneurs through its Self-Help Group (SHG) program, as part of its microfinance initiatives.

AXIS Bank is one of India’s premier private-sector financial institutions. In 1994, it was one of the first to receive approval from the Reserve Bank of India (RBI) to establish a private-sector bank. Currently, AXIS Bank operates a network of over 5,480 branches and more than 14,530 ATMs spread across 2,800+ cities in India. Despite being listed as a private company, AXIS Bank Limited has maintained a steady growth rate over the past two decades. The bank offers a comprehensive range of banking and financial services, covering both wholesale and retail banking. Its Treasury segment includes net interest earnings from the bank’s diverse investment portfolio, market lending and borrowings, profits or losses from investment operations, and trading in foreign exchange and derivative contracts. The Retail Banking segment serves customers through its extensive branch network and alternative delivery channels, introducing numerous modern banking practices and financial products.

Over the years, AXIS Bank’s shares have shown significant growth, prompting the company to split its stocks twice in the last decade. This article will explore how a modest investment in AXIS Bank could potentially be worth millions today, and the best methods for investors to reclaim such amounts.

Importance of Claiming Old Shares

As illustrated by the above calculations, shares of AXIS Bank from two or three decades ago can yield substantial returns. In addition to the increase in share value, AXIS Bank has also consistently paid dividends, making it a preferred stock for many investors. If we include the returns from dividends, the total return on investment could easily exceed one crore rupees. These impressive figures highlight that old shares of AXIS Bank are indeed a hidden treasure.

Dividends and Claiming Shares from IEPF

In the following sections, we will provide data on the dividends released by AXIS Bank over the past two decades, enabling investors to calculate the total dividends received. We will also explain what the Investor Education and Protection Fund (IEPF) is and how to find and claim old shares of AXIS Bank from it.

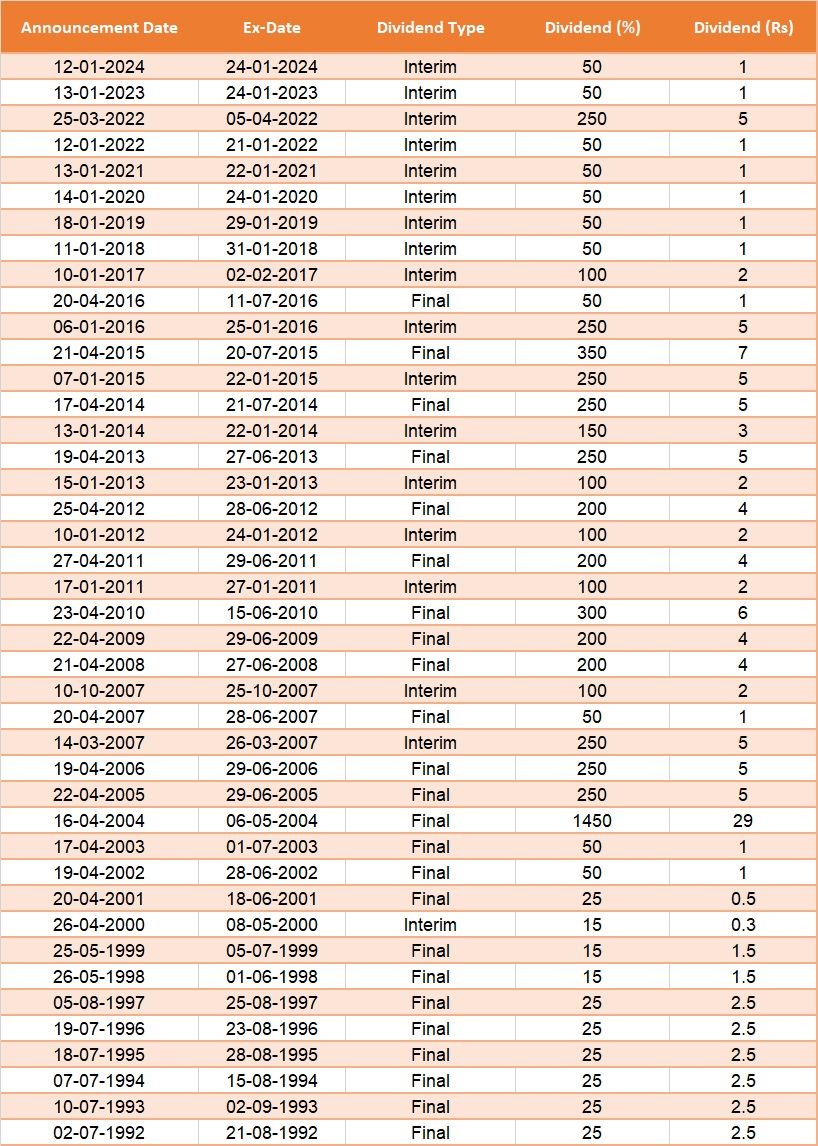

Dividend History of AXIS Bank LTD.

Below is a detailed table of the dividends released by AXIS Bank since 1997. This table allows investors to analyze the potential dividends generated from any investment made after 1997.

|

Announcement Date |

Ex- Date |

Face -Value |

Dividend Type |

Dividend (%) |

Dividend (Rs) |

|

27-04-2023 |

07-07-2023 |

2 |

Final |

50 |

1.00 |

|

28-04-2022 |

07-07-2022 |

2 |

Final |

50 |

1.00 |

|

25-04-2019 |

04-07-2019 |

2 |

Final |

50 |

1.00 |

|

28-04-2017 |

06-07-2017 |

2 |

Final |

250 |

5.00 |

|

26-04-2016 |

07-07-2016 |

2 |

Final |

250 |

5.00 |

|

29-04-2015 |

09-07-2015 |

2 |

Final |

230 |

4.60 |

|

25-04-2014 |

12-06-2014 |

10 |

Final |

200 |

20.00 |

|

25-04-2013 |

05-07-2013 |

10 |

Final |

180 |

18.00 |

|

27-04-2012 |

14-06-2012 |

10 |

Final |

160 |

16.00 |

|

22-04-2011 |

08-06-2011 |

10 |

Final |

140 |

14.00 |

|

20-04-2010 |

20-05-2010 |

10 |

Final |

120 |

12.00 |

|

20-04-2009 |

14-05-2009 |

10 |

Final |

100 |

10.00 |

|

21-04-2008 |

22-05-2008 |

10 |

Final |

60 |

6.00 |

|

17-04-2007 |

17-05-2007 |

10 |

Final |

45 |

4.50 |

|

17-04-2006 |

16-05-2006 |

10 |

Final |

35 |

3.50 |

|

21-04-2005 |

20-05-2005 |

10 |

Final |

28 |

2.80 |

|

29-04-2004 |

28-05-2004 |

10 |

Final |

25 |

2.50 |

|

06-05-2003 |

09-06-2003 |

10 |

Final |

22 |

2.20 |

|

02-05-2002 |

26-06-2002 |

10 |

Final |

20 |

0.00 |

|

05-05-2001 |

04-06-2001 |

10 |

Final |

15 |

0.00 |

|

25-04-2000 |

Interim |

15 |

|||

|

22/04/1999 |

Final |

12 |

|||

|

22/04/1998 |

Final |

10 |

Source: https://www.moneycontrol.com/company-facts/axisbank/dividends/AB16

In accordance with the annual report of AXIS Bank for the fiscal year 2018-19, the bank made a significant transfer of 414,423 shares to the Investor Education and Protection Fund (IEPF), operated under the Ministry of Corporate Affairs, as per the provisions of the IEPF Rules 2016. These shares were transferred bearing Demat account number 12047200 13676780, held with Central Depository Services Limited (CDSL) through a Depository Participant in SBI CAP Securities Ltd. Under the provisions of the IEPF Authority rules, all benefits and returns gained from these shares are directed to the IEPF.

Furthermore, the report indicated that the IEPF transferred a total of 4,685 shares for claims associated with old AXIS shares by March 31, 2019.

As per the IEPF rules, the company is obligated to disclose the details of shareholders whose shares have been transferred to the authority under these regulations. The company provides information regarding the dates of transfer for dividends and also specifies the deadline for claiming these funds before they are transferred to the IEPF.

Timeline for Transferring Unclaimed Dividends to IEPF

| Dividend for the year ended | Date of Declaration of Dividend | The Last date for Claiming a Dividend |

|---|---|---|

| March 31, 2012 | July 13, 2012 | July 12, 2019 |

| March 31, 2013 | June 27, 2013 | June 26, 2020 |

| March 31, 2014 | June 25, 2014 | June 24, 2021| |

| March 31, 2015 | July 21, 2015 | July 20, 2022 |

| March 31, 2016 | July 21, 2016 | July 20, 2023 |

| March 31, 2017 | July 24, 2017 | July 23, 2024 |

| March 31, 2018 | June 29, 2018 | June 28, 2025 |

Unclaimed dividends declared by AXIS Bank for the fiscal year 2013 were transferred to the IEPF account on June 26, 2020. Shareholders wishing to claim their dividends before the deadline must contact the bank's nodal officer or transfer agent. They should present the necessary documents to prove ownership of the shares and dividends.

Overview of the Investor Education and Protection Fund

The Government of India has set an ambitious target of achieving a $5 trillion economy by 2024, driving continuous reforms in the financial and economic sectors. From the introduction of the Insolvency and Bankruptcy Code (IBC) in 2016 to various banking reforms, the government has been striving to formalize and organize the Indian financial sector. One such significant reform was the establishment of the Investor Education and Protection Fund (IEPF) in 2016. Prior to this, there was no regulatory body overseeing unclaimed dividends in the Indian stock market since Independence.

In 2016, the government established the IEPF authority and introduced regulations in conjunction with the Companies Act, 2013, mandating compliance by all listed companies. Here are the key changes introduced by the IEPF rules and subsequent amendments regarding the transfer of unclaimed dividends to the IEPF account:

- Investors must claim their dividends from the company within 30 days of declaration.

- Companies are required to create a separate unclaimed dividend account for transferring dividends not claimed by investors within 30 days.

- To claim amounts from the special account after 30 days, investors must contact the company's transfer officer or nodal officer with the necessary documents.

- Companies must inform shareholders that their dividends have been transferred to the unclaimed dividend account, urging them to claim it before it is transferred to the IEPF.

- Companies are obligated to publish a list of investors whose dividends have been transferred to the unclaimed dividend account.

- Companies should individually notify shareholders about dividend transfers via email and letters.

- If investors fail to claim dividends from the company's unclaimed dividend account for seven years, the dividends are transferred to the IEPF.

- Annually, companies must release a list of shareholders whose shares have been transferred to the IEPF.

- After seven years, shareholders must apply to the IEPF to retrieve their dividends.

These rules were implemented by the Ministry of Corporate Affairs (MCA) to streamline the process of claiming dormant dividends, making it more regularized and transparent. The process of claiming dividends from the IEPF is also well-organized and involves thorough scrutiny to ensure dividends are received by the rightful owners, preventing fraudulent claims.

Procedure for Claiming AXIS Bank Dividends from IEPF

Claiming dividends from the IEPF can seem complicated due to the required documents and procedural knowledge. However, we’ve simplified the process into easy-to-follow steps for better understanding. Here’s how to claim dividends from IEPF:

- Initial Contact: The shareholder should first contact AXIS Bank's nodal officer to obtain details about their shares and the claim process. The nodal officer will provide a list of necessary documents for the claim form.

- Filing the Claim Form: The shareholder needs to visit the IEPF website and complete the IEPF claim form, entering personal details and information about share ownership.

- Documentation: After submitting the form online, the claimant should print the form and gather all required documents as specified by the IEPF website and the nodal officer.

- Submission to Nodal Officer: The compiled documents and printed form should be sent to the nodal officer. The nodal officer will review the submission to verify the claimant's ownership of the shares and ensure all details are correct.

- Verification Report: Within 15 days of receiving the documents, the nodal officer will prepare a claim verification report and send it to the IEPF Authority's regional fund manager.

- Fund Manager Review: The regional fund manager will examine the claim verification report, application form, and accompanying documents.

Based on this review, the fund manager may:

- Request Additional Documents: The claimant may be asked to provide further documentation, which should be submitted via the nodal officer.

- Reject the Application: The application may be rejected due to errors or missing documents not submitted in time.

- Approve the Claim: If everything is in order, the fund manager will sanction the claimed amount after successful verification.

By following these steps, shareholders can navigate the IEPF claim process more smoothly.

Need for Legal Assistance in Claiming AXIS’s Old Shares

As discussed earlier, the claim process for old shares requires meticulous scrutiny by nodal officers and the IEPF authority to prevent fraudulent claims. Ownership documents are thoroughly examined, and background checks are conducted. Even minor errors in the application form need to be corrected promptly, or the claim might be rejected.

This detailed scrutiny makes the claim process time-consuming and challenging for the average investor. To simplify this process, it is advisable to hire a reputable legal consultancy firm. These firms specialize in filing IEPF forms, significantly reducing the likelihood of errors in your application. They provide comprehensive support, liaising with the nodal officer and IEPF authority to address any issues or missing documents. This service can save investors a considerable amount of time and effort.

Additionally, legal firms are particularly helpful in cases where shares are inherited from a relative who did not name an heir. They assist clients in proving ownership and rightful claim over the shares, ensuring a smoother claim process. By leveraging their expertise, investors can navigate the complexities of the IEPF claim process more effectively and efficiently.

Conclusion

Given the points discussed, recovering AXIS Bank shares can be a profitable endeavor for investors. It’s worth examining the investment portfolios of your parents and grandparents for any dormant or unclaimed shares and dividends of AXIS Bank LTD that have been transferred to the IEPF. By hiring Share Samadhan, the share recovery firm in Delhi, to handle the claims process with the IEPF on your behalf, you can simplify the task and reduce the overall turnaround time. Attempting to complete all the processes independently can be time-consuming. Furthermore, the increasing scrutiny of shares owned by heirs has made it more challenging for descendants to claim ownership. To avoid these complications, it is advisable to have a knowledgeable attorney assist you in filing claims for such investments. This ensures a smoother process and helps prevent potential issues.