- Sign In

- 8800 33 2200

- samadhan@sharesamadhan.com

- Sharesamadhan App

- Sharesamadhan App

Blog Details

Recover JSW Steel Unclaimed Shares Transferred to the IEPF

JSW Steel, a leading steel manufacturer in India and part of the JSW Group, has undergone significant developments recently. Originally established as Jindal Vijayanagar Steel Ltd. in 1982, the company rebranded to JSW Steel in 2005 and is headquartered in Mumbai. As of March 2023, JSW Steel's installed manufacturing capacity stood at 28.5 million tonnes per annum (MTPA), with plans to expand this to 39 MTPA by the end of the financial year 2024. People who have unclaimed shares and dividends of JSW Steel must go for an IEPF claim as it can help them unfold investments worth crores now.

Financial Performance and Dividends

For the financial year ending March 2024, JSW Steel has maintained a dividend rate of 20%. However, as of March 31, 2023, the company reported unclaimed dividends amounting to ₹11,53,078, which reflects the ongoing issue of unclaimed shareholder dividends. These unclaimed amounts are transferred to the Investor Education and Protection Fund (IEPF) if not claimed within seven years.

Upcoming Annual General Meeting

JSW Steel is set to hold its 30th Annual General Meeting (AGM) on July 26, 2024, where shareholders will discuss the audited financial statements for the fiscal year ending March 31, 2024. This meeting will be conducted via video conferencing, reflecting the company's commitment to accessibility and transparency in its operations.

Overall, JSW Steel continues to strengthen its position in the steel industry while addressing shareholder concerns regarding unclaimed dividends and shares.

JSW Steel has shown impressive growth over the past 22 years, significantly enhancing shareholder value.

Historical Performance

In 2000, the share price of JSW Steel was approximately ₹0.58. As of July 25, 2024, the current market price is ₹874.00. This substantial increase reflects the company's strong performance in the stock market.

Investment Calculation

If you had purchased 100 shares of JSW Steel in 2000 at ₹0.58 per share, your initial investment would have been:

Total Investment=100×0.58=₹58

Stock Split Impact

JSW Steel executed a stock split on September 8, 2017, in a 10:1 ratio. After the split, your 100 shares would have increased to:

Number of Shares after Split=100×10=1,000 shares

Current Value of Investment

With the current market price at ₹874.00, the total value of your investment would now be:

Total Value of Investment=1,000×874.00=₹874,000

Summary

If you had invested ₹58 in JSW Steel shares in 2000, your investment would now be worth approximately ₹874,000 as of July 25, 2024. This remarkable increase highlights the importance of claiming any unclaimed shares or dividends, as the potential value is substantial. Shareholders should take note of this growth and consider retrieving any unclaimed assets to benefit from their investment fully.

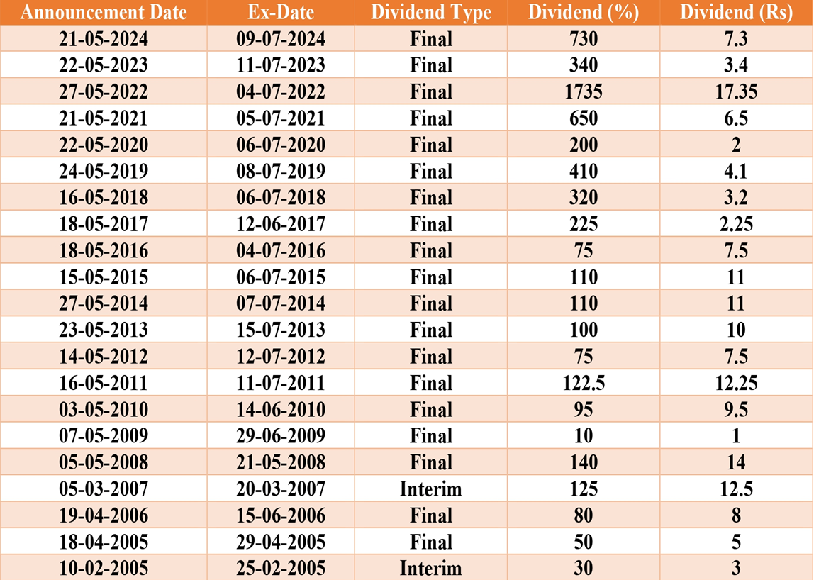

Dividend History:

Source: https://www.moneycontrol.com/company-facts/jswsteel/dividends/JSW01

The Unclaimed Dividend Dilemma

Unclaimed dividends are a significant issue in India, with over ₹5,000 crores lying unclaimed as of November last year, according to the Investor Education and Protection Fund (IEPF). When shareholders fail to claim their dividends, these unclaimed funds are held by the company for a certain period before being transferred to the IEPF, which is managed by the Ministry of Corporate Affairs.

Reasons for Unclaimed Dividends

There are several reasons why dividends may go unclaimed, including changes in address, misplaced or damaged physical share certificates, non-updation of bank details, and the death of the primary holder with no information passed on to inheritors. To prevent this, it is crucial for shareholders to ensure that their contact information is up-to-date with the company and to claim dividends on time.

The Role of the IEPF

The IEPF plays a crucial role in protecting investor interests and promoting investor education in India. It offers guidance to investors on various topics, including investment risks, investor rights, and investment scams, helping them make informed decisions and avoid falling victim to fraudulent schemes. The IEPF is also responsible for enforcing investor protection laws and ensuring that companies comply with these regulations.

Recovering Unclaimed Dividends from the IEPF

To recover IEPF unclaimed dividends or IEPF unclaimed shares from the IEPF, investors must follow a specific process. First, they need to complete the IEPF-5 form with all the required information, such as personal details, specifics on the shares or dividends to be claimed, and bank account details for reimbursement.

The Verification Process

Next, the claimant must send the completed IEPF-5 form, along with the necessary supporting documents, to the Nodal Officer/Registrar of the company that owes the money. The company has 15 days to compile a verification report and send it to the IEPF Authorities with the claimant's supporting materials. The IEPF Authority then has 60 days to issue a sanction order for the claimed refund after confirming the claimant's eligibility.

Limits on Consolidated Amounts

It is important to note that there are certain limits on the maximum consolidated amount per claim that can be made. For unclaimed dividends, the total amount claimed across all companies in a single IEPF-5 form should not exceed ₹10 lakhs per claim. For unclaimed shares, the total market value of shares claimed across companies should not exceed ₹5 lakhs in one claim.

Streamlining the Process

In the recent Union Budget 2023 announcement, the Finance Minister highlighted the need for a more efficient process for investors to reclaim their unpaid dividends and unclaimed shares. To facilitate this, an integrated IT portal will be developed to streamline the process and enhance convenience for shareholders. This portal will facilitate IEPF shares search, IEPF claim, and provide information on how to find unclaimed shares.

Increasing Awareness

Despite multiple efforts from the authorities concerned, the refund rate remains extremely low at 1.8%. Therefore, it is crucial for investors to stay informed about the channels and methods available for them to claim what rightfully belongs to them. Opting for an IEPF unclaimed shares search can significantly aid in this process.

Conclusion

Unclaimed dividends and shares are a significant issue in India, with a large amount of money lying idle instead of compounding returns in markets or bank savings. The IEPF plays a crucial role in protecting investor interests and promoting investor education, but more needs to be done to increase awareness and streamline the process of claiming unclaimed funds. Investors should ensure that their contact information is up-to-date with the company and claim dividends on time to prevent their funds from going unclaimed. Get in touch with Share Samadhan, the leading share recovery firm in Delhi, and make the process easy for yourself. The assistance of the dedicated team can help you get the answer on how to find unclaimed shares.

FAQs

Q1: Who is eligible to file an IEPF claim?

A: Shareholders or their legal heirs, successors, or nominees can file an IEPF claim to recover unclaimed dividends or shares.

Q2: How can I file an IEPF claim?

A: You can file an IEPF claim by submitting the necessary documents and forms online on the IEPF Authority's website and sending the physical copies to the respective nodal officer of the company.

Q3: What documents are required for an IEPF claim?

A: Required documents include the claimant's identity proof, address proof, original share certificates, indemnity bond, and any other documents specified by the IEPF Authority.

Q4: How long does it take to process an IEPF claim?

A: The processing time for an IEPF claim can vary, but it generally takes a few months from the date of submission of the claim to the IEPF Authority.

Q5: What should I do if I find unclaimed shares in the IEPF?

A: If you find unclaimed shares in the IEPF, you need to file an IEPF claim to recover them by submitting the required documents and following the IEPF Authority's procedures.

India's largest & most trusted platform for recovery of unclaimed investments

Submit Your Query

Recent Posts

- Lost Your Bajaj Auto Limited Shares? A Guide To Lost Share Recovery!

- Recover Your Godrej Consumer Products Shares from IEPF – A Complete Guide

- Lost PGCIL Shares to IEPF? Here’s a Step-by-Step Recovery Guide with Share Samadhan

- How to Recover Unclaimed HDFC Life Shares from IEPF

- Recover Lost Shares of DLF Limited from IEPF

- Have You Lost Your Tech Mahindra Shares? A Guide To Lost Share Recovery!