- Sign In

- 8800 33 2200

- samadhan@sharesamadhan.com

- Sharesamadhan App

- Sharesamadhan App

Blog Details

How to Recover Lost Shares of Adani Enterprises Limited from IEPF

Adani Enterprises Limited (AEL) is a leading company with businesses ranging from coal trading, power generation, and infrastructure development to renewable energy, agribusiness, and defense. AEL is a publicly traded company that has been listed on the Indian stock exchanges since 1994. If you have lost your shares of Adani Enterprises Limited and are wondering how to recover shares from IEPF, the good news is that you opt for an IEPF claim in order to get them back. In this blog, we will provide you with a step-by-step guide on how to recover shares from IEPF.

About Adani Enterprise Limited

The Adani Group traces its origins back to a modest beginning in commodity trading, dealing initially with agricultural products and textiles. By the early 1990s, the company had ventured into importing and exporting both raw materials and finished goods.

During the late 1990s, the Adani Group embarked on a path of diversification, expanding into sectors such as infrastructure, logistics, and energy. A pivotal achievement during this period was the establishment of Mundra Port, India's first private port, in 1998. Subsequently, the group extended its footprint into developing airports, roads, and power plants.

Entering the early 2000s, the Adani Group emerged as a key player in India's renewable energy landscape, focusing notably on solar and wind power projects. This period also marked the group's global expansion, with investments in ports, mines, and power facilities across Indonesia, Australia, and Africa.

More recently, the Adani Group has encountered significant scrutiny and opposition regarding its proposed Carmichael coal mine in Australia. Despite facing challenges from environmental groups and local communities, the company continues to pursue growth and investment opportunities across diverse industries in India and globally.

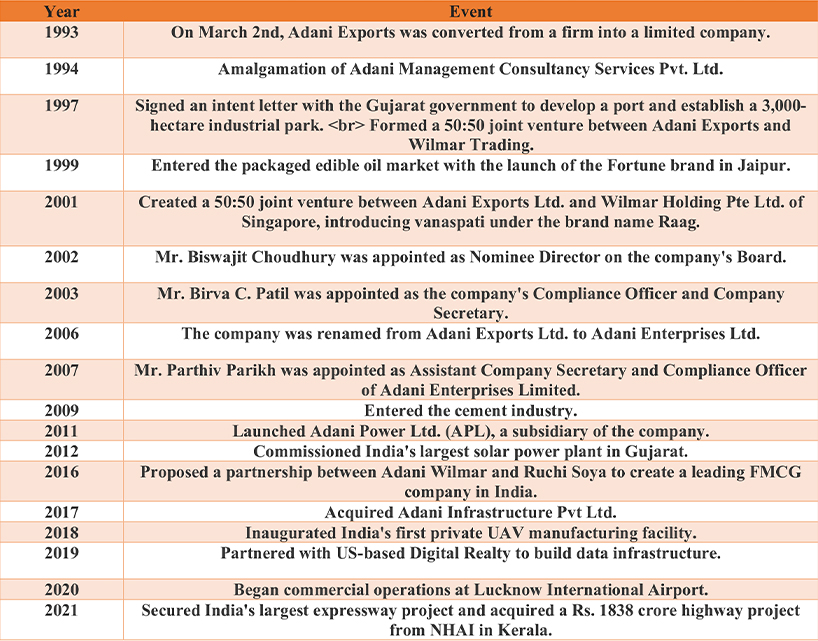

Adani History Table:

Source: https://groww.in/blog/history-of-adani-group

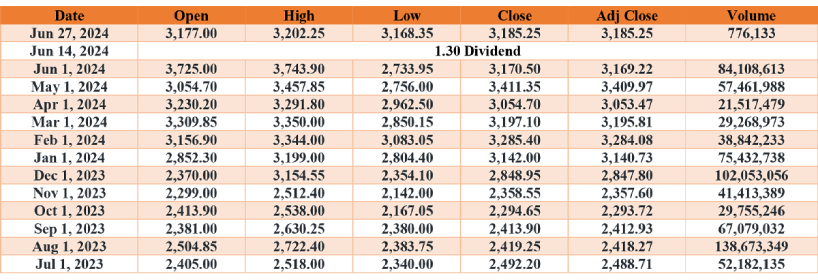

Adani Stock Price (July 2023-June 2024):

Source: https://finance.yahoo.com/quote/ADANIENT.NS/history/?frequency=1mo

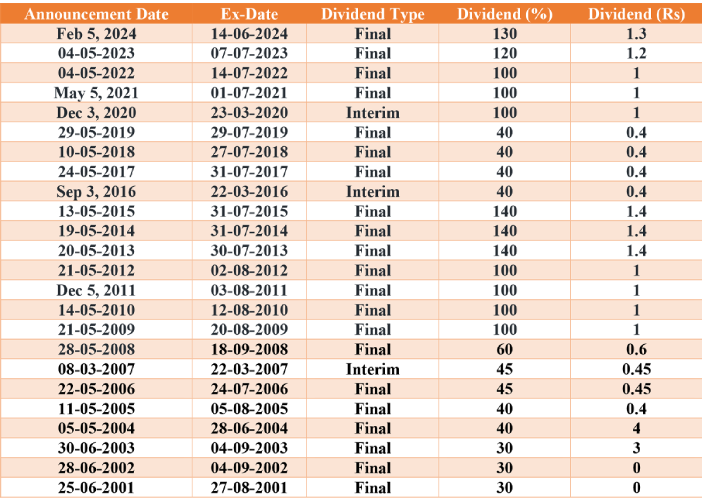

Adani Dividend History:

Source: https://www.moneycontrol.com/company-facts/adanienterprises/dividends/AE13

Latest Big Investment News of Adani

According to a report by the Economic Times, Adani Enterprises plans to invest around Rs 1.75 lakh crore ($21 billion) in its airports business over the next ten years, as stated by group CFO Jugeshinder Singh. This significant investment will be overseen by Adani Airport Holdings, which currently operates seven airports in India.

The initial phase of city-side development has begun at airports in Mumbai, Ahmedabad, Jaipur, Lucknow, and Guwahati. The company aims to boost its revenue from non-aero segments, targeting these segments to contribute 75 percent to the overall revenue. Adani Airport is also planning to go public by 2028.

In addition to managing these airports, Adani Airport Holdings is overseeing the construction of the Navi Mumbai International Airport, which is anticipated to be completed by early next year. Singh highlighted the group's dedication to enhancing India's airport infrastructure, with a focus on gateway development, regional expansion, and the integration of digital technology.

For FY25, the Adani Group plans to invest Rs 1.3 lakh crore ($15.6 billion) across various sectors, with a significant portion directed towards green energy and airport projects. The group aims to raise $2-3 billion through equity within this financial year, primarily sourcing funds from internal cash flows.

Furthermore, Chairman Gautam Adani recently unveiled a $100-billion investment plan for energy transition and infrastructure development over the next 10 years. Additionally, the group is targeting an addition of 40 GW of renewable energy capacity by 2030, which will necessitate an investment of approximately Rs 2 lakh crore.

Gautam Adani: Hindenburg Report Timed to Disrupt FPO; Company Growth Remains Strong

At the 32nd annual general meeting (AGM) with shareholders on Monday, Adani Group Chairman Gautam Adani addressed the Hindenburg saga, describing it as a ‘designed attack’ aimed at disrupting the company’s follow-on public offer (FPO).

"It was designed to defame us. It was a two-sided attack, a vague criticism of our financial standing," said Adani about the US short seller's scathing report against the conglomerate last year.

He also pointed out that certain sections of the media played a role in amplifying the attack, which he believes was orchestrated to damage his reputation and erode the market value of his companies. Adani characterized the incident as a targeted effort designed for maximum defamation and financial harm.

"We safeguarded our portfolio against any volatility by pre-paying Rs 17,500 crore in margin-linked financing," said Adani.

Discussing the much-discussed FPO, Adani highlighted that the company maintained “ethical” practices by returning the money of investors.

“Despite successfully raising Rs 20,000 crore through India’s largest ever FPO, we made the extraordinary decision to return the proceeds. This underscored our dedication to investors and our commitment to ethical business practices,” he said. Hindenburg, in a report, accused the group of stock manipulation and improper use of tax havens, triggering a sell-off in Gautam Adani's ports-to-power conglomerate.

Addressing the short-seller attack, Adani described it as a coordinated effort involving distortion of information and political allegations. According to Adani, the timing of the attack was strategically aimed to coincide with a follow-on public offer (FPO), suggesting a deliberate attempt to disrupt the market.

About IEPF:

The Investor Education and Protection Fund (IEPF) was created by the Indian government under the Companies Act, 2013, to safeguard investors' interests and foster investor education. Managed by the Ministry of Corporate Affairs, the fund provides compensation to investors who have incurred losses due to unpaid dividends or unclaimed investments.

Step-by-Step Guide to Recover Your Lost Shares from IEPF

Step 1: Determine Your Eligibility

Before initiating the process to recover your shares from the Investor Education and Protection Fund (IEPF), you need to confirm your eligibility. According to IEPF regulations, you can claim your shares if you fall into one of the following categories:

- Shareholders who haven't claimed their dividends for seven consecutive years.

- Shareholders who haven't exercised their voting rights for seven consecutive years.

- Shareholders whose unclaimed shares were transferred to IEPF after being declared abandoned by the company.

- Legal heirs or successors of deceased shareholders.

If you meet any of these criteria, you can proceed to the next steps.

Step 2: Gather Required Documents

To claim your shares from IEPF, you'll need to submit specific documents, including:

- A copy of your PAN card.

- A copy of your Aadhaar card.

- A bank statement/ canceled cheque.

- Proof of ownership of the shares (e.g., share certificate or demat statement).

- Any additional documents requested by the IEPF authority.

Ensure all necessary documents are ready before moving to the next step.

Step 3: Submit an Online Application

Visit the IEPF website (www.iepf.gov.in) to file an online application. The application process is straightforward. You will need to provide your personal details, contact information, and specifics about the shares you wish to claim.

Upon submitting your application, you will receive an acknowledgment receipt containing a unique IEPF claim ID. Keep this receipt for future reference and correspondence with the IEPF authority.

Step 4: Verification of Your Claim

The IEPF authority will then verify your claim. This involves checking your documents and confirming your eligibility to claim the shares. This process may take some time.

Once your claim is verified, the IEPF authority will issue a refund order in your name. This order, containing details like the refund amount and the bank account information, will be sent to your registered address.

Step 5: Receive Your Refund

Take the refund order to your bank and provide the necessary details. The bank will then credit the refund amount to your account. The lost share recovery of Adani Enterprises Limited can be done online from the Investor Education and Protection Fund (IEPF). If you are eligible, start by gathering all the necessary documents. Then, file an online application on the website for an IEPF claim. After submitting your application, the IEPF authority will verify your claim. Once verified, a refund order will be issued in your name. Take this refund order to your bank and provide the required details to receive your refund. Following these steps will help you reclaim your lost shares and secure your investments. For a quick process, get in touch with Share Samadhan, the best share recovery firm in Delhi. Their professional services can help you understand the process of recovering your shares from IEPF efficiently and effectively.

India's largest & most trusted platform for recovery of unclaimed investments

Submit Your Query

Recent Posts

- Lost Your Bajaj Auto Limited Shares? A Guide To Lost Share Recovery!

- Recover Your Godrej Consumer Products Shares from IEPF – A Complete Guide

- Lost PGCIL Shares to IEPF? Here’s a Step-by-Step Recovery Guide with Share Samadhan

- How to Recover Unclaimed HDFC Life Shares from IEPF

- Recover Lost Shares of DLF Limited from IEPF

- Have You Lost Your Tech Mahindra Shares? A Guide To Lost Share Recovery!