- Sign In

- 8800 33 2200

- samadhan@sharesamadhan.com

- Sharesamadhan App

- Sharesamadhan App

Blog Details

Have You Lost Your Tech Mahindra Shares? A Guide To Lost Share Recovery!

Do you know, when you don't claim your top company shares, what happens to them? The unclaimed dividend transfers to the IEPF. The good news is that these shares are still there, hidden, and can be recovered.

If you have lost Tech Mahindra Shares or an NRI, then this guide will help you. Here, we discussed the process of recovering lost shares, along with other details of Tech Mahindra.

About IEPF

IEPD stands for Investor Education and Protection Fund. The Government of India established the IEPF Authority in 2016. Its responsibility is to handle investor shares and unclaimed funds. Dividends, matured deposits, and shares that haven't been claimed in seven years or more are examples of this.

As per the Companies Act, 2013, this transfer is mandatory. Investors and legal heirs can still recover them by following the proper IEPF claim procedure.

About Tech Mahindra Limited

With its headquarters in Pune, Tech Mahindra is a multinational Indian technology firm. This company specialises in providing IT services and consulting to assist organisations in expanding and undergoing digital transformation. It offers a wide range of services across several industries, including banking, telecommunications, and manufacturing, and is a part of the wider Mahindra Group. Some of the services include consulting, enterprise applications, cloud, AI & analytics, and business process services.

Having shares in Tech Mahindra has been profitable for many investors. Over the last 5 years, the company’s revenue has grown from around ₹378,550 crore in FY 2021 to approximately ₹529,880 crore in FY 2025, with a compound annual growth rate (CAGR) of about 6-7%.

**Source- https://stockanalysis.com/quote/bom/532755/revenue/

Do you have your forgotten shares here? It's time to perform your IEPF claim.

Check Your Unclaimed Shares In Tech Mahindra Limited

- Visit the Registrar & Transfer Agent (RTA) for Tech Mahindra (Tech Mahindra’s RTA is KFin Technologies Limited (KFin).

- Search using your name, folio number, DP-ID & Client-ID, or PAN to identify the available dormant holdings.

- Use the IEPF shares search or the IEPF unclaimed shares search on the official IEPF portal to check if any shares have been transferred.

- Look through physical records: old share certificates, demat statements, or family documents may reveal forgotten holdings.

**If you found unclaimed shares, prepare the supporting documents, and initiate the shares recovery with IEPF.

Step-by-Step Guide To Claim Tech Mahindra Limited Shares From IEPF

Step 1: Identify Unclaimed Shares From the Official IEPF Portal

Go to iepf.gov.in → navigate to “Claim Refund” or “Unclaimed Shares” → enter your PAN/Aadhaar/shareholder details to do an IEPF search.

Step 2: Download and Fill Form IEPF-5

Select your Tech Mahindra shares, fill in your personal, bank, and demat account information.

Step 3: Sign the Form

Ensure all fields are correctly filled before printing. Once confirmed, print and sign the IEPF-5 form.

Step 4: Prepare Supporting Documents

- Self-attested PAN & Aadhaar

- Demat account statement/proof of demat account

- Cancelled cheque of the bank account

- Original share certificate, if available, or follow the procedure for the issue of a duplicate share certificate if lost

- Succession certificate or legal heir documents if the beneficiary is deceased

Step 5: Submit to RTA & Tech Mahindra

Send the signed form and all documents to the RTA (Tech Mahindra’s RTA is KFin Technologies Limited (KFin) and to Tech Mahindra’s investor relations/share transfer desk.

Step 6: Verification & Approval by IEPF

After verification by RTA and the company, the claim is forwarded to IEPF. Upon approval, your shares (and any unclaimed dividends) are transferred to your Demat account and payments to your bank.

Important Notes

- Only shares officially transferred to IEPF are eligible for recovery.

- Claims should be made within 25 years from the date when the shares/dividends were transferred to the IEPF.

- Missing or incorrect documents (e.g., mismatched names, address proof) can lead to delays.

- Be wary of fraud; use trusted share recovery services like Share Samadhan for better assistance.

How Share Samadhan Helps You With Lost Share Recovery?

- Locating your dormant Tech Mahindra shares via RTA and IEPF unclaimed shares search

- Assisting with share transmission, finding old folios, and lost certificates

- Preparing, filing, and tracking your IEPF-5 form with accuracy

- Helping NRIs with PoA, apostille, and demat account setup

- Coordinating with Tech Mahindra & RTA for verification

- Ensuring recovery of both shares and past unclaimed dividends

Act Now! Why?

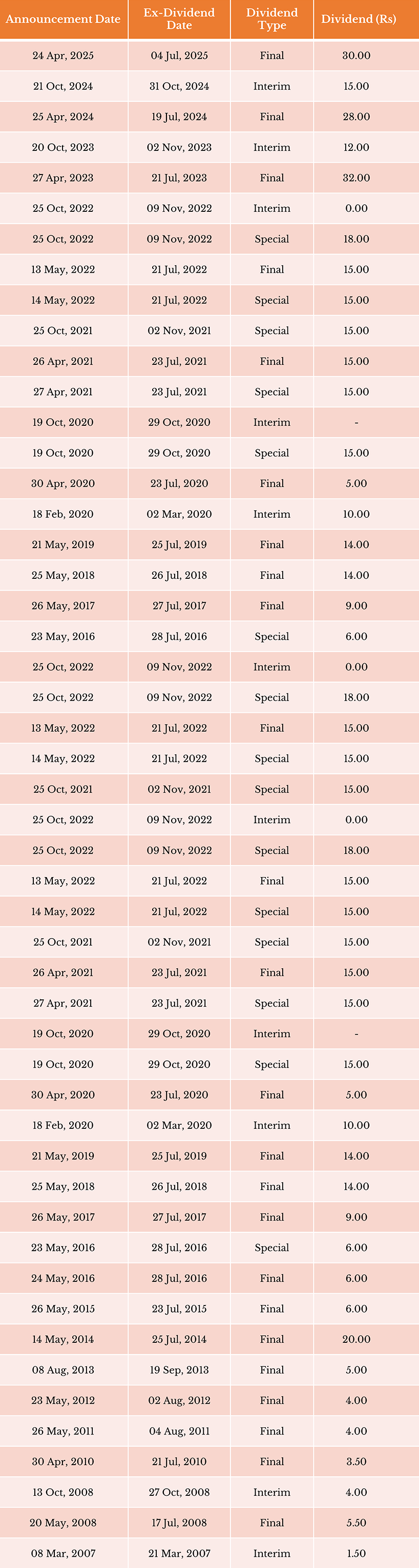

- Value Appreciation: Tech Mahindra has declared ₹45 per share total dividend for FY25 (₹30 final + ₹15 interim), which is attractive. The value of your lost shares might potentially be in the lakhs.

- Dividend Recovery: Unpaid dividends over several years may be recovered.

Dividend History Table

** Source- https://www.moneycontrol.com/company-facts/techmahindra/dividends/TM4/

Share Price Graph Over The Years

Source- https://www.moneycontrol.com/india/stockpricequote/computers-software/techmahindra/TM4

FAQ

1. What is the difference between share transfer and transmission of shares?

- Share transfer happens when an existing shareholder voluntarily transfers shares to another person (through sale or gift). Transmission of shares, on the other hand, takes place by operation of law in case of death, insolvency, or succession of a shareholder. No stamp duty is payable on transmission.

2. How do I initiate the transmission of Tech Mahindra shares after the death of a shareholder?

- To claim shares of a deceased shareholder, the nominee or legal heir must submit a transmission request form, death certificate, succession certificate (if applicable), and KYC documents to Tech Mahindra’s Registrar (KFin Technologies). Once verified, the shares are transmitted to the rightful claimant’s demat account.

3. Can shares under transmission also be transferred to IEPF?

- Yes. If the shareholder passed away and no legal heir claims the dividends or shares for seven consecutive years, those holdings are also transferred to the IEPF. Legal heirs must then recover them by filing IEPF-5 along with succession documents.

4. How do I check if my deceased family member’s shares were transferred to IEPF?

- You can use the IEPF unclaimed shares search tool on www.iepf.gov.in. Enter details like the Folio Number or DP-ID & Client-ID linked to the deceased’s investments. If found, you’ll need to file a claim as a legal heir.

5. What is the procedure for issuing a duplicate share certificate in Tech Mahindra?

- If your physical share certificate is lost, torn, or misplaced, you must immediately inform the RTA (KFin Technologies) and lodge an FIR/affidavit. Apply with supporting documents. Once verified, the company issues a duplicate share certificate, or if the shares are already dematerialised, they’ll credit them directly into your demat account.

6. Are unclaimed dividends also transferred to IEPF during share transmission?

- Yes. If dividends linked to the deceased shareholder remain unclaimed for seven years, both the unclaimed dividend and corresponding shares are transferred to the IEPF. The claimant must follow the IEPF claim procedure to recover both.

7. Can I recover Tech Mahindra shares transferred to IEPF without a demat account?

- No. As per IEPF rules, recovery of shares is only possible in demat form. Claimants must open a demat account in their name before filing Form IEPF-5 to recover lost or transmitted shares.

8. What is the timeline for recovering Pidilite shares from IEPF?

- Generally, it takes 8 months to 1.5 years, depending on how complete and accurate the documentation is. Share Samadhan speeds up the process with proper filing, liaison, and legal support.

Conclusion

If you suspect you have unclaimed investments in Tech Mahindra—be it shares, dividends, or other assets—don’t delay. Share Samadhan can help you navigate the entire recovery process. Reclaim what is rightfully yours and turn your lost shares into valuable assets.

India's largest & most trusted platform for recovery of unclaimed investments

Submit Your Query

Recent Posts

- Recover Your Godrej Consumer Products Shares from IEPF – A Complete Guide

- Lost PGCIL Shares to IEPF? Here’s a Step-by-Step Recovery Guide with Share Samadhan

- How to Recover Unclaimed HDFC Life Shares from IEPF

- Recover Lost Shares of DLF Limited from IEPF

- IEPF Recovery & Transmission: How To Claim Eicher Motors Shares Of A Deceased Relative?

- Lost Vedanta Shares? Here’s How You Can Get Them Back