- Sign In

- 8800 33 2200

- samadhan@sharesamadhan.com

- Sharesamadhan App

- Sharesamadhan App

Blog Details

How to Recover Unclaimed Shares of Sun Pharmaceutical Industries Limited from IEPF Authority

Sun Pharmaceutical Industries Ltd., commonly known as Sun Pharma, was founded in 1983 by Dilip Shangvi. Initially, it focused on manufacturing drugs for psychiatric illnesses, with operations limited to West Bengal and Bihar. However, by 1985, the company had expanded its sales network across India. In 1987, Sun Pharma ventured into cardiology, launching several successful products, including Monotrate, which remains a top seller in the category.

By 1994, Sun Pharma had gone public, listing on major Indian stock exchanges. Today, it is a global specialty pharmaceutical company with a presence in 30 markets. The company produces active pharmaceutical ingredients (APIs) and its medications are widely prescribed for chronic therapies in areas such as respiratory, gastrointestinal, psychiatry, and neurology.

In 1993, Sun Pharma established the SPARC research facility, bolstering its product and process development capabilities. The company's manufacturing facilities, located in India, the US, Hungary, and Bangladesh, have received approvals from regulatory authorities such as the USFDA and UK MHRA. Sun Pharma operates 19 facilities dedicated to the production of APIs and dosage forms.

Sun Pharma's international growth was significantly boosted in 2004 when it increased its stake in Caraco from 44% to over 60% by purchasing shares and options from major shareholders for approximately $42 million. By 2007, Sun Pharma's diluted stake in Caraco had grown to 75%. The company's formulation facility in Halol, India, received approvals from regulatory bodies including the USFDA, UK MHRA, South African MCC, Brazilian ANVISA, and Colombian INVIMA.

According to the BT Stern Stewart report, Sun Pharma ranks among the top 20 wealth creators in India and is one of the top three in the pharmaceutical industry. The company has also established a state-of-the-art formulation production facility in Jammu and operates its first joint venture manufacturing facility in Dhaka, Bangladesh, which spans 25,000 square feet.

In 2014, Sun Pharmaceutical Industries announced definitive agreements to acquire 100% of Ranbaxy Laboratories in an all-stock transaction, further consolidating its position in the pharmaceutical sector.

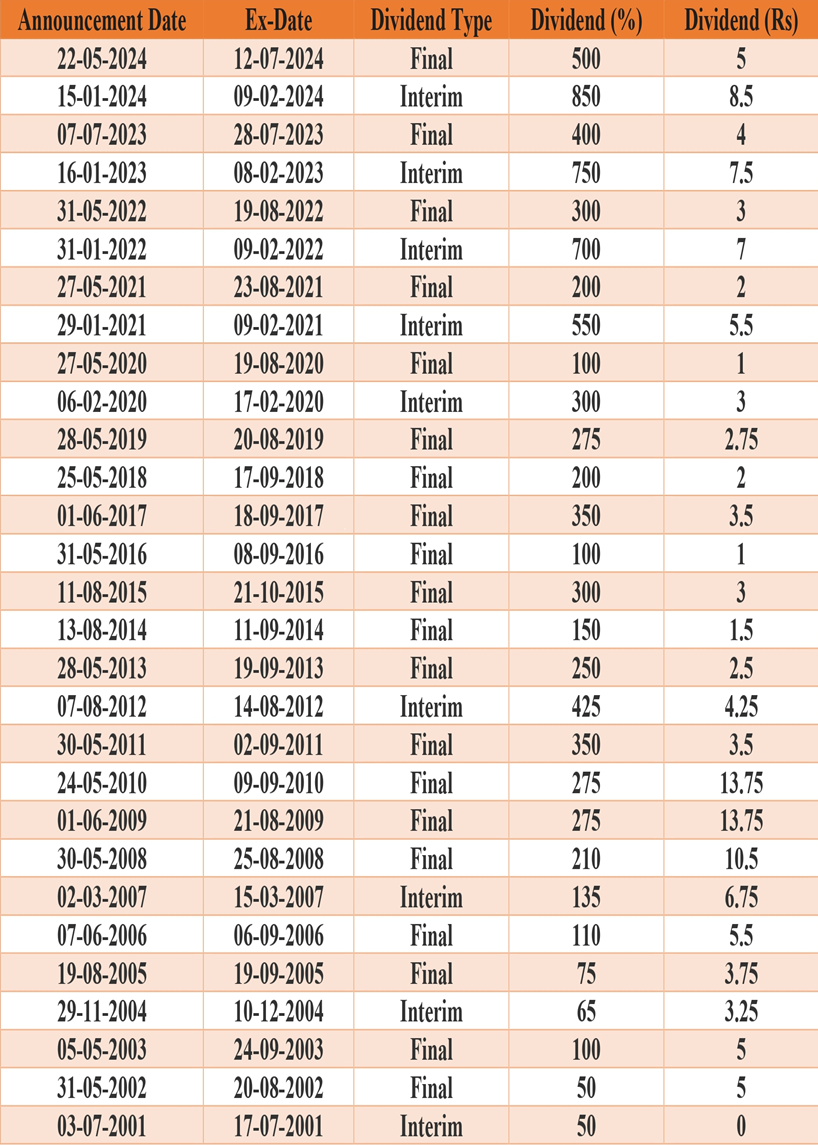

Dividend History:

Understanding the Investor Education and Protection Fund (IEPF) Authority

The Investor Education and Protection Fund (IEPF) Authority is a statutory entity created by the Indian government under the Companies Act, 2013. It aims to safeguard investors' interests and promote investor education. Managed by the Ministry of Corporate Affairs, the fund compensates investors for losses due to non-payment of dividends or unclaimed investments.

How to Retrieve Your Unclaimed Shares from the IEPF Authority: A Step-by-Step Guide

Step 1: Verify Eligibility

Before starting your IEPF claim for IEPF unclaimed shares, ensure you meet the eligibility criteria. According to IEPF rules, the following shareholders can file a claim:

- Shareholders who haven't claimed dividends for seven consecutive years

- Shareholders who haven't exercised voting rights for seven consecutive years

- Shareholders whose shares were declared unclaimed or abandoned and transferred to the IEPF Authority

- Legal heirs or successors of shareholders who have passed away

If you fall into one of these categories, you can proceed to the next steps.

Step 2: Gather Required Documents

You'll need specific documents to support your IEPF claim for IEPF unclaimed shares from the IEPF Authority:

- Copy of your PAN card - Copy of your Aadhaar card

- Cancelled cheque leaf or bank statement

- Proof of share ownership (share certificate or demat statement)

- Any additional documents requested by the IEPF Authority

Ensure you have all the necessary documents before moving forward.

Step 3: Submit an Online Application

File your claim online on the IEPF website (www.iepf.gov.in). The process is straightforward, requiring details like your name, address, contact information, and share details. After submitting your application, you will receive an acknowledgment receipt with a unique IEPF claim ID. Keep this receipt for future correspondence with the IEPF Authority.

Step 4: Verification of Your Claim

The IEPF Authority will verify your IEPF claim after receiving your application. This verification process may take some time as they review your documents and confirm eligibility. Once verified, the IEPF Authority will issue a refund order in your name. This order will be sent to your registered address, detailing the refund amount, bank account number, and bank branch for crediting the refund.

Step 5: Receive Your Refund

Take your refund order to your bank and provide the necessary details. The bank will then credit the refund amount to your account.

How to Recover Shares from IEPF

If you're wondering how to recover shares from IEPF, the process is straightforward. You begin with an IEPF shares search to determine the status of your shares. By following the steps outlined above, you can successfully file an IEPF claim and recover your shares.

Conducting an IEPF Shares Search

To start the process, an IEPF shares search or an IEPF unclaimed shares search is essential. This helps you determine the status of your shares and gather the necessary information to support your IEPF claim.

How to Find Lost Investments

If you are looking for how to find lost investments, the IEPF Authority provides resources and guidelines to help you. Conducting an IEPF search will assist you in tracking down unclaimed investments and beginning the recovery process.

Shares Recovery Services from IEPF

Share Samadhan offers comprehensive services for recovering unclaimed shares transferred to the IEPF. Our team provides end-to-end assistance, from the application process to collecting payment from the IEPF. We make the recovery process straightforward for our clients by offering:

- Assistance with paperwork

- Completing application forms and providing necessary documents

- Regular updates to the IEPF on the application status

Our expert team at Share Samadhan is available to guide you through the entire share recovery process, ensuring a smooth and efficient experience.

Transmission of Shares

Share transmission occurs when the ownership of shares passes from the original shareholder to a claimant or legal heir due to circumstances such as death, insolvency, insanity, marriage, or other statutory reasons. The documentation required includes:

- Request for the transfer of shares by the legal heir

- Copy of the death certificate of the original shareholder, if applicable

- Letter of administration - Probate of the will

- Certificate of succession

- Example of the legal heir's or successor's signature

- Self-attested copy of the PAN

Our team at Share Samadhan helps streamline the process, ensuring that all necessary documentation is correctly prepared and submitted.

IEPF Unclaimed Dividend Recovery

Dividends, which are a portion of a company's profits distributed to shareholders, can become unclaimed if not claimed within seven years. Factors that contribute to unclaimed dividends are as follows:

- Improper execution of share transfer or transmission

- Missing shareholder information

- Unclaimed bonus shares

Share Samadhan provides expert assistance to help clients recover their IEPF dividends efficiently and without legal complications. Our team ensures that the recovery process is handled professionally and with minimal hassle for our clients.

Conclusion

Claiming your IEPF unclaimed shares from the IEPF Authority is a straightforward online process if you take the assistance of Share Samadhan, the leading share recovery firm in Delhi. By following these steps, you can efficiently claim your shares and receive a refund. While the process may take some time, ensuring you have all the necessary documents will facilitate a smoother experience. If you have questions or concerns, contact the IEPF Authority for assistance. Reclaiming your IEPF unclaimed shares and IEPF unclaimed dividends helps protect your investments and ensures you receive your entitled benefits.

FAQs

1. What is an IEPF claim?

An IEPF (Investor Education and Protection Fund) claim refers to the process by which investors or their legal heirs can reclaim shares, dividends, or other investments that have been transferred to the IEPF due to being unclaimed for a specified period.

2. How can I initiate an IEPF shares search?

To initiate an IEPF shares search, you can visit the official IEPF Authority website and use the search feature to look up unclaimed shares. You will need to provide details such as the investor's name, company name, and folio number.

3. What steps are involved in an IEPF search?

An IEPF search involves:

- Visiting the IEPF Authority website.

- Entering the required investor and company details.

- Reviewing the search results to identify any unclaimed shares or dividends.

- Initiating the claim process if unclaimed investments are found.

4. What are IEPF unclaimed shares?

IEPF unclaimed shares are shares that have remained unclaimed by the investor for a continuous period of seven years, after which they are transferred to the IEPF. Investors or their heirs can reclaim these shares by following the prescribed procedure.

5. How do I recover unclaimed shares from IEPF?

To recover unclaimed shares from IEPF, follow these steps:

- Conduct an IEPF shares search to identify unclaimed shares.

- Fill out the IEPF claim form available on the IEPF Authority website.

- Submit the form along with necessary documents, such as proof of identity, address, and ownership.

- Follow up with the IEPF Authority for claim status and resolution.

6. What is an IEPF unclaimed dividend?

An IEPF unclaimed dividend refers to dividend amounts that have not been claimed by the investor for seven consecutive years. These dividends are transferred to the IEPF and can be reclaimed by the investor or their legal heirs.

7. How can I recover unclaimed dividends from IEPF?

To recover unclaimed dividends from IEPF, you need to:

- Conduct an IEPF search to identify unclaimed dividends.

- Fill out the relevant claim form on the IEPF Authority website.

- Attach required documents, such as proof of identity, address, and dividend warrants.

- Submit the form and follow up with the IEPF Authority for status updates.

8. How do I find lost investments?

To find lost investments, you can:

- Use the search feature on the IEPF Authority website to look for unclaimed shares or dividends.

- Contact the companies where you have invested to check for any unclaimed assets.

- Consult with financial advisors or investment recovery firms for assistance in locating lost investments.

9. What should I do if I have unclaimed investments?

If you have unclaimed investments, take the following steps:

- Conduct an IEPF search to identify any unclaimed shares or dividends.

- Submit the necessary claim forms and documents to the IEPF Authority or the respective company.

- Keep track of your investments to prevent future occurrences of unclaimed assets.

10. How can Share Samadhan help with IEPF claims?

Share Samadhan provides expert assistance in locating and reclaiming unclaimed shares, dividends, and other investments from the IEPF. They offer services such as:

- Conducting comprehensive searches for unclaimed assets.

- Guiding you through the claim submission process.

- Ensuring timely follow-up and resolution of claims.

India's largest & most trusted platform for recovery of unclaimed investments

Submit Your Query

Recent Posts

- Recover Your Godrej Consumer Products Shares from IEPF – A Complete Guide

- Lost PGCIL Shares to IEPF? Here’s a Step-by-Step Recovery Guide with Share Samadhan

- How to Recover Unclaimed HDFC Life Shares from IEPF

- Recover Lost Shares of DLF Limited from IEPF

- Have You Lost Your Tech Mahindra Shares? A Guide To Lost Share Recovery!

- IEPF Recovery & Transmission: How To Claim Eicher Motors Shares Of A Deceased Relative?