- Sign In

- 8800 33 2200

- samadhan@sharesamadhan.com

- Sharesamadhan App

- Sharesamadhan App

Blog Details

Recover Unclaimed Shares & Dividends of TCS transferred to the IEPF

Imagine the thrill of finding ₹1,000 in a forgotten pair of jeans. Now, amplify that feeling exponentially by discovering 1,000 shares of Tata Consultancy Services (TCS) purchased during its IPO. You’ve just unearthed a treasure trove worth ₹1 crore! However, if these shares have been unclaimed for over seven years, they may have been transferred to the Investor Education and Protection Fund (IEPF). To reclaim this treasure, you need to initiate an IEPF claim and conduct an IEPF unclaimed shares search. This process ensures that you can recover your valuable assets and enjoy the fruits of your investment.

The TCS Success Story

Tata Consultancy Services Ltd. (TCS) stands as India’s premier multinational giant in Information Technology (IT) and Consultancy Services. Since its inception, TCS has seen remarkable growth, hitting significant milestones along the way. In April 2018, TCS became the first IT company in India to reach a market capitalization of $100 billion, following in the footsteps of Reliance Industries Ltd. (RIL). Consistency has been TCS’s hallmark, and even amidst the global COVID-19 pandemic, the company delivered a stellar performance.

By March 2020, TCS reclaimed its position as India’s most valued firm, with a market capitalization of ₹6,82,408.68 crores, surpassing RIL by ₹6,959.73 crores. By September 2020, TCS became the first IT company and the second Indian company to achieve a market capitalization of ₹9 trillion, following RIL. In October, TCS surpassed Accenture to become the world’s most valuable IT company.

Reaping Rewards in Challenging Times

While the world grappled with the fallout from the COVID-19 pandemic, TCS continued to reward its investors handsomely. In the first two quarters of the 2020-21 fiscal year, TCS shares generated an aggregate dividend of ₹17 per share. If you or a deceased relative had purchased 1,000 shares during the TCS IPO in 2004, you would have received ₹68,000 in dividends for just the first two quarters of 2020 alone.

A Hidden Fortune Awaits

Don’t let unclaimed shares gather dust. Recovering lost TCS shares from the Investor Education and Protection Fund (IEPF) can unlock substantial wealth. If you have unclaimed TCS shares, now is the time to act. Start the recovery process today and you could potentially transform a forgotten investment into a multimillion-rupee windfall.

TCS Share Price and Performance

- TCS share price was ₹3,993.20 as of July 8, 2024, down 0.47% from the previous day's close.

- In the last 1 month, TCS's share price has moved up by 1.67%. - TCS's market capitalization is ₹14,26,938 crore, making it one of the most valuable companies in India.

- Analysts have a mixed outlook on TCS, with 5 recommending "Strong Buy", 19 recommending "Buy", 10 recommending "Hold", 7 recommending "Sell", and 2 recommending "Strong Sell".

TCS Dividends

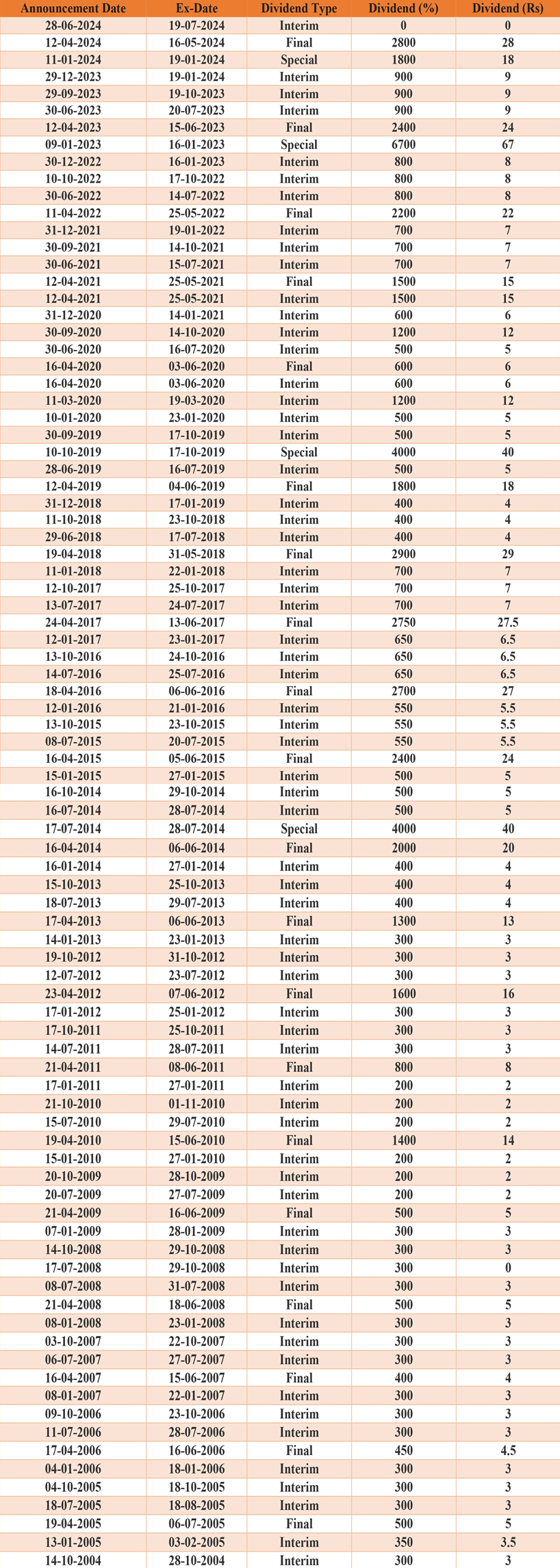

TCS has announced several dividends in the recent past, including:

- Final dividend of 2800% (₹28 per share) announced on April 12, 2024

- Special dividend of 1800% (₹18 per share) announced on January 11, 2024

- Interim dividends of 900% (₹9 per share) announced on December 29, 2023, September 29, 2023, and June 30, 2023

Calculation

Let's say you bought 1,000 shares of TCS in 2004. Here's how those shares have grown over time:

Bonus Shares Issued:

- July 28, 2006: TCS issued bonus shares at a 1:1 ratio. This means for every share owned, shareholders received one additional share. So, your 1,000 shares doubled to 2,000 shares.

- June 16, 2009: TCS issued another set of bonus shares at a 1:1 ratio. This doubled your 2,000 shares to 4,000 shares.

Dividend Calculation:

The formula for calculating dividends is:

Dividend Received×Number of Shares=Total Dividend

So,

₹17×4,000 shares=₹68,000

Current Share Value:

As of July 8, 2024, the price of one TCS share was ₹3,983.70. So, the value of shares becomes:

₹3,983.70×4,000 shares=₹1,59,34,800

*(One Crore Fifty-Nine Lakhs Thirty-Four Thousand Eight Hundred Rupees)*

This calculation only includes the current market value of the shares, not the dividends received over the years.

Total Dividends Received:

TCS is renowned for rewarding its investors with substantial dividends. To date, the company has paid an aggregate dividend of ₹518.5 per share.

By reclaiming these shares from the Investor Education and Protection Fund (IEPF), you can unlock a significant fortune. The earlier you act, the sooner you can benefit from the impressive growth and dividends of TCS shares.

Dividend History Table:

TCS Share Recovery from IEPF

Shareholders who have unclaimed TCS shares or dividends can recover them from the Investor Education and Protection Fund (IEPF) by following the prescribed procedure. The IEPF was established to safeguard investor interests and ensure that unclaimed dividends, matured deposits, and other investor monies are not lost or misused. Shareholders need to fill out Form IEPF-5 and submit the required documents to initiate an IEPF claim for their TCS shares.

In summary, TCS continues to be a strong performer in the Indian stock market, with its share price and market capitalization reflecting the company's consistent growth and profitability. Shareholders can also recover any unclaimed TCS shares or dividends from the IEPF by following the necessary steps.

Unclaimed Shares and the IEPF

Suppose you or a deceased relative had purchased those 1,000 TCS shares during the IPO but failed to claim the dividends for seven consecutive years. In that case, those shares may have been transferred to the Investor Education and Protection Fund (IEPF) by the company. To reclaim these shares, you would need to conduct an IEPF shares search and follow the IEPF claim process.

The Indian government established the IEPF to safeguard investor interests and ensure that unclaimed dividends, matured deposits, and other investor monies are not lost or misused. If you find yourself in this situation, it's important to conduct an IEPF search to identify any unclaimed shares or dividends that may have been transferred to the IEPF.

By conducting an IEPF unclaimed shares search, you can locate any unclaimed TCS shares or IEPF unclaimed dividends that belong to you or your family. Following the proper procedures and submitting the necessary documentation can help you recover these assets and secure your financial interests. For a smooth IEPF shares search get in touch with the expert team at Share Samadhan, the leading share recovery firm in Delhi.

FAQ:

Q: What is the process of recovering shares through the IEPF claim?

A: To recover shares through the IEPF claim, you need to submit an application in Form IEPF-5 on the IEPF portal, along with the required documents. The documents should then be sent to the concerned company and the IEPF Authority for verification and approval.

Q: How long does it take to receive shares through the IEPF claim?

A: The time taken to process and receive shares after the IEPF claim can vary. Generally, it takes around 60 days from the date of submitting a complete application, provided all documents are in order and there are no discrepancies.

Q: How can I search for shares that have been transferred to the IEPF?

A: You can search for shares transferred to the IEPF by visiting the IEPF website and using the search facility provided. You need to enter the company name, folio number, and other relevant details to find your unclaimed shares.

Q: Can I conduct an IEPF shares search using my PAN number?

A: Yes, you can conduct an IEPF shares search using your PAN number on the IEPF portal. Enter your PAN and other required details to check for any shares transferred to the IEPF in your name.

Q: What information is required to perform an IEPF search?

A: To perform an IEPF search, you need details such as the company name, folio number, investor name, and PAN number. This information will help you locate any unclaimed shares or dividends transferred to the IEPF.

Q: Is there a fee for performing an IEPF search?

A: No, there is no fee for performing an IEPF search on the IEPF portal. The search facility is available free of cost to help investors locate their unclaimed shares and dividends.

Q: How can I search for unclaimed shares that have been transferred to the IEPF?

A: You can search for unclaimed shares transferred to the IEPF by visiting the IEPF website and using their search tool. You will need details such as the company name, folio number, and investor's PAN.

Q: Can IEPF unclaimed shares search be done for multiple companies at once?

A: Yes, you can search for unclaimed shares for multiple companies by entering the relevant details for each company on the IEPF portal's search tool.

Q: What are IEPF unclaimed shares?

A: IEPF unclaimed shares are shares that have remained unclaimed by investors for seven or more years and have been transferred to the Investor Education and Protection Fund by the respective companies.

Q: How can I claim my unclaimed shares from the IEPF?

A: To claim your unclaimed shares from the IEPF, you need to file Form IEPF-5 online, attach the required documents, and send them to the concerned company and the IEPF Authority for verification and approval.

Q: What is an IEPF unclaimed dividend?

A: An IEPF unclaimed dividend is a dividend that has remained unclaimed by shareholders for seven years or more, which is then transferred to the Investor Education and Protection Fund by the respective companies.

Q: How do I claim my unclaimed dividend from the IEPF?

A: To claim your unclaimed dividend from the IEPF, you must file Form IEPF-5 on the IEPF portal, along with the necessary documents, and send them to the concerned company and the IEPF Authority for processing and approval.

India's largest & most trusted platform for recovery of unclaimed investments

Submit Your Query

Recent Posts

- Lost Your Bajaj Auto Limited Shares? A Guide To Lost Share Recovery!

- Recover Your Godrej Consumer Products Shares from IEPF – A Complete Guide

- Lost PGCIL Shares to IEPF? Here’s a Step-by-Step Recovery Guide with Share Samadhan

- How to Recover Unclaimed HDFC Life Shares from IEPF

- Recover Lost Shares of DLF Limited from IEPF

- Have You Lost Your Tech Mahindra Shares? A Guide To Lost Share Recovery!