Recover Lost Shares of DLF Limited from IEPF

DLF Limited, a flagship in India's real estate landscape, has transformed skylines with its residential, commercial, and retail landmarks. Founded in 1946 by Chaudhary Raghvendra Singh, DLF's journey from New Delhi to pan-India dominance is a testimony to innovation, integrity, and long-term vision. From iconic projects like DLF Cyber City and DLF Mall of India to strategic expansions across India and international markets, DLF has not only built structures but also trust.

Yet, many investors who believed in DLF early on may now find their shares untraceable due to inactivity, address changes, or unclaimed dividends. These often result in the transfer of shares to the Investor Education and Protection Fund (IEPF) Authority. If you or your family are among them, this blog is your comprehensive guide to reclaiming what is rightfully yours through Share Samadhan.

The IEPF Context

When a shareholder fails to claim dividends for 7 consecutive years, the underlying shares are transferred to the IEPF as per regulatory norms. While the intention is protective, the recovery process can appear complex. That’s where professional assistance from Share Samadhan makes the journey smoother, quicker, and legally compliant.

How to Recover Lost Shares of DLF Limited from IEPF

Step 1: Search for Shares on the IEPF Portal

Begin by visiting the IEPF Website. Search using your name, folio number, or shareholder ID to confirm whether your DLF shares have indeed been transferred to IEPF.

Step 2: File the IEPF-5 Form

Complete Form IEPF-5 available on the MCA portal. It requires details like name, address, bank account number, demat details, and shareholding data. Attach supporting documents such as:

- PAN and Aadhaar

- Cancelled cheque leaf

- Client Master Report (from your DP)

- Self-attested identity and address proof

- Original share certificate (if available)

Step 3: Submit to Nodal Officer (DLF)

Post submission, send the filled IEPF-5 form and physical documents to the Nodal Officer at DLF's registered office. Share Samadhan can help prepare, verify, and dispatch your complete claim bundle.

Step 4: Track and Follow Up

Once submitted, the IEPF Authority verifies the claim with the company and registrar. On approval, shares are credited to your demat account. Timelines typically range between 8 months and 1.5 years, but Share Samadhan’s follow-up drastically improves efficiency.

Source: https://www.moneycontrol.com/india/stockpricequote/constructioncontracting-real-estate/dlf/D04

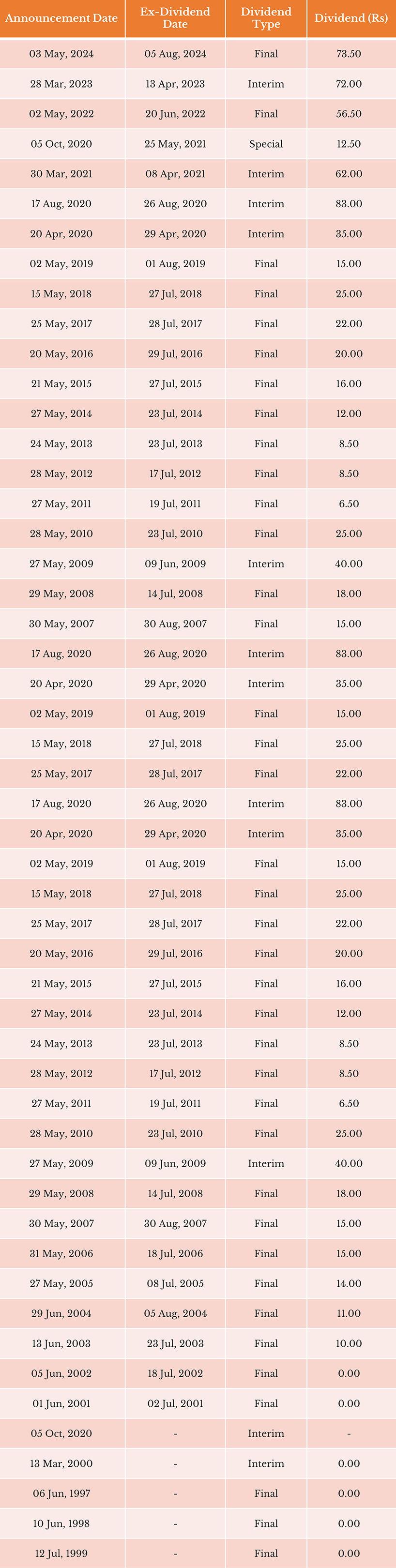

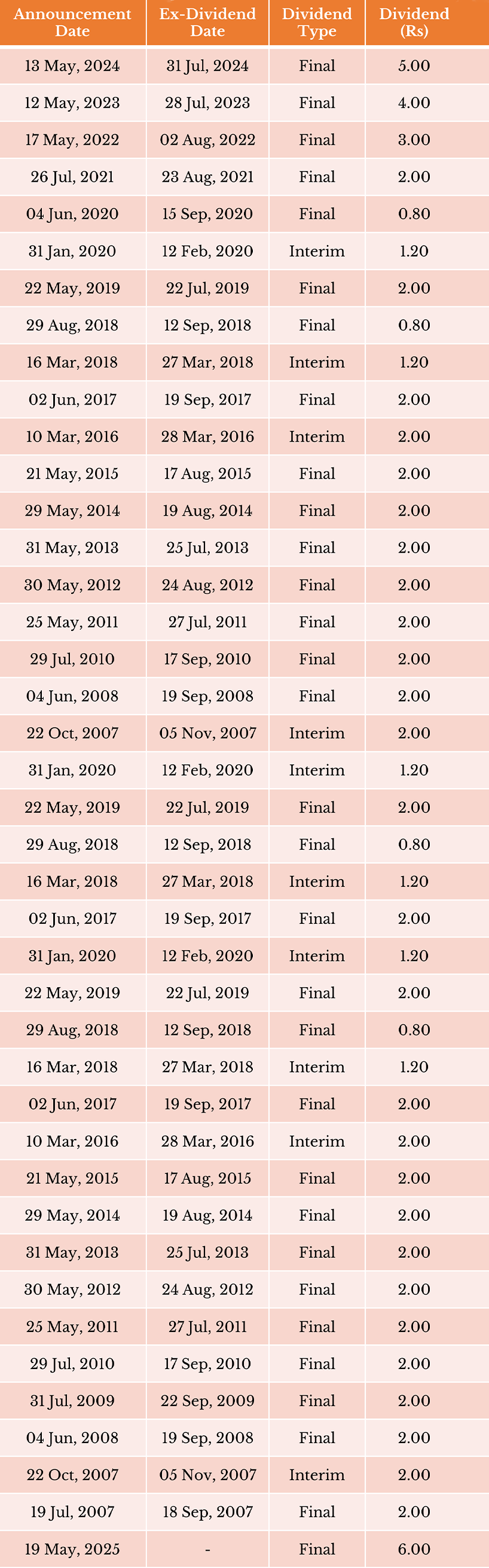

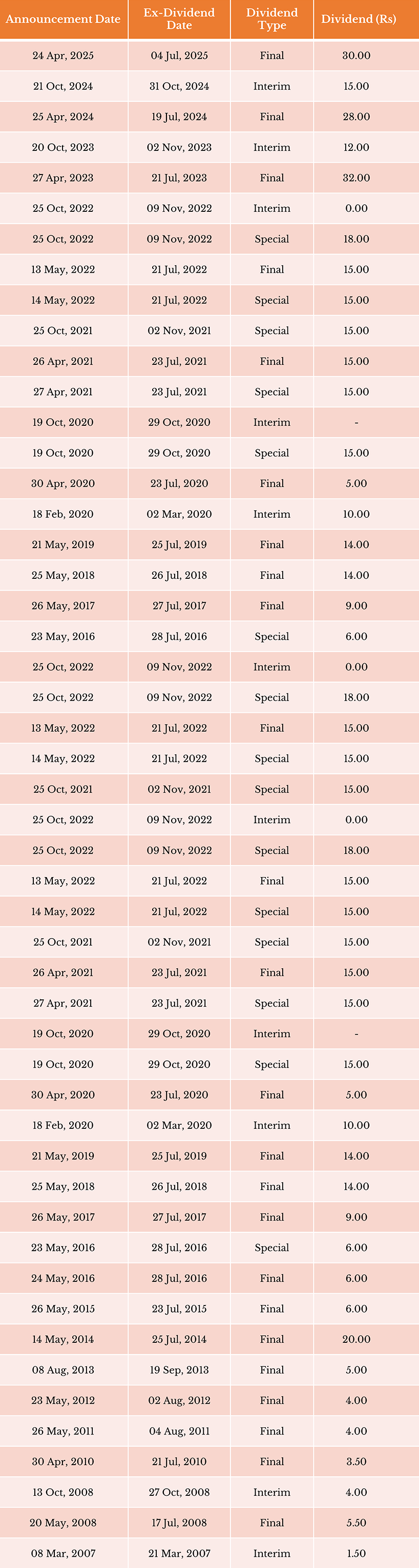

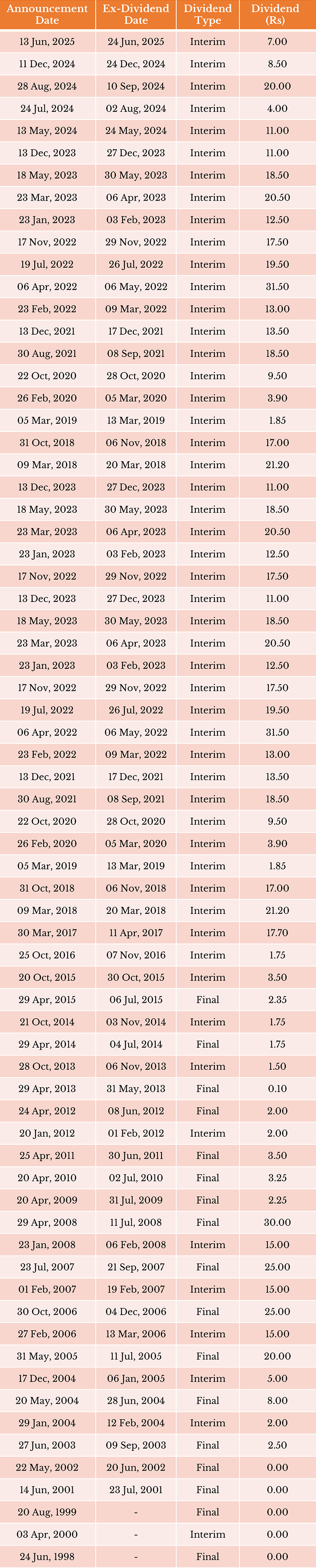

Dividend History Table of DLF Limited

Source: https://www.moneycontrol.com/company-facts/dlf/dividends/D04/#google_vignette

Why Shares Get Lost

DLF has issued dividends and corporate communications for decades. However, shares often go unclaimed due to:

- Change in residential address

- Death of the original shareholder

- Misplaced or damaged certificates

- Lack of demat conversion

- Forgotten investments made decades ago

In such scenarios, they silently move to IEPF without family members being aware. Share Samadhan identifies and recovers these overlooked assets.

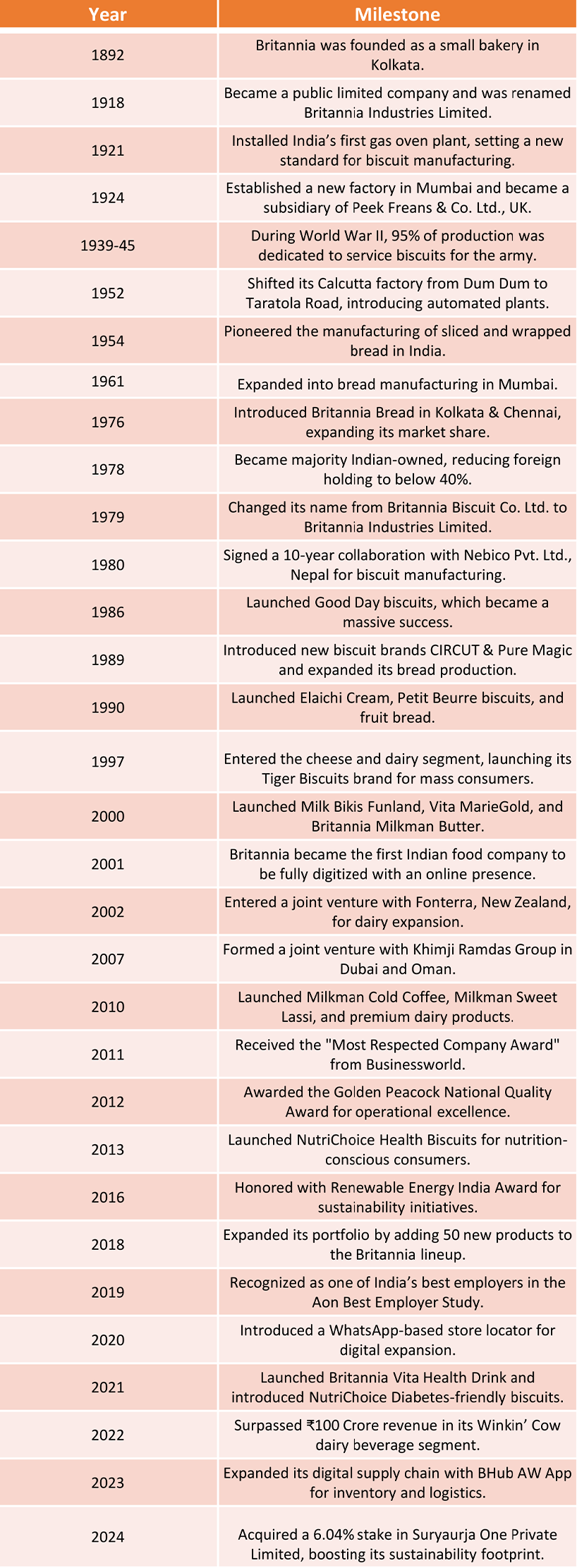

Timeline of DLF Limited: Year-wise Company History

Common Issues Faced in DLF Share Recovery

- Lost share certificates

- Death of the original holder without nomination

- Incomplete documentation

- Mismatched signatures or address records

- Delay in transmission of shares by legal heirs

Share Samadhan offers end-to-end legal and documentation support to overcome these roadblocks.

Why Choose Share Samadhan for DLF Share Recovery

- Specialized Team: 40+ experts in SEBI, IEPF, succession, and legal documentation

- Nationwide Access: Remote recovery is possible for NRIs and domestic clients

- Comprehensive Services: From tracing lost shares to final demat credit

- Transparent Communication: Real-time updates and client dashboard

- Faster Turnaround: Years of registrar experience and high success rates

FAQs

Q1: Can I recover shares without the original certificate?

Yes, you can. Even if the original share certificate is lost, Share Samadhan can help recover your shares using alternative documents. We work with folio numbers, dividend warrants, PAN, Aadhaar, and historical address proofs to reconstruct your shareholding. Our team coordinates with registrars and company records to verify ownership and initiate the claim. This is particularly useful in cases where physical certificates have been misplaced or damaged over time. By ensuring accurate documentation and follow-up, Share Samadhan simplifies the recovery process, even without the original certificate in hand.

Q2: Can legal heirs recover shares if the original holder has passed away?

Absolutely. Legal heirs have the right to claim shares that belonged to a deceased holder. The process typically involves obtaining a succession certificate, a legal heir certificate, or a probated will. Share Samadhan supports legal heirs through every stage, right from legal document preparation to liaison with the Registrar and IEPF Authority. We ensure that your claim is valid, well-documented, and submitted in the correct format. With our expert guidance and legal support, heirs can reclaim what’s rightfully theirs without confusion or delays, even in complex family or nominee-related cases.

Q3: I don’t live in India. Can I still recover my family’s DLF shares?

Yes, even if you're an NRI or living abroad, you can recover your family’s DLF shares without needing to travel to India. Share Samadhan facilitates complete remote recovery by leveraging the power of attorney (POA), notarized and apostilled documents, and digital filing support. We also assist with translation and jurisdictional formalities where required. Our end-to-end process is specifically designed to assist NRIs in asset recovery from anywhere in the world. With our help, you can claim your shares or those of a deceased relative without ever setting foot in the country.

Q4: How long does the IEPF recovery process take?

On average, recovering shares from the IEPF takes about 8 months to 1.5 years, depending on the completeness and accuracy of your documentation. Delays often occur due to missing legal papers, incorrect forms, or inconsistent address proofs. Share Samadhan reduces these bottlenecks by preparing, validating, and submitting all your documents correctly the first time. Our regular follow-ups with registrars and the IEPF Authority help ensure that your case progresses efficiently. With Share Samadhan by your side, you’re likely to experience a smoother, faster, and stress-free recovery journey.

Q5: What documents are mandatory for claiming shares from IEPF?

To claim shares from the IEPF, you need a set of verified documents. These include your PAN card, Aadhaar card, address proof, canceled cheque, proof of shareholding (such as dividend warrants or demat statements), and a duly filled Form IEPF-5. For legal heirs, additional documents such as succession certificates, probate of will, or legal heirship certificates are required. Share Samadhan helps you gather and validate each document while ensuring the correct formats and notarizations. This reduces rejections and speeds up the claim process through professional handling of all paperwork.

Q6: How safe is the process with Share Samadhan?

The entire process with Share Samadhan is secure, transparent, and RBI/SEBI-compliant. We prioritize data confidentiality and take every precaution to safeguard your personal and financial details. From document handling to claim filing, every step follows strict protocols and legal standards. We also offer real-time updates and expert guidance throughout the process, so you're always informed. With a team of legal, financial, and regulatory experts, Share Samadhan ensures that your recovery journey is not only successful but also stress-free and secure, whether you're in India or abroad.

Reclaim What Is Rightfully Yours

Investments are meant to secure your future. If your DLF shares have gone unclaimed, they still belong to you. Reclaim them with expert assistance. Let Share Samadhan trace, file, and recover your shares while you stay worry-free.

Act Now. Let Share Samadhan Help You Reconnect With Your DLF Investments.

Source:

Source:  Source:

Source: