- Sign In

- 8800 33 2200

- samadhan@sharesamadhan.com

- Sharesamadhan App

- Sharesamadhan App

Blog Details

Bank of Baroda Shares Lost to IEPF? Here’s How You Can Recover Them

Bank of Baroda (BOB), a state-owned banking and financial services company headquartered in Vadodara, Gujarat, has been an integral part of India's banking evolution since its inception in 1908. Over the decades, BOB has expanded its reach domestically and globally, offering various services like net banking, customer care, card facilities, retail loans, and much more. However, due to investor inaction or a lack of awareness, many shareholders have lost track of their shares and unclaimed dividends, which are later transferred to the Investor Education and Protection Fund (IEPF).

In this blog, we'll take a detailed look at BOB's growth, its services, and most importantly, how you can recover your lost shares, dividends, or matured deposits transferred to the IEPF.

About Bank of Baroda

-

Incorporation Year: 1908

-

Headquarters: Vadodara, Gujarat

-

BSE Code: 532134

-

NSE Code: BANKBARODA

-

ISIN: INE028A01039

-

Current Share Price: ₹180.55

-

Market Capitalisation: ₹93,860.22 Cr

-

Registrar: K FIN Technologies Ltd.

-

Registered Address: Baroda Bhavan, Alkapuri, Vadodara-390007, Gujarat

Bank of Baroda is currently the fourth-largest public sector bank in India, known for its robust infrastructure and customer-first approach. It has diversified into areas like insurance, merchant banking, credit card issuance, international banking, and infrastructure finance, among others.

Bank of Baroda: Key Services

Net Banking: Baroda Connect

Offers 24/7 digital access to account transactions, fund transfers via RTGS/NEFT, bill payments, and more. Especially helpful for senior citizens, differently-abled users, and working professionals.

Customer Care:

BOB's toll-free helpline and quick email response time ensure customer issues are resolved efficiently. The bank offers both domestic and international customer care services.

Card Services:

Bank of Baroda provides various credit and debit cards with reward points, special railway and corporate offers, and a wide credit limit.

Bank of Baroda Share Price Trend

Source: https://www.moneycontrol.com/india/stockpricequote/banks-public-sector/bankbaroda/BOB

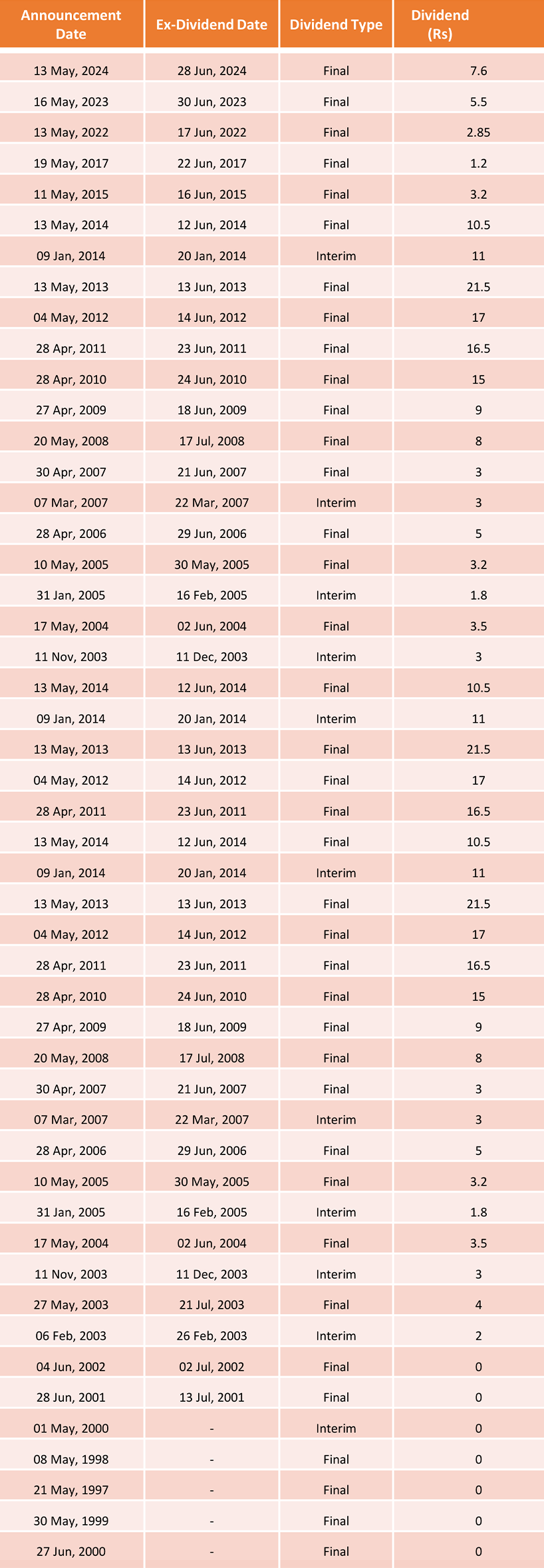

Bank of Baroda Dividend History

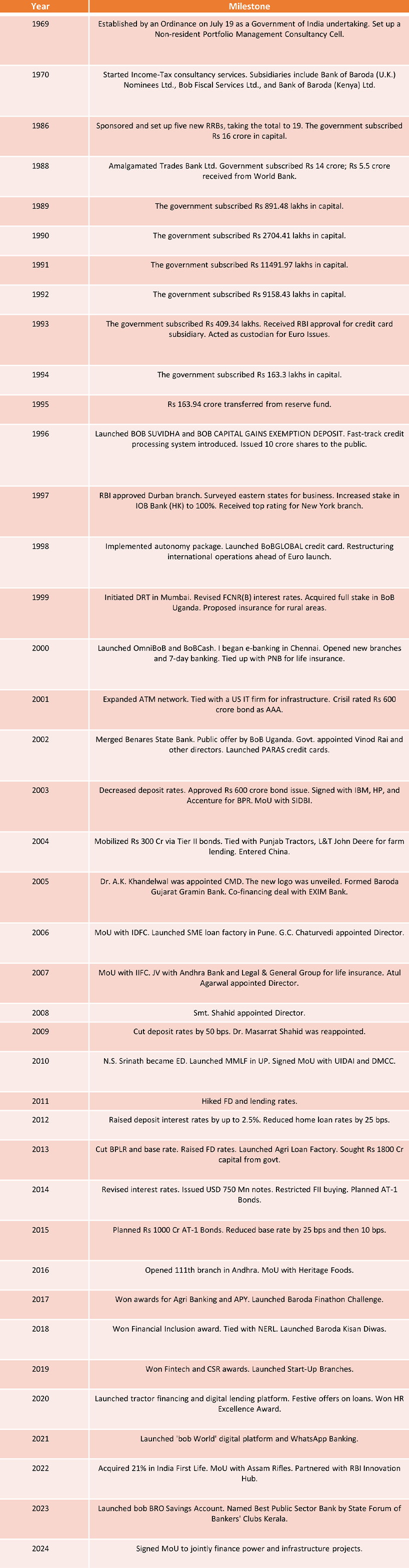

Bank of Baroda Milestones: A Century of Growth

Bank of Baroda Milestones: A Century of Growth

What is IEPF, and Why Are Your Shares Transferred?

The Investor Education and Protection Fund (IEPF) was established by the Ministry of Corporate Affairs under the Companies Act 2013 to safeguard investor interests. If dividends remain unclaimed for seven consecutive years, the shares, along with the accrued benefits, are transferred to the IEPF. This includes:

-

Unclaimed dividends

-

Matured deposits

-

Debentures

-

Application money due for refund

Once transferred, these securities cannot be claimed directly from the company.

Recovering Shares of Bank of Baroda from IEPF: Step-by-Step

-

Visit the IEPF Portal: Go to iepf.gov.in

-

Check Eligibility: Ensure your shares have been unclaimed for seven years or more and were transferred to IEPF.

-

Fill out Form IEPF-5: Enter personal details, bank and demat account info, and PAN.

-

Attach Required Documents:

-

PAN & Aadhaar

-

Share certificate or demat statement

-

Bank passbook/cancelled cheque

-

Proof of ownership

-

-

Download Advance Receipt & Indemnity Bond from IEPF portal

-

Submit Originals to the Company (Bank of Baroda via KFIN Tech)

-

Verification & Refund: The company verifies your claim in 30 days. IEPF processes and returns your shares/dividends post-verification.

Common Mistakes to Avoid

-

Missing documents

-

Inaccurate share details

-

Not following up

-

Submitting incomplete forms

Even a tiny mistake can cause delays or rejection. Always double-check everything.

How Share Samadhan Can Help

Recovering shares or dividends from IEPF is complex and time-consuming. Share Samadhan simplifies this process by offering:

-

Documentation assistance

-

Liaising with KFIN Technologies and IEPF

-

Legal and compliance support

Our experts have helped hundreds of investors reclaim their lost wealth.

FAQs on Recovering BOB Shares from IEPF

1. Can I claim shares after they’ve been transferred to IEPF?

Yes, by submitting Form IEPF-5 and completing the verification process, you can recover your shares.

2. What happens if I make a mistake in the IEPF form?

You have one chance to resubmit the form. Any errors can cause rejection.

3. Do I need original share certificates to claim them?

Yes. If you don’t have them, you may need to file an FIR and publish a notice in a newspaper.

4. Is there any cost to file an IEPF-5?

No, IEPF-5 filing is free. Share Samadhan charges only for its support services.

5. How long does it take to receive a refund?

Usually, within 3-4 months after submission and successful verification.

Final Thoughts

Losing your Bank of Baroda shares or dividends doesn’t mean you lose your wealth forever. The IEPF is your legal channel to recover it. But the process can be challenging without guidance.

Let Share Samadhan make it stress-free for you. Our recovery experts handle the paperwork, liaise with registrars, and follow up with IEPF, so you don’t have to.

Start your recovery journey today because your wealth belongs to you.

India's largest & most trusted platform for recovery of unclaimed investments

Submit Your Query

Recent Posts

- Recover Your Godrej Consumer Products Shares from IEPF – A Complete Guide

- Lost PGCIL Shares to IEPF? Here’s a Step-by-Step Recovery Guide with Share Samadhan

- How to Recover Unclaimed HDFC Life Shares from IEPF

- Recover Lost Shares of DLF Limited from IEPF

- Have You Lost Your Tech Mahindra Shares? A Guide To Lost Share Recovery!

- IEPF Recovery & Transmission: How To Claim Eicher Motors Shares Of A Deceased Relative?