IEPF Recovery & Transmission: How To Claim Eicher Motors Shares Of A Deceased Relative?

Eicher Motors Limited is a prominent Indian automotive company best known for its Royal Enfield motorcycles. Over time, its consistent growth, premium positioning, and loyal customer base have made its shares a sought-after holding.

Deceased shares with Eicher Motors Limited can now give a substantial return of lakhs or crores via capital appreciation and dividends. The good news? You can recover it through the transmission of shares or the IEPF.

Making recovery more seamless, here, we combined both the IEPF claim and share transmission processes so families can realistically and clearly understand how to reclaim Eicher Motors shares belonging to a deceased relative.

Transmission Of Share Vs IEPF

The transmission of shares is an involuntary transfer of ownership. This is mainly performed due to legal events like shareholders' death, insolvency, or mental incapacity.

On the other hand, IEPF is the governmental initiative that holds shares and dividends that are unclaimed for 7 years or more.

Both stages are essential if the deceased shareholder’s Eicher Motors shares have already been moved to IEPF.

How Transferred Shares Of Eicher Motor Can Be Claimed?

When a shareholder passes away, their physical or dematerialised shares remain under their name. If no one claims the dividends for seven consecutive years, both the unclaimed dividends and corresponding shares are transferred to the IEPF account.

To claim them back, the process involves two critical stages:

- Transmission of shares – transferring ownership to the legal heir.

- IEPF claim filing – reclaiming the transferred shares and dividends from the IEPF Authority.

Both stages require accurate documentation, verification by the Registrar & Transfer Agent (RTA) of Eicher Motors (usually KFin Technologies or Link Intime), and submission to the IEPF authority under the Ministry of Corporate Affairs.

Step-By-Step Guide To IEPF Claim Of Eicher Motor

Step 1: IEPF Shares Search

Visit the official IEPF website and search for unclaimed dividends or shares using the shareholder’s name and company name (Eicher Motors Limited).

Step 2: File IEPF Form-5

Download and fill out Form IEPF-5 on the MCA portal. Attach identity proof, PAN, Aadhaar, bank details, and shareholding proof.

Step 3: Send Documents to RTA

After submitting Form IEPF-5 online, print the acknowledgement and send it along with self-attested physical documents to Eicher Motors’ RTA by registered post.

Step 4: Verification by the RTA

The RTA verifies your claim, cross-checks with company records, and sends the verified claim to the IEPF Authority.

Step 5: IEPF Authority Approval

Upon successful verification, the IEPF Authority credits the reclaimed shares to your demat account and transfers the unclaimed dividends directly to your registered bank account.

Step-by-Step Guide To Claim Eicher Motor Transmission Of Shares

Step 1: Obtain Legal Documents

Collect essential documents such as:

- Death Certificate of the shareholder

- Succession Certificate or Legal Heir Certificate

- PAN & Aadhaar of legal heir(s)

- Original share certificates (if physical)

Note- Probate Of Wiill and Succession Certificate is not same thing. Probate is provided when a deceased individual leaves a will. A Succession Certificate is given in cases when a deceased individual leaves no will.

Step 2: Submit Transmission Request

Send the documents and a formal transmission request to the RTA of Eicher Motors.

Step 3: Verification and Processing

The RTA verifies the authenticity of documents and transfers ownership of shares into the legal heir’s demat account.

Step 4: Conversion and Dematerialisation (If Physical)

If the shares were held in paper form, apply for dematerialisation by submitting the share certificates through a registered Depository Participant (DP).

Important Things To Consider

IEPF Claim Timeline: All claims must be made within 25 years of transfer to IEPF.

NRI Recovery: NRIs can also recover unclaimed shares by submitting notarised and attested KYC documents from the Indian Embassy.

Duplicate Share Certificates: If original certificates are lost, apply for reissue following the procedure for the issue of a duplicate share certificate with indemnity and surety.

Multiple Heirs: If there are multiple heirs, a No Objection Certificate (NOC) from other legal heirs is mandatory.

Avoid Agents or Third Parties: Only rely on recognised share recovery services or firms like Share Samadhan — avoid paying unverified intermediaries.

Claim Succession Certificate: You must submit a petition to the relevant Civil Court at the dead person's last residence in order to receive a Succession Certificate. After paying the required court fees, the applicant must draft, confirm, and sign a petition before submitting it to the district judge in the relevant jurisdiction.

Claim Legal Heir Certificate: The Revenue department of the district where the shareholder passed away issues the Legal Heir Certificate. The SDM office issues it for metropolitan areas, whereas the Tehsil office issues the Legal Heir Certificate for non-metropolitan areas.

How Share Samadhan Helps?

At Share Samadhan, India’s trusted share recovery firm in Delhi, we simplify complex financial recoveries.

Our share recovery services include:

- IEPF claim filing & status tracking

- Transmission of shares for deceased investors

- Duplicate share certificate issuance

- Unclaimed mutual funds, provident fund, and insurance recovery

- End-to-end NRI fund recovery support

With a dedicated legal and technical team, we manage documentation, liaise with registrars, and ensure the timely recovery of unclaimed investments from the IEPF and other financial institutions.

Whether you’re dealing with lost share recovery, unclaimed dividends, or an IEPF shares search, we ensure your rightful assets reach you — safely, transparently, and efficiently.

Stop The Chaos, Act Now!

Thousands of crores lie unclaimed in the IEPF under investors’ names — including Eicher Motors shareholders who may have simply lost track of their investments.

Don’t let legacy investments vanish into government funds. Reclaim them through legitimate fund recovery services that ensure compliance, transparency, and results.

Remember: Every lost share certificate, forgotten dividend, or unclaimed investment tells a financial story that deserves closure.

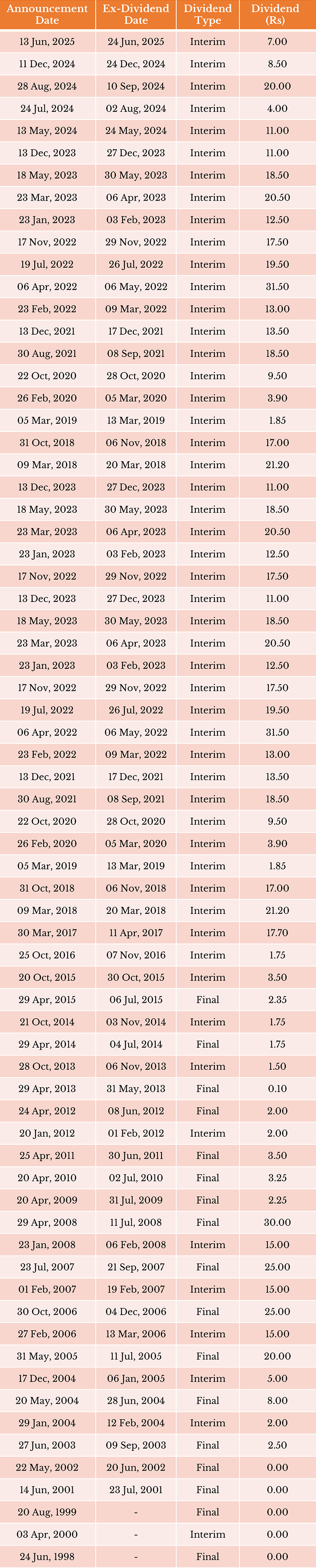

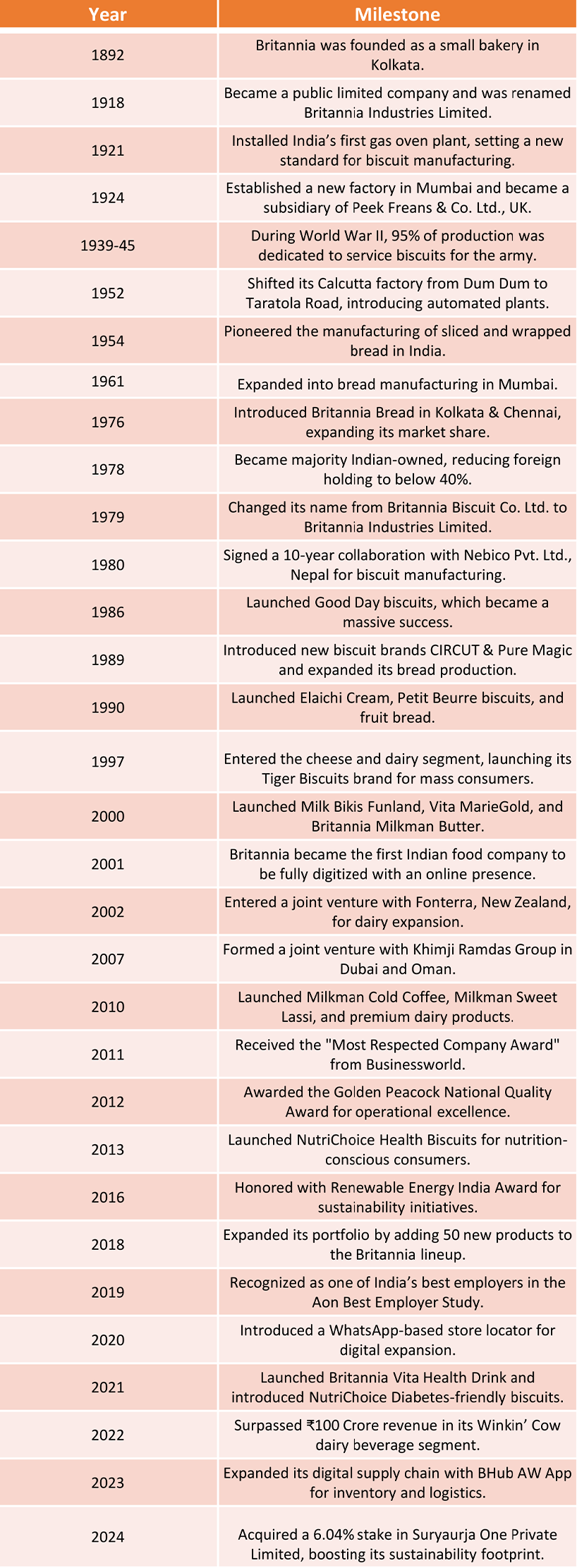

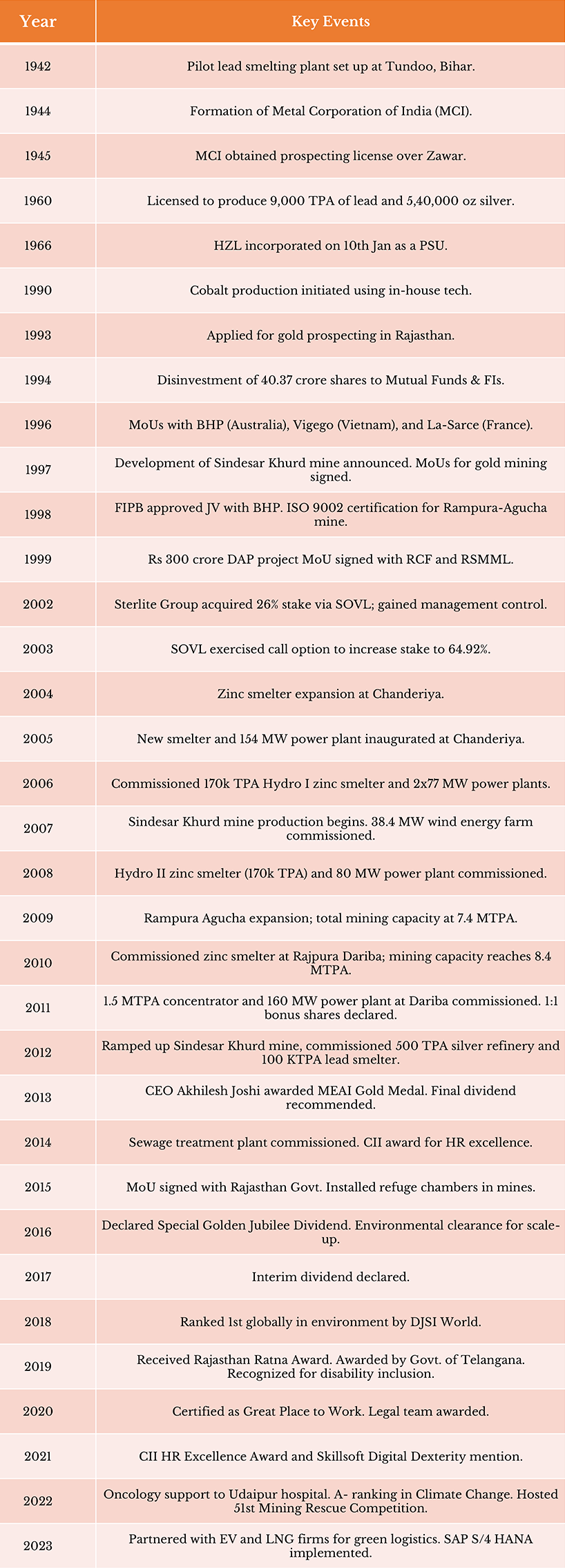

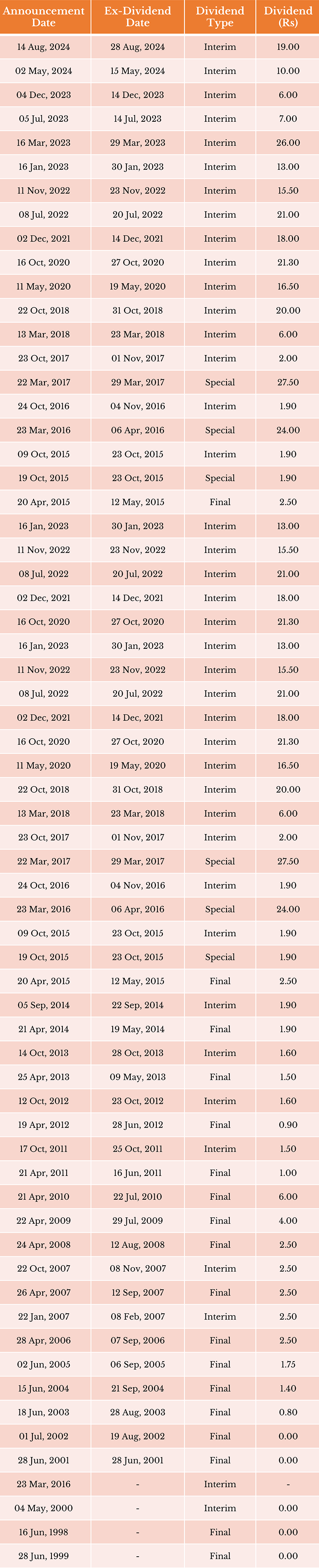

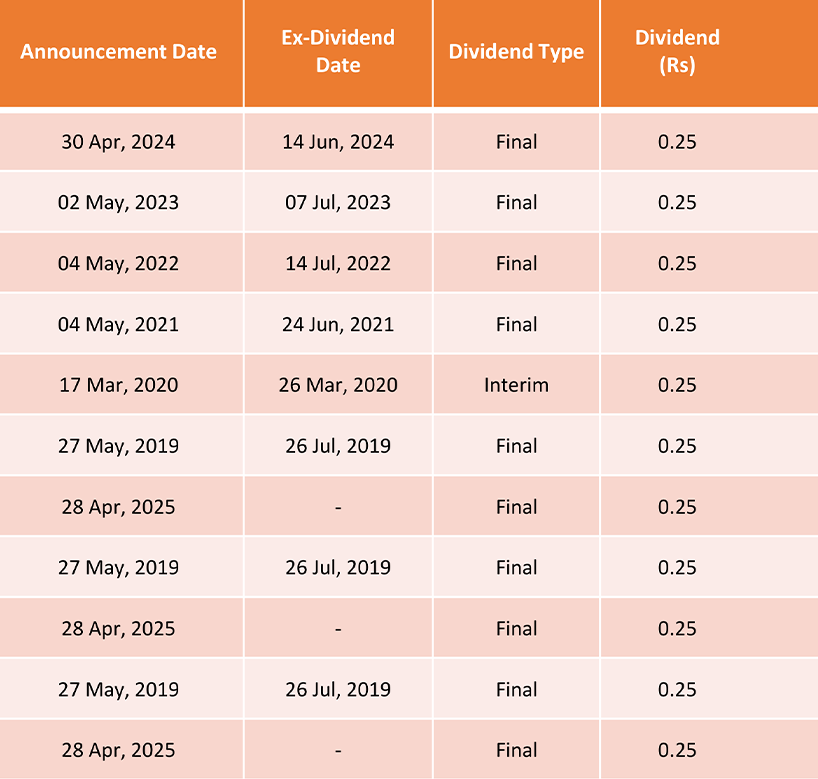

Eicher Motor Dividend History Table

Source- https://www.moneycontrol.com/company-facts/eichermotors/dividends/EM/

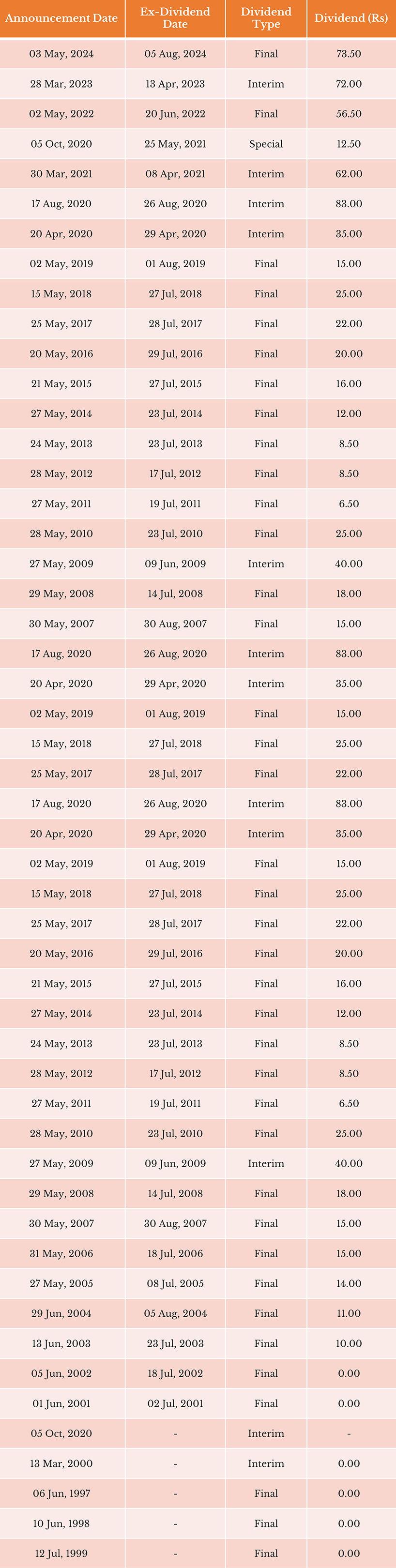

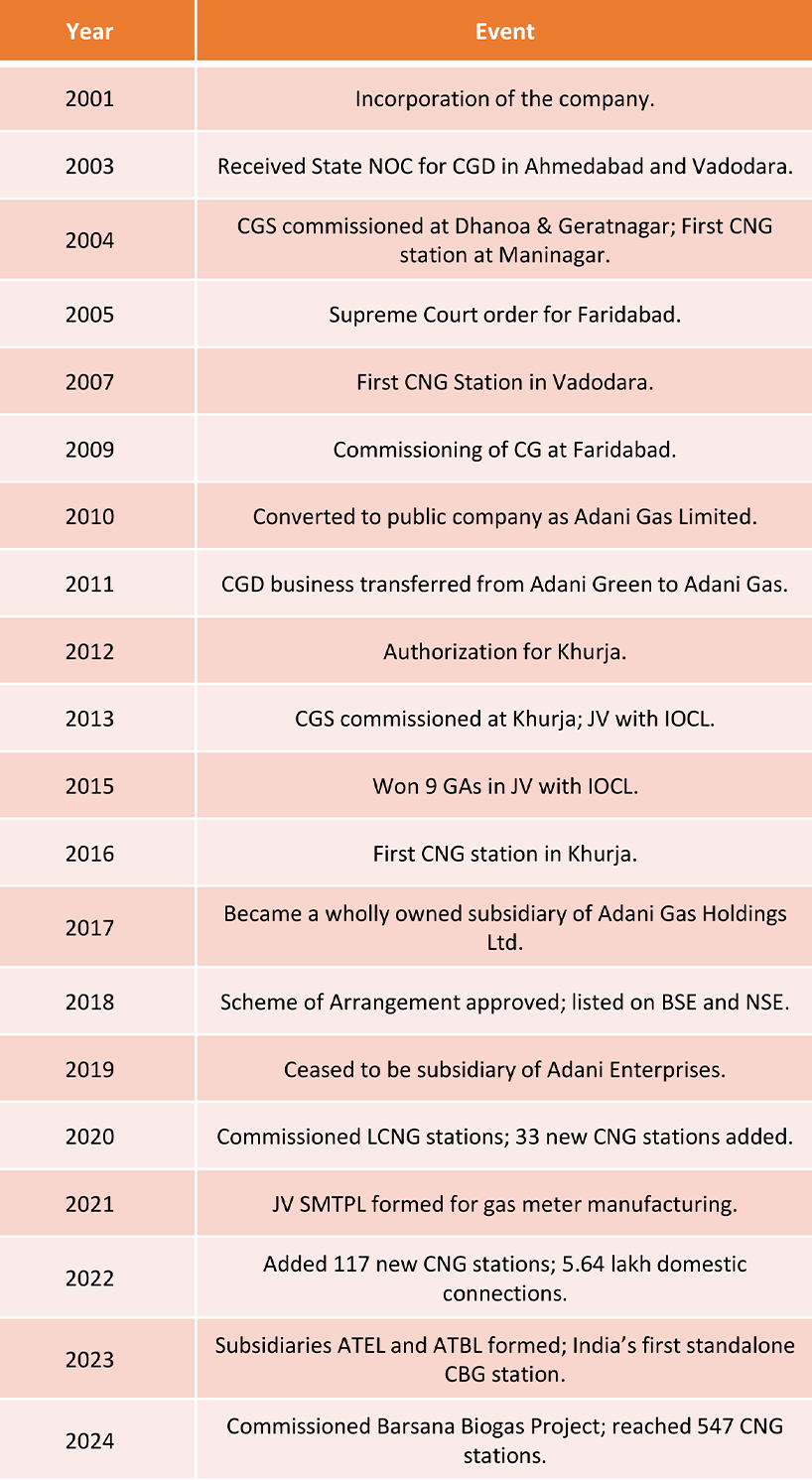

Eicher Motor Share Price Graph Over the Years

Source- https://www.moneycontrol.com/india/stockpricequote/auto-lcvshcvs/eichermotors/EM

FAQ'S

1. How to find unclaimed Eicher Motors shares?

Visit the IEPF website and use the IEPF unclaimed shares search tool with the shareholder’s name and company details.

2. How to recover shares from IEPF?

File Form IEPF-5, submit documents to Eicher’s RTA, and await verification and approval by IEPF authorities.

3. What if my IEPF status is pending for approval?

If your IEPF status shows pending, it means verification is ongoing. It may take 3–6 months. Regularly check updates via the IEPF portal or consult your recovery agent.

4. Can I claim unclaimed dividends as an NRI?

Yes, NRIs can reclaim unclaimed dividends by submitting attested KYC documents and proof of ownership.

5. How to check if shares are transferred to IEPF?

Visit www.iepf.gov.in → Search Unclaimed Shares/Dividends → Enter company name (Eicher Motors).

Conclusion

Recovering Eicher Motors shares of a deceased relative is not just about financial gain — it’s about restoring family legacy and rightful ownership. Through the combined processes of share transmission and IEPF recovery, legal heirs and families can reclaim what’s rightfully theirs. Reclaim what’s yours. Recover your Eicher Motors shares today with Share Samadhan — where forgotten investments find their way back home.

Source:

Source:  Source:

Source:

Source:

Source: