Lost Your Bajaj Auto Limited Shares? A Guide To Lost Share Recovery!

Bajaj Auto Limited, the flagship of the Bajaj Group, is one of India’s leading automotive manufacturers, renowned globally. With a rich legacy of over 75 years, the company has established a strong presence across more than 70 countries, making it a trusted name in mobility and innovation. While investors have reaped significant gains from this company’s growth and consistent dividend payouts, many shareholders remain unaware of their dormant holdings. Due to inaction, paperwork gaps, or lack of tracking, these unclaimed investments—including shares and dividends—are eventually transferred to the Investor Education and Protection Fund (IEPF).

About IEPF

The Investors Education and Protection Fund (IEPF) is an authority established by the Government in 2016 to manage unclaimed money, locate lost shares, facilitate share claims, and more. If they remain unclaimed for a consecutive 7 years, the funds are directly transferred to IEPF. It can include lost dividends, matured deposits, bank accounts, and shares. Although there's nothing to worry about! While these are transferred to IEPF, investors or their legal heirs can still recover them by following the prescribed process.

About Bajaj Auto Limited

Bajaj Auto is a major Indian exporter and has a presence in over 50 countries across Africa, Latin America, the Middle East, and Asia. It is often described as "The World's Favourite Indian," with its brand recognized internationally.

- Company Name: Bajaj Auto Limited

- Industry: Automotive (two-wheelers, three-wheelers, and quadricycles)

- Founded: 1945

- Headquarters: Akurdi, Pune, India

- Affiliation: Part of the Bajaj Group, an Indian conglomerate

- Products & Brands:

- Motorcycles: Known for brands like Pulsar and Boxer

- Three-wheelers: A major producer and exporter of auto rickshaws

- Quadricycles: Also manufactures and exports quadricycles

How to Check If You Have Unclaimed Shares Of Bajaj Auto Limited?

- Visit Bajaj Auto Limited Registrar & Transfer Agent (RTA) website (KFin Technologies Limited, formerly Karvy Fintech) and search by name, folio number, or PAN.

- You can also use the official IEPF portal to perform an IEPF shares search or an IEPF unclaimed shares search.

- Look out for old physical share certificates, demat statements, or investment records in family documents.

**If you discover any unclaimed investment, proceed with the claim filing process through IEPF.

Step-by-Step Guide to Claim Lost Bajaj Auto Limited Shares from IEPF

Step 1: Search for Unclaimed Shares

Visit iepf.gov.in → go to “Claim Refund” → enter PAN/Aadhaar/shareholder details → initiate IEPF search.

Step 2: Download & Fill Form IEPF-5

Select Bajaj Auto shares and provide personal, bank, and demat details.

Step 3: Print & Sign the Form

Verify details and sign the printed IEPF-5 form.

Step 4: Attach Required Documents

- Self-attested PAN & Aadhaar

- Demat account proof

- Cancelled cheque

- Original share certificates (if available) or follow the procedure for the issue of a duplicate share certificate

- Succession/legal heir certificate if the original holder is deceased

Step 5: Submit to RTA & Bajaj Auto Limited

Send the signed form with documents to RTA and Bajaj Auto’s corporate office.

Step 6: Verification & Approval

Once verified, the claim is forwarded to the IEPF Authority. Upon approval, the shares and associated dividends are credited to your demat and bank account—completing the Lost share recovery.

Things To Remember-

- Recovery is limited to shares that have been transferred to IEPF.

- Within 25 years after the transfer date, claims must be filed.

- Documents that are erroneous or incomplete may cause delays in approval.

- Rely on a professional share recovery firm in Delhi, like Share Samadhan, instead to avoid any fraud.

How Share Samadhan Can Help You?

As a leading provider of share recovery services, Share Samadhan ensures a smooth recovery process. We help you:

- Conduct an IEPF unclaimed shares search and trace how to find old shares.

- Assist with share transmission and reconstructing lost folios.

- File and process IEPF-5 with accuracy.

- Help NRIs with PoA, apostille, and demat account setup.

- Follow up with Bajaj Auto and KFin Technologies Limited for verification.

- Recover both shares and unclaimed dividends without hassle.

Why Act Now?

- Value Growth: Bajaj Auto shares have surged significantly, trading around ₹9,000+, with steady appreciation over the years.

- Dividend Recovery: Multiple years of unclaimed dividends can be recovered alongside your shares.

- Wealth Consolidation: Reclaiming forgotten shares ensures your family’s investments are preserved and consolidated.

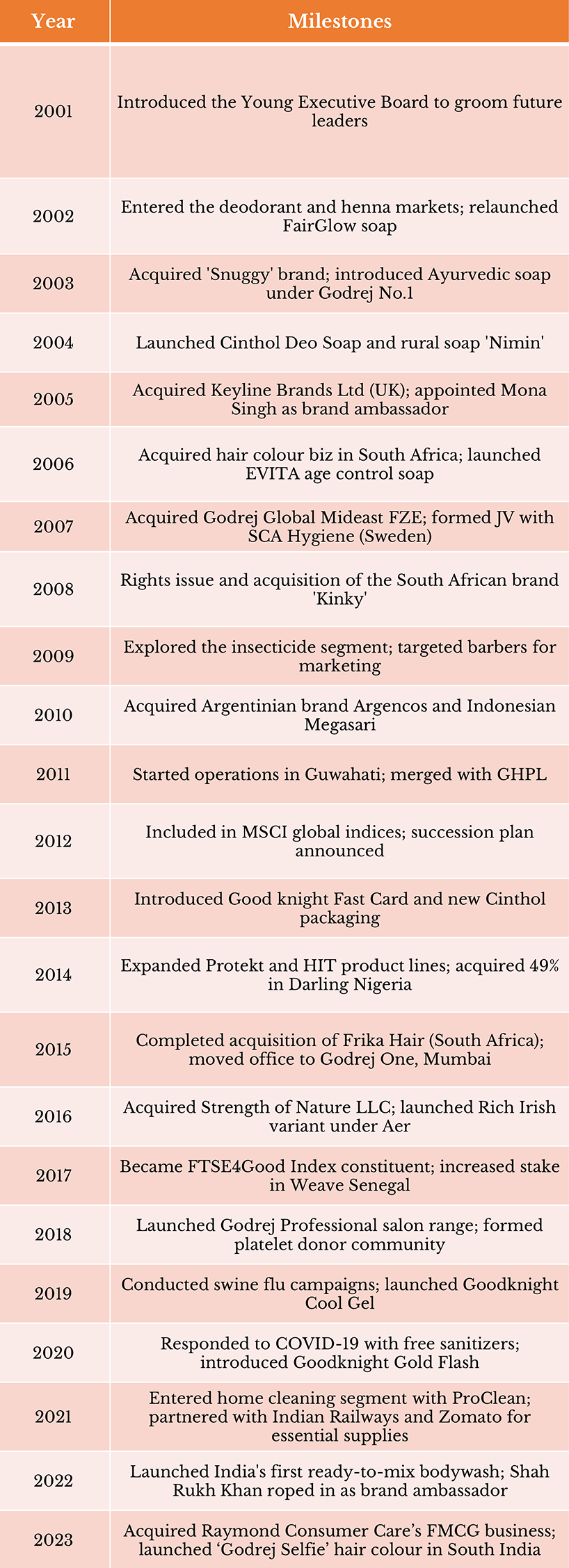

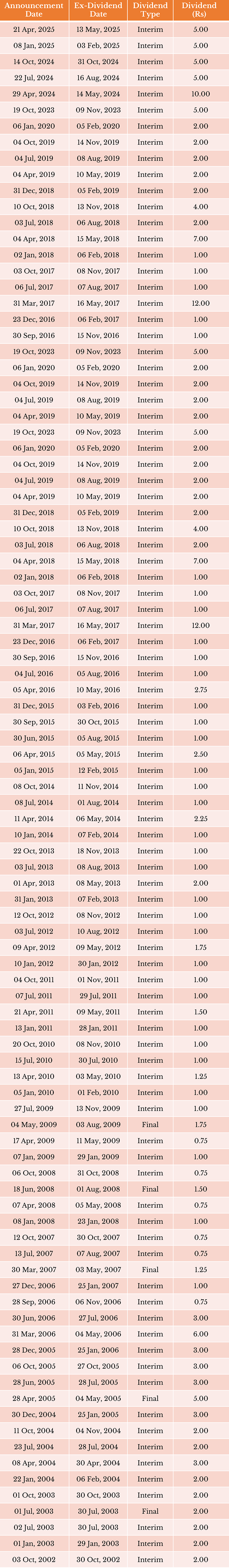

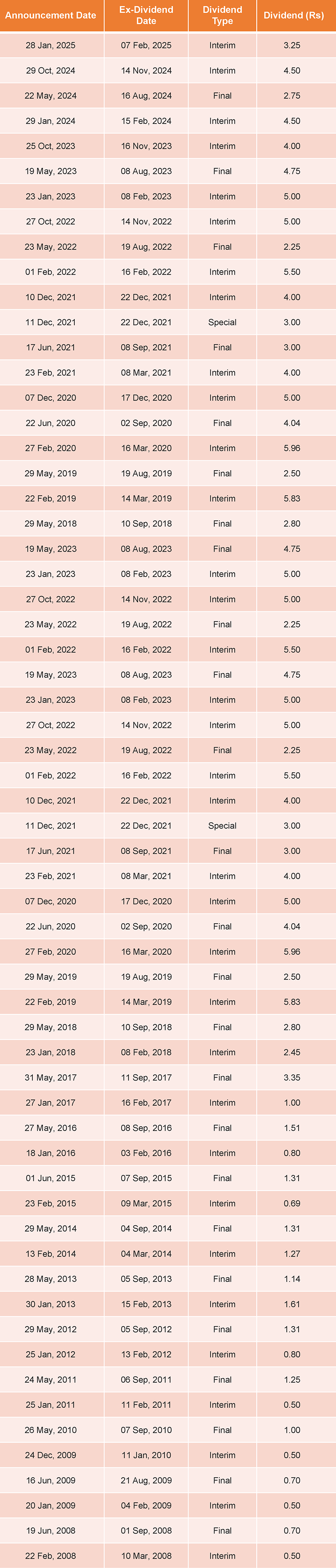

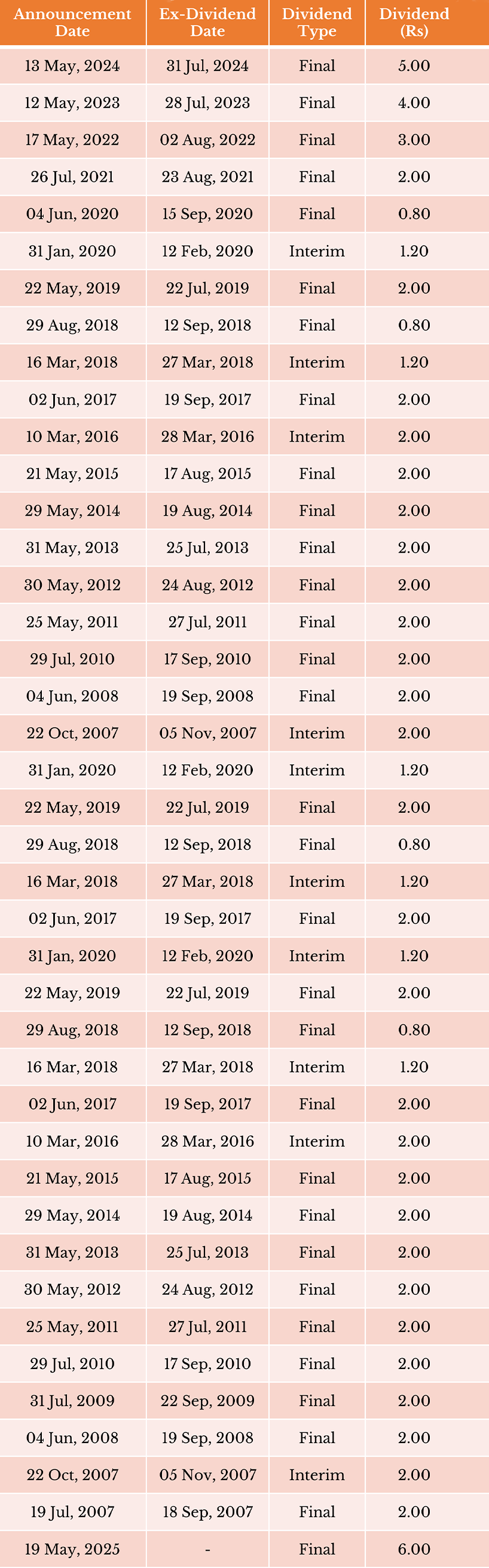

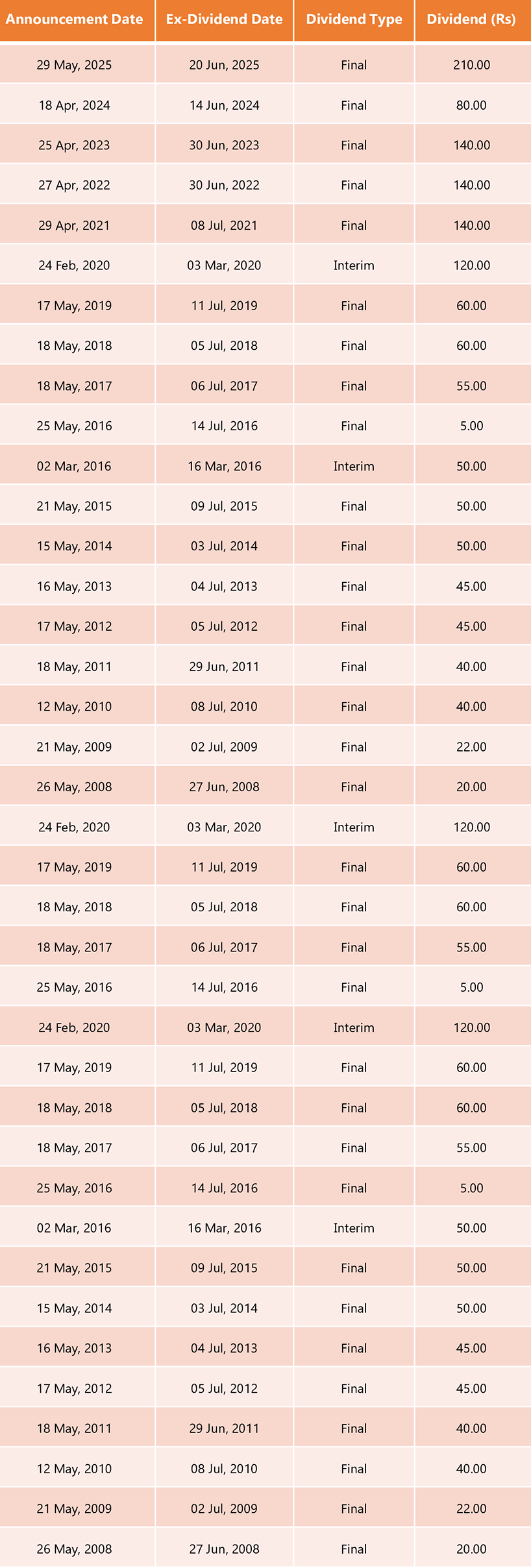

Dividend History Table

Source- https://www.moneycontrol.com/company-facts/bajajauto/dividends/BA10

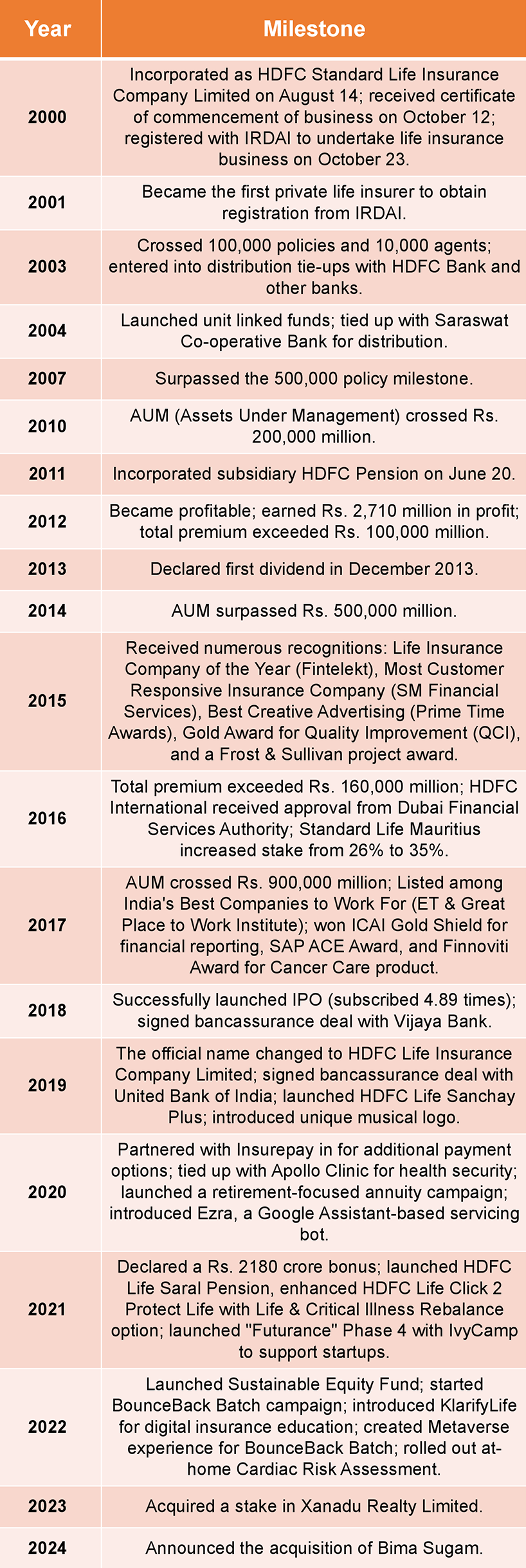

Share Price Graph Over The Years

Source- https://www.moneycontrol.com/india/stockpricequote/auto-23-wheelers/bajajauto/BA10#google_vignette

FAQ’s

Q1: What if I don’t have the original share certificate?

In such cases, you can still claim your shares by applying for the procedure for the issue of a duplicate share certificate. This involves submitting an indemnity bond, affidavit, identity proof, and PAN card. Share Samadhan can help in the process of claiming lost shares using RTI records and gives guidance through alternative document submission.

Q2: Can NRIs or overseas investors recover their Bajaj Auto shares?

Yes. NRIs and foreign investors can recover their shares with the help of Share Samadhan guidance. The process requires a valid demat account, Power of Attorney (PoA), documents apostilled or attested by the Indian Embassy, and an NRO demat account opening. The entire process can be done remotely while ensuring compliance with SEBI and RBI norms.

Q3: Can I recover dividends along with my shares?

Yes. When your shares are transferred to IEPF, the associated dividends are also transferred. By filing a single IEPF claim, you can recover both your shares and all past unclaimed dividend amounts. This ensures you don’t lose years of accumulated earnings from your Bajaj Auto Ltd investments. Share Samadhan does the necessary and ensures your dividends are included in your IEPF.

Q4: How long does it take to recover shares from IEPF?

The recovery process generally takes 8months to 1.5 years, depending on document accuracy, company and RTA verification, and IEPF approval timelines. In cases where documents are missing or legal heir certificates are required, the process may take longer. Share Samadhan speeds up the process with proper filing, liaison, and legal support.

Q5: Can legal heirs claim the deceased person’s Bajaj Auto Ltd shares?

In case of the death of the shareholder, their legal heirs can apply for share transmission and claim shares through the IEPF. This requires documents such as a death certificate, a legal heir certificate/succession certificate, and KYC documents of heirs. Share Samadhan ensures that legal heirs face no hurdles in the transmission of shares and dividend recovery.

Q6: What happens if my IEPF claim shows “status pending for approval”?

Many investors face delays due to incomplete documentation or verification backlogs, where the system shows IEPF status pending for approval. In such cases, regular follow-up with Bajaj Auto Ltd RTA (KFin Technologies Limited) and the IEPF Authority is required. Share Samadhan helps to resolve all discrepancies so that you can claim what’s yours without unnecessary delays.

Conclusion

Don’t let your unclaimed investments in Bajaj Auto Ltd remain dormant. With expert guidance from Share Samadhan, complete your IEPF claim efficiently and secure your rightful wealth. From tracing old holdings to IEPF form fill-up and follow-ups to document support, we ensure end-to-end assistance. Take the first step today and transform your lost investments into valuable, active assets. Reclaim what’s rightfully yours with Share Samadhan.