Recover Your Godrej Consumer Products Shares from IEPF – A Complete Guide

Godrej Consumer Products Limited (GCPL), one of India’s leading FMCG companies, has a vast shareholder base. Yet, each year, numerous shareholders lose access to their investments due to inactivity, outdated contact details, or unforeseen legal delays. As per the Companies Act, 2013, such unclaimed shares and dividends are transferred to the Investor Education and Protection Fund (IEPF) after seven consecutive years of inaction. Fortunately, recovery is possible, and this blog explains how.

India’s largest and most trusted platform for recovery of unclaimed investments, Share Samadhan, has successfully helped thousands of investors reclaim their rightful assets. Let us now explore how you can recover your unclaimed GCPL shares from the IEPF Authority.

Understanding the IEPF Transfer Rule

As per Section 124(6) of the Companies Act, 2013, companies must transfer shares to the IEPF Authority under the following conditions:

- Dividends on the shares have not been claimed or encashed for seven consecutive years.

- Physical shares have remained unclaimed for over seven years.

- Jointly held shares with incomplete endorsements.

- Shares of deceased holders with no legal transmission or claimant action.

Before initiating the transfer, GCPL sends reminders to registered addresses. However, many shareholders remain unaware due to outdated KYC or a change of residence.

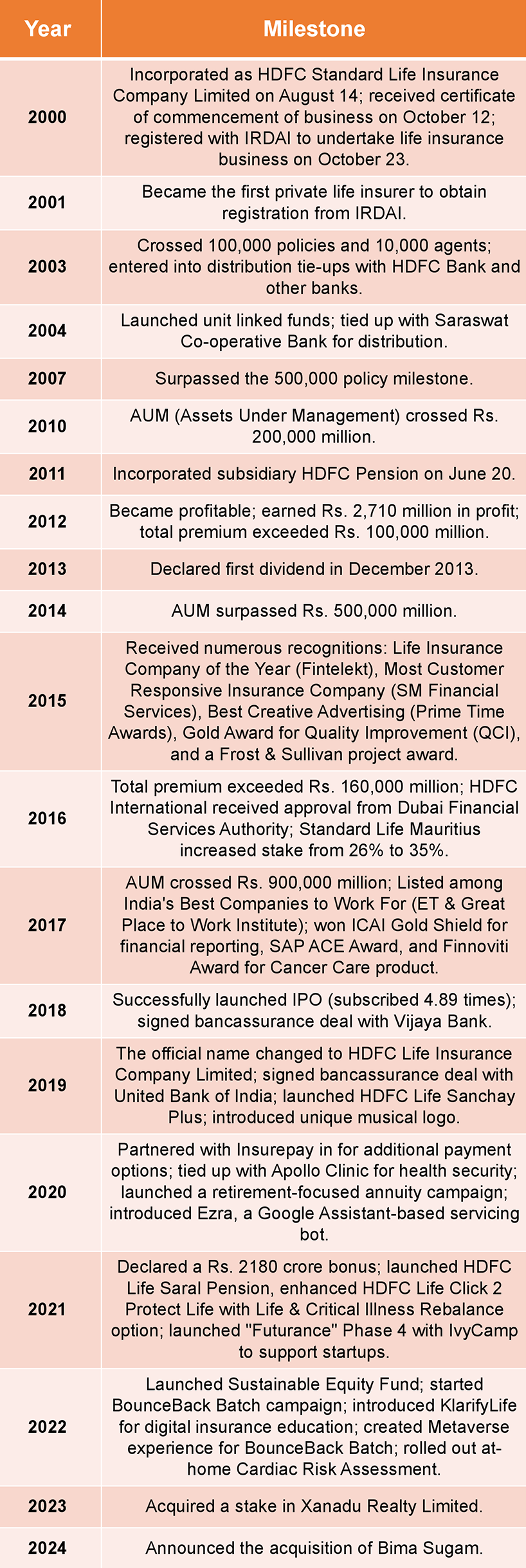

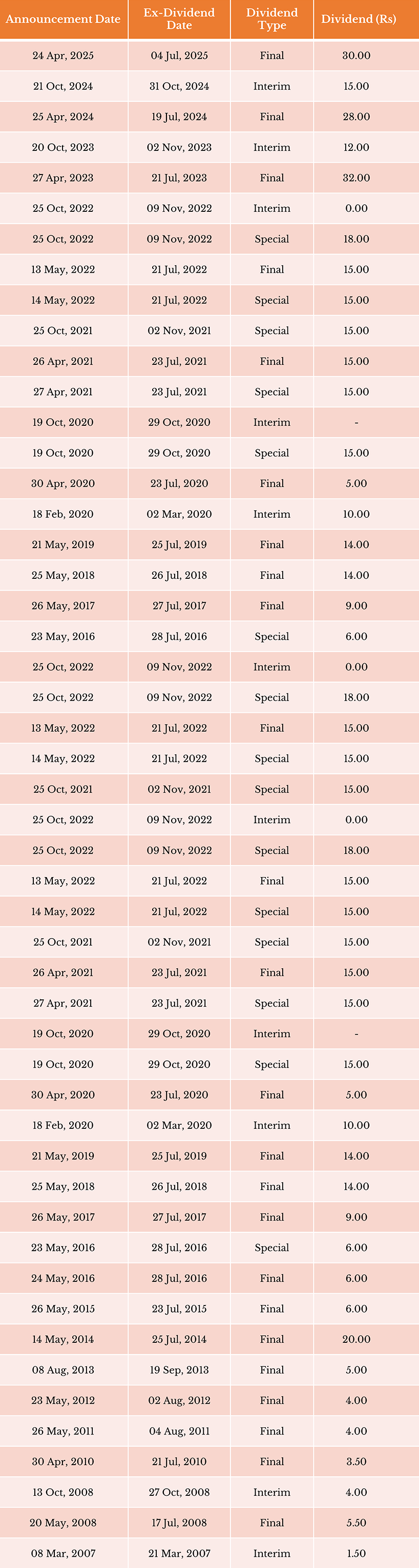

Yearwise Company History of GCPL

GCPL has evolved rapidly over the past two decades. Below is the rewritten table showcasing major milestones:

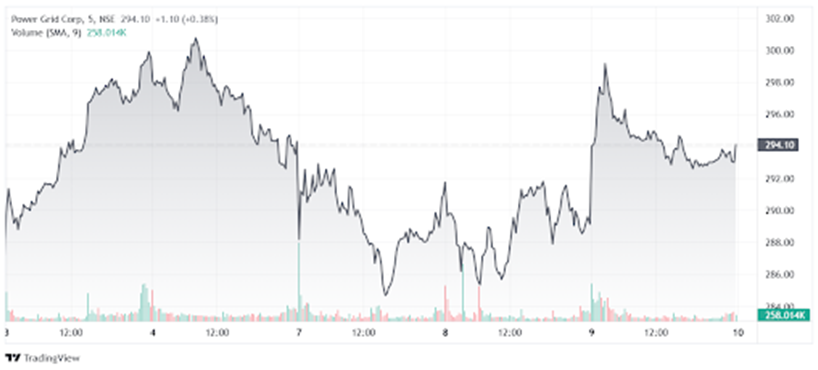

Share Price Graph of GCPL (2002–2024)

Source: https://www.moneycontrol.com/india/stockpricequote/personal-care/godrejconsumerproducts/GCP

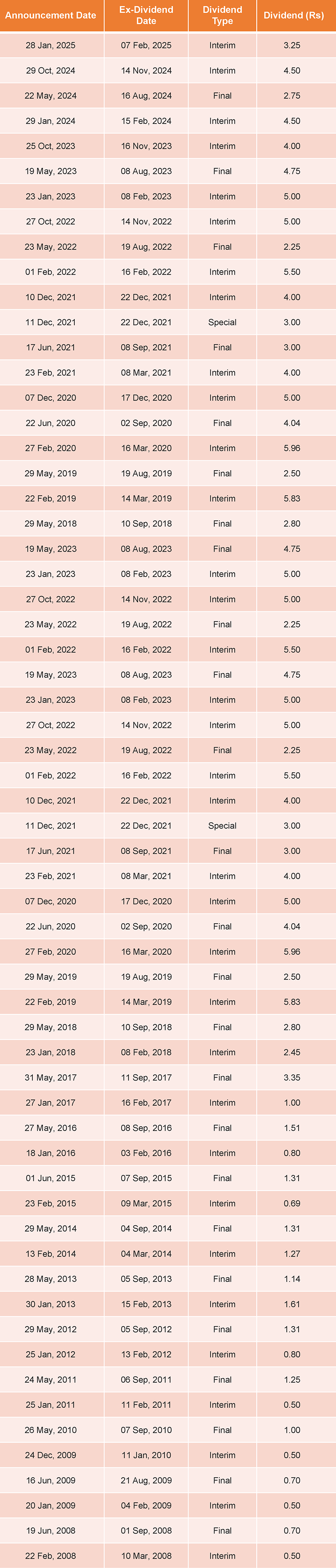

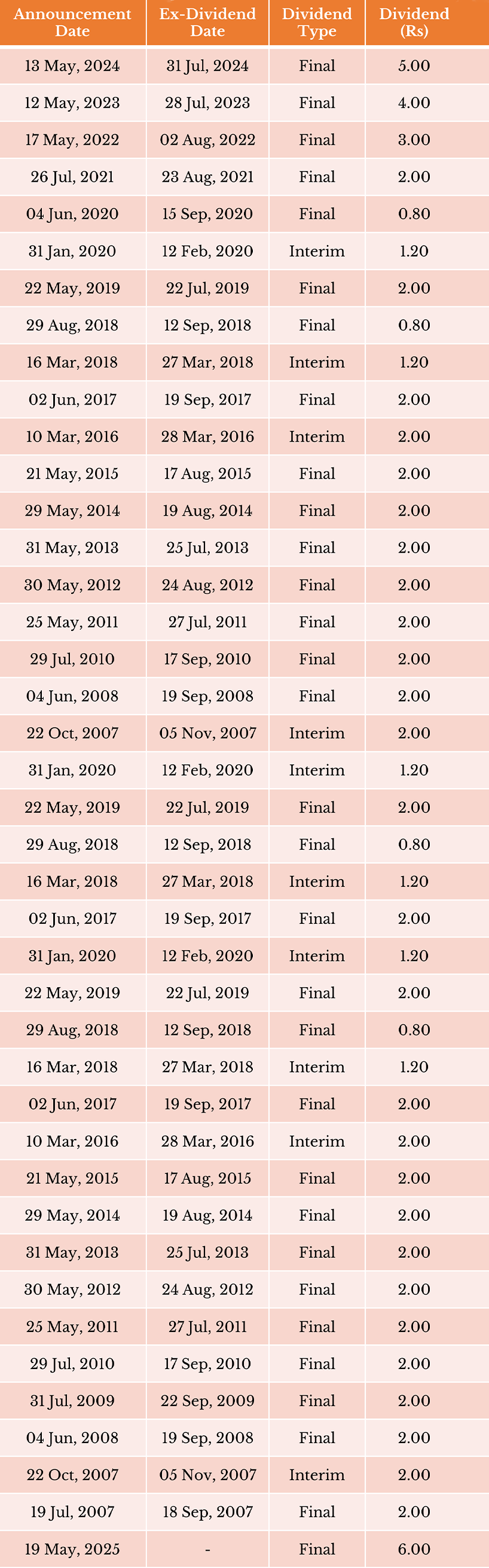

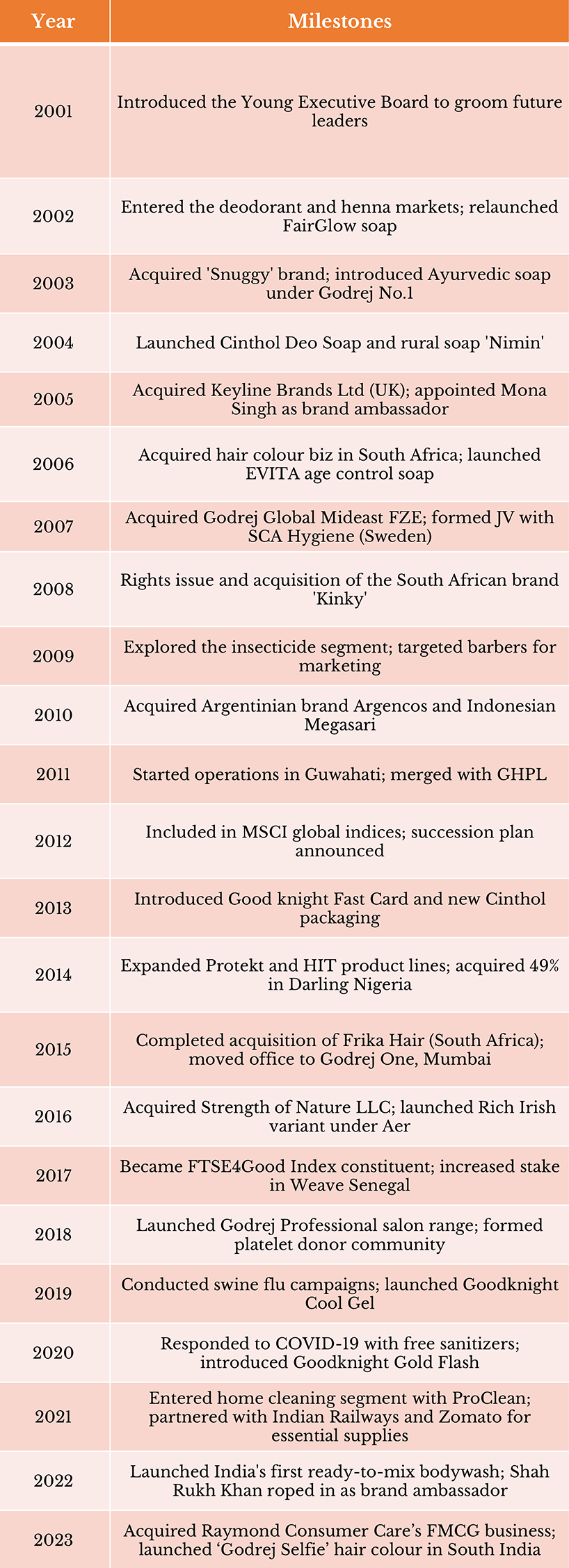

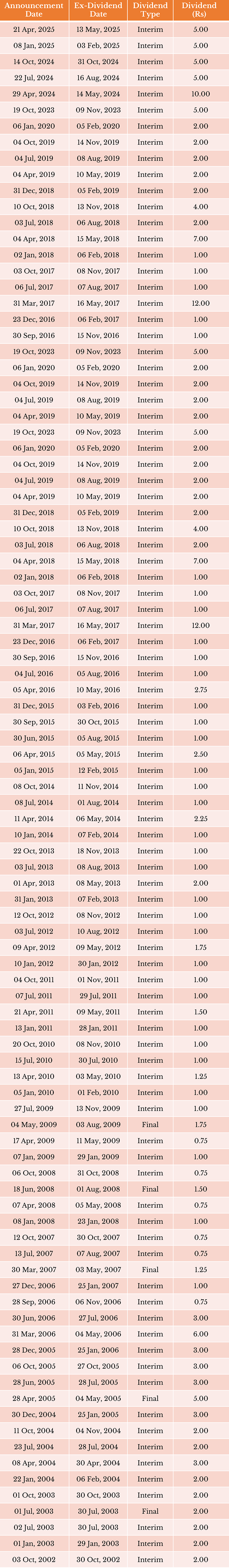

Dividend History Table of GCPL

Source: https://www.moneycontrol.com/company-facts/godrejconsumerproducts/dividends/GCP

Step-by-Step Process to Recover GCPL Shares from IEPF

Step 1: Verify Share Transfer to IEPF

- Visit http://www.iepf.gov.in

- Download GCPL’s "Statement of Unclaimed and Unpaid Amounts"

- Search by shareholder name or folio number

Step 2: Prepare Required Documents

- Indemnity Bond (duly signed)

- Original Share Certificate / IEPF transfer letter from GCPL

- PAN and Aadhaar (for Indian residents)

- Client Master List (for demat form)

- Advance receipt (signed)

- Death and succession certificates (for legal heirs)

- Cancelled cheque

Step 3: File Form IEPF-5 Online

- Register and log in at www.iepf.gov.in

- Navigate to e-Forms > IEPF-5

- Fill details: folio number, no. of shares, DP ID, personal info

- Attach scanned documents

- Submit with the fee and save the acknowledgment number

Step 4: Send Physical Copies to Nodal Officer

- Download PDF of filled Form IEPF-5

- Courier signed form and documents to the Nodal Officer of GCPL

Step 5: Track Your Claim

- Use the acknowledgment number to check claim status online

- Respond to SMS/email alerts for additional information, if required

On approval, shares will be credited to your demat account and unpaid dividends will be released.

Why Choose Share Samadhan?

Share Samadhan is India’s largest and most trusted platform for recovering unclaimed shares and investments. Here’s why thousands rely on us:

- 100% assistance with IEPF Form filing and document preparation

- Legal guidance for legal heirs and NRI claimants

- Handholding support from verification to approval

- Coordination with company registrars and depositories

Let our experts simplify this legal and procedural maze for you. Reclaim what is rightfully yours, without errors or delays.

Key Considerations for Legal Heirs & NRIs

For Legal Heirs:

- Provide a death certificate, succession certificate, and ID proofs

- The claim is valid even if transmission was never done previously

- All legal heirs must provide NOC if only one is claiming

For NRIs:

- Submit a passport copy instead of an Aadhaar

- Provide Indian NRO bank details for dividend credit

- Get documents certified by the Indian Embassy or a practicing CA

Common Mistakes to Avoid

- Not updating the address with GCPL is leading to missed notices

- Ignoring the joint holder endorsement on share certificates

- Filing an incomplete or inaccurate Form IEPF-5

- Failing to dematerialize physical shares in time

How Transfer to IEPF Safeguards Investor Rights

The IEPF mechanism ensures:

- Unclaimed assets do not lie idle with companies

- A statutory recovery path is available for rightful owners

- Legal heirs can claim inherited shares officially

- Promotes dematerialization and active investor participation

Your Investments Deserve Attention

Inaction can lead to years of hard-earned investments being trapped in the IEPF. Fortunately, recovery is possible with expert help. Share Samadhan has the expertise to assist GCPL shareholders in recovering their unclaimed shares and dividends smoothly and confidently.

Don’t let paperwork or legal formalities come in the way of your rightful wealth.

Act now. Reclaim your Godrej Consumer Products shares with Share Samadhan.

Frequently Asked Questions

1. What are unclaimed shares?

Unclaimed shares are equity holdings for which no dividend has been claimed or encashed for seven consecutive years, or which remain physically unclaimed by investors. As per Section 124(6) of the Companies Act, 2013, such shares are transferred to the IEPF Authority. This applies even if the dividend history is unknown or the shares are held in joint names without proper endorsement. Once transferred, they can only be recovered by filing a formal claim.

2. When does GCPL transfer shares to IEPF?

GCPL transfers shares to the IEPF when dividends on them remain unpaid or unclaimed for seven consecutive years. Additionally, if shares held in physical form are not claimed or encashed during this period, they are also moved to the IEPF. The company sends prior notices and reminders before initiating the transfer. The exact year of transfer depends on when the dividend first remained unpaid for that specific shareholder.

3. How to check if my shares are with IEPF?

To verify if your GCPL shares have been transferred to IEPF, visit the official IEPF website and download the "Statement of Unclaimed and Unpaid Amounts" under the company name. You can search using your folio number, name, or certificate number. If listed, it confirms that your shares have been moved to IEPF. You can then begin the recovery process by filing Form IEPF-5 with supporting documents.

4. Can I file a claim if my original certificate is lost?

Yes, even if the original share certificate is lost, you can still file a claim with IEPF. In such cases, you must obtain a duplicate certificate from the company or registrar by submitting a copy of the FIR and a notarized indemnity bond. The duplicate certificate serves as proof during the claim process. Ensure all required documents are in place to prevent rejection by the IEPF Authority.

5. Can legal heirs claim shares?

Yes, legal heirs are eligible to recover unclaimed shares transferred to IEPF. They must submit the original shareholder’s death certificate, succession certificate, or legal heirship certificate along with identity proofs. If multiple heirs exist, a no-objection certificate from other legal heirs may be required. The claim must be filed through Form IEPF-5, and Share Samadhan offers assistance to complete the legal formalities smoothly.

6. Can I file one claim for multiple folios?

Yes, shareholders can file a single consolidated claim covering multiple eligible folios, provided all folios belong to the same individual. It is essential to mention folio numbers and share details clearly in Form IEPF-5. This reduces documentation effort and simplifies the recovery process. However, proper supporting documents for each folio must still be submitted to ensure successful processing by the IEPF Authority.

7. Is there a time limit to file an IEPF claim?

There is currently no legal deadline or expiry for filing claims for unclaimed shares from IEPF. Shareholders and legal heirs can file claims anytime, as long as they submit valid supporting documentation. However, early filing is recommended to avoid loss of track or changes in claim rules over time. Prompt action ensures quicker recovery and better compliance with the existing IEPF regulations.

8. What happens after approval?

Once your claim is approved by the IEPF Authority, the shares are transferred electronically to your demat account. Any unpaid dividends are also credited to your linked bank account. You will receive an SMS or email notification confirming the completion of the process. The overall processing time typically ranges between 60 to 90 days, depending on the completeness of your documentation and verification timelines.

9. Can I file an offline application?

No, as per IEPF Authority guidelines, claims must be filed through the online Form IEPF-5 via the MCA portal. Physical or offline submissions are not accepted except in rare cases for senior citizens or those from remote regions with no internet access. Share Samadhan assists claimants in filing online forms correctly, ensuring error-free and prompt application submissions as per the latest procedures.

10. Why choose Share Samadhan?

Share Samadhan is India’s largest and most trusted platform for the recovery of unclaimed investments. We provide end-to-end assistance, from verifying whether your shares are with IEPF to filing and tracking your Form IEPF-5 claim. Our experts handle documentation, legal queries, and communication with registrars, making the entire process faster, safer, and stress-free. Thousands of investors and legal heirs trust Share Samadhan to reclaim their lost wealth.

For expert assistance, contact Share Samadhan – India’s largest and most trusted unclaimed share recovery platform.