A Complete Guide on Recovering Lost Coal India Limited Shares from IEPF

Coal India Limited (CIL) is a state-owned coal mining corporation that plays a crucial role in India's energy sector. Established in 1975 and headquartered in Kolkata, CIL is the largest coal producer in the world, contributing approximately 82% of India’s total coal supply. The company operates through eight fully owned coal-producing subsidiaries and a mining planning and consulting firm.

CIL is a Maharatna company, granting it operational and financial autonomy to expand its business. With 322 mines, including 138 underground, 171 opencast, and 13 mixed mines, and a workforce of 239,210 employees, it is a key driver of India's economic growth. CIL is listed on both the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE), making it a major investment opportunity.

However, many investors may unintentionally lose track of their shares or dividends, leading to their transfer to the Investor Education and Protection Fund (IEPF) after seven years of inactivity. This blog provides a structured guide to help shareholders recover lost CIL shares and dividends from IEPF.

Coal India Limited’s Market Presence and Financial Strength

As one of India’s most influential public sector enterprises, CIL has consistently maintained a strong market presence with:

-

Largest coal production capacity globally.

-

High dividend yield, making it a preferred choice for long-term investors.

-

Major supplier to power plants, steel industries, and cement companies.

-

Commitment to sustainability and environmental initiatives.

CIL recorded a coal production of 703.21 million tonnes, marking a growth of 12.94%, further strengthening India's energy security and economic resilience.

Coal India Share Price Movement

Source: https://www.moneycontrol.com/india/stockpricequote/miningminerals/coalindia/CI11

Source: https://www.moneycontrol.com/india/stockpricequote/miningminerals/coalindia/CI11

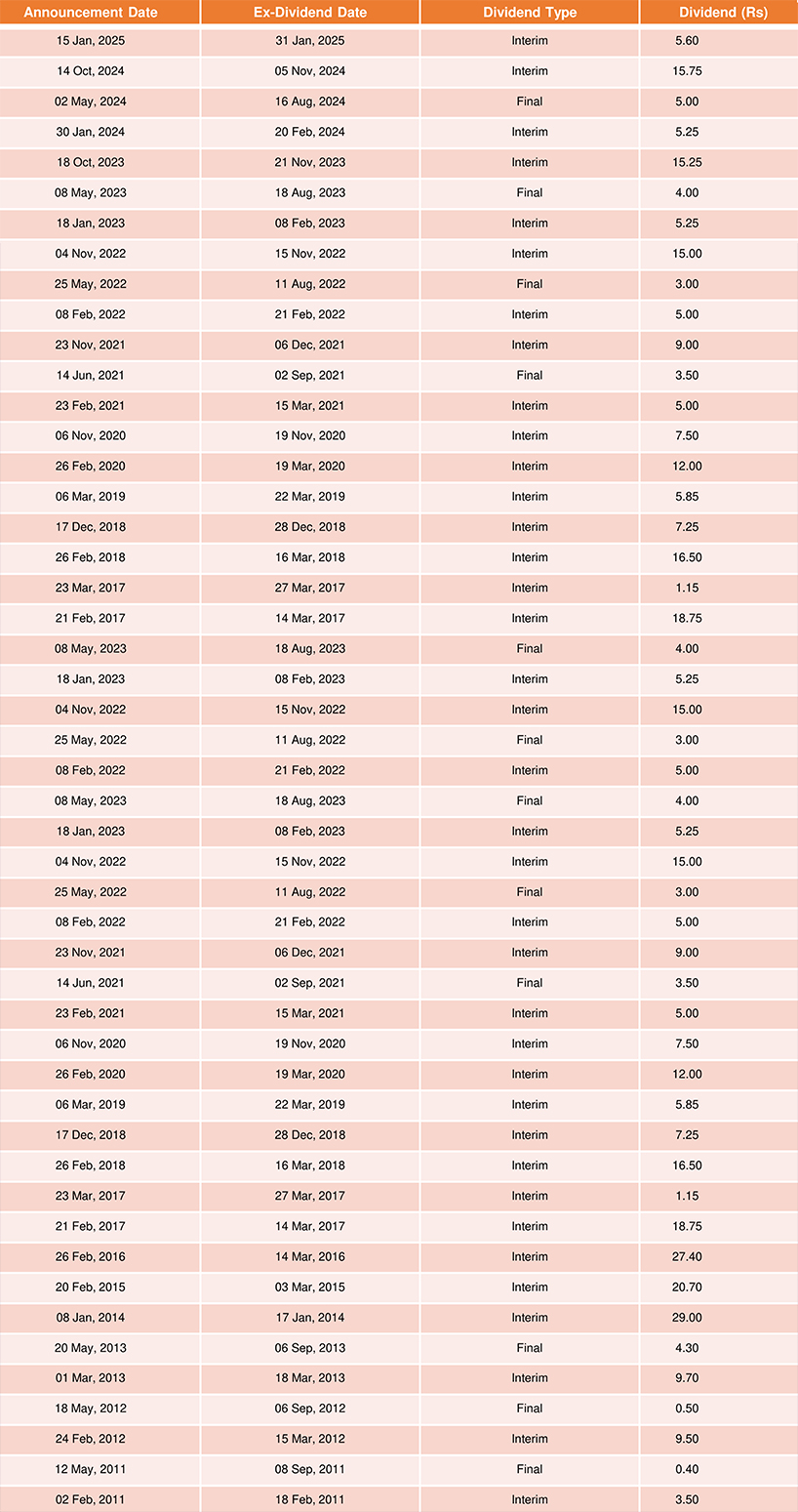

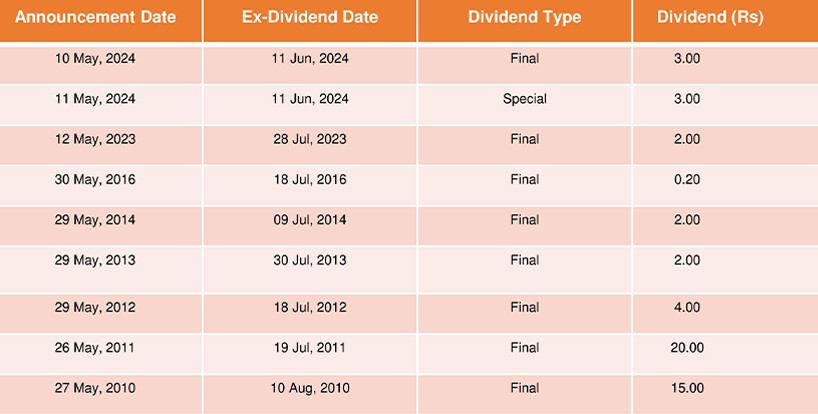

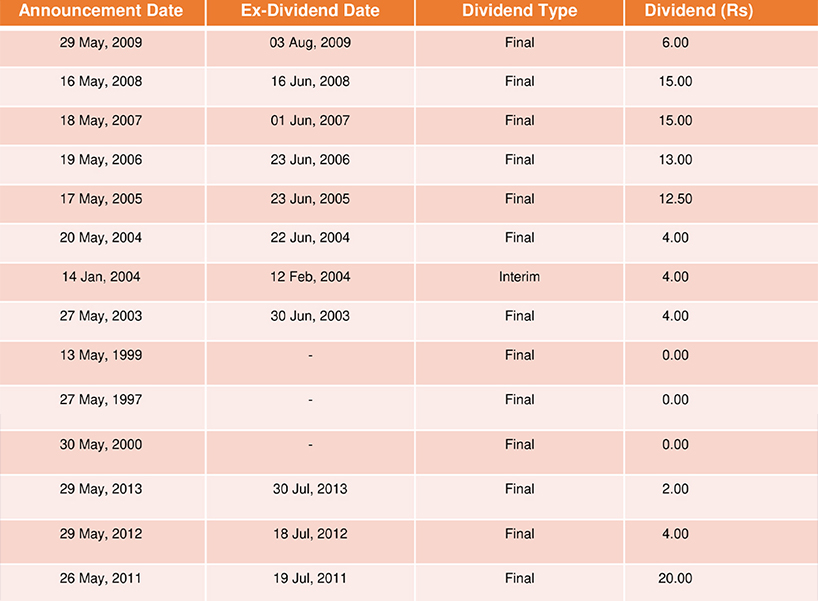

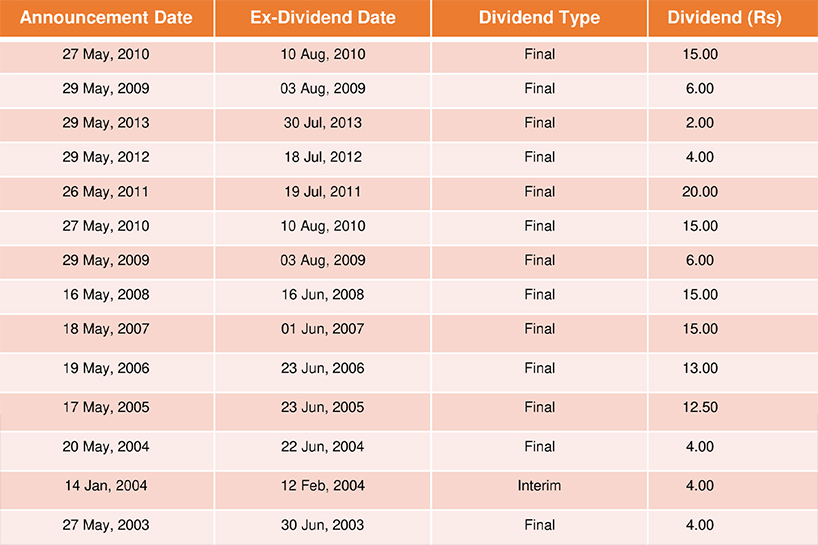

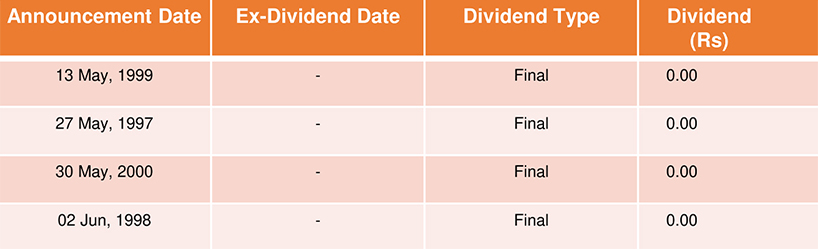

Coal India Dividend History

Why Do Coal India Shares and Dividends Become Unclaimed?

Several reasons contribute to shares and dividends being unclaimed and eventually transferred to IEPF:

-

Change of Address: Shareholders forget to update their details, missing dividend notifications.

-

Inactive Bank Accounts: Dividend payments fail if the linked bank account is dormant or closed.

-

Lost Share Certificates: Physical certificates misplaced by investors.

-

Uninformed Legal Heirs: If a shareholder passes away, their heirs may not be aware of the investment.

-

Neglected Emails and Notifications: Shareholders may overlook corporate communications regarding dividend claims.

To protect ownership and financial interests, investors must actively monitor their holdings and claim any unclaimed assets.

How to Claim Lost Coal India Shares and Dividends from IEPF

Step 1: Check IEPF Eligibility

To determine whether your shares or dividends have been transferred to IEPF:

-

Visit the IEPF website: https://www.iepf.gov.in/IEPF/refund.html

-

Enter your Folio/DP ID or shareholder name to check the status.

Step 2: Gather Required Documents

Once eligibility is confirmed, prepare the following documents:

-

Self-attested PAN and Aadhaar copies

-

Bank passbook or a canceled cheque (for dividend credit)

-

Demat account statement or physical share certificate

-

Indemnity bond notarized on stamp paper

-

Affidavit notarized on stamp paper

-

Form IEPF-5 (downloaded from the IEPF portal)

Step 3: Submit the IEPF Claim

-

Fill out Form IEPF-5 online via the IEPF website.

-

Print and sign the form, attach the necessary documents, and send them to Coal India’s Nodal Officer.

-

The company will verify and process the claim before forwarding it to the IEPF Authority.

Step 4: Processing by IEPF Authority

-

The IEPF Authority reviews and verifies the claim.

-

Upon successful verification, the shares are credited back to the investor’s Demat account.

-

Dividends are transferred to the registered bank account.

Step 5: Tracking IEPF Claim Status

-

Visit the IEPF website.

-

Navigate to ‘Track Claim Status’.

-

Enter the acknowledgment number received after submission.

-

Check the claim status: Pending, Under Process, Approved, or Rejected.

Benefits of Reclaiming Coal India Shares and Dividends

1. Recovering Lost Financial Assets

Reclaiming shares ensures investors regain ownership and benefit from potential appreciation.

2. Protecting Shareholder Rights

Recovering shares prevents ownership loss and secures legal shareholder rights.

3. Avoiding Legal Complexities

Unclaimed shares can lead to legal disputes, particularly for heirs.

4. Streamlined Recovery Process

IEPF provides a structured approach to reclaiming assets, making it accessible for investors.

How Share Samadhan Can Assist You

Although the IEPF process is structured, it can be time-consuming and document-intensive. Share Samadhan specializes in assisting investors in reclaiming Coal India shares and dividends from IEPF.

Why Choose Share Samadhan?

✔ Expert Assistance: Ensures correct documentation and avoids errors.

✔ End-to-End Support: Manages paperwork and communication with authorities.

✔ Quicker Processing: Expedites claim verification and approval.

✔ Legal Guidance: Assists in inheritance-related claim complexities.

If your Coal India shares and dividends are stuck in IEPF, contact Share Samadhan today to recover your investments efficiently.

FAQs

1. How do I check if my Coal India shares are in IEPF?

Visit the IEPF website and search for unclaimed shares using your Folio/DP ID or shareholder name.

2. What happens if I don’t reclaim my shares from IEPF?

The shares will remain with IEPF, making them harder to recover in the future.

3. Can legal heirs claim Coal India shares from IEPF?

Yes, legal heirs can claim shares by providing succession certificates or other legal documents.

4. How long does the IEPF recovery process take?

It typically takes 3 to 6 months, depending on document verification and approval timelines.

5. Can I file an IEPF claim online?

Yes, Form IEPF-5 must be submitted online, followed by sending physical documents to the company’s Nodal Officer.

Reclaiming Coal India shares and dividends ensures that your investments remain secure and accessible. Stay proactive, recover your assets, and protect your financial future today!

.jpg) How to Claim Unclaimed IOCL Shares and Dividends from IEPF

How to Claim Unclaimed IOCL Shares and Dividends from IEPF