NRI Shares Recovery from IEPF - A Practical Guide for Reclaiming Your Investments

Your Investments May Not Be Lost—Just Waiting to Be Claimed

For many NRIs, investing in Indian shares and mutual funds was a way to stay connected with home—and to grow their wealth over time. However, years later, many of these investments remain unclaimed and quietly transferred to the Investor Education and Protection Fund (IEPF) due to the non-encashment of dividends or outdated communication details.

If you're an NRI wondering why your Indian investments have gone silent, you're not alone. The reality is, your money may still be there, but you need to claim it. And with the right guidance, you don’t have to travel to India to do it.

Let’s explore how NRI Shares Recovery from IEPF works, the challenges involved, and how expert assistance like Share Samadhan can help you claim what’s rightfully yours.

Why Do NRIs Lose Track of Their Investments?

NRIs hold shares, mutual funds, and fixed deposits across decades. These get lost for several reasons:

-

No Update of Contact Details: Addresses and bank accounts changed after moving abroad, but records weren’t updated.

-

Unclaimed Dividends: Dividend cheques weren’t cashed for 7+ years.

-

Physical Share Certificates: Shares remained in paper form and were never dematerialized.

-

No Nominee Registered: Inherited investments get stuck due to missing succession documents.

-

Inactive Bank/Demat Accounts: Dormant accounts lead to dividend rejections and eventual IEPF transfer.

The result? Your investment gets transferred to IEPF—a government fund that holds unclaimed shares and dividends until the rightful owner steps forward.

What is IEPF and Can NRIs Claim Their Shares Back?

IEPF (Investor Education and Protection Fund) is managed by the Ministry of Corporate Affairs, where companies deposit unclaimed dividends and shares if they’ve been inactive for 7 consecutive years.

The good news?

You can claim your shares back from IEPF.

And no, you don’t have to come to India to do it.

With support from experts like Share Samadhan, NRIs can complete all the documentation and recovery steps remotely—saving time, money, and endless follow-ups.

Step-by-Step NRI Shares Recovery from IEPF

Here's how Share Samadhan helps you recover shares from IEPF without setting foot in India:

Step 1: Review Investment & Ownership Documents

-

Share certificates

-

PAN card

-

Passport (Indian or Foreign)

-

OCI/PIO card (if applicable)

-

Demat statements or folio numbers

Step 2: Identify the Status of the Investment

-

We check with the company/registrar to confirm if the shares and dividends are still with them or have been transferred to IEPF.

-

IEPF’s public records are searched for unclaimed holdings.

Step 3: Obtain Supporting Documents

-

Assistance in applying for a PAN Card, Demat Account, NRE/NRO Bank Account if not already available

-

For deceased cases: help with Legal Heir Certificate, Succession Certificate, or Probate of Will

Step 4: Draft and File IEPF Claim

-

Fill Form IEPF-5 online

-

Prepare all required affidavits, indemnity bonds, and receipts

-

Share Samadhan ensures everything is formatted and attested per IEPF norms

Step 5: Submit Physical Documents to the Company

-

Once online filing is complete, physical documents are couriered to the company’s Nodal Officer

Step 6: Company Verification and Report Submission

-

The company verifies your claim and sends its approval to the IEPF Authority

Step 7: Final Approval and Recovery

-

Once approved, your shares are credited to your Demat account and dividends to your bank account

Documents Required for NRIs in IEPF Claims

For Indian Passport Holders:

-

PAN Card

-

Indian Passport

-

NRE/NRO Bank Account

-

NRE/NRO Demat Account

For Foreign Passport Holders:

-

PAN Card

-

Foreign Passport

-

OCI/PIO Card (if applicable)

-

NRE/NRO Bank Account

-

NRE/NRO Demat Account

How Share Samadhan Simplifies NRI Asset Recovery

We understand that NRI investors face multiple hurdles:

-

Different time zones

-

Legal formalities in India

-

Apostille requirements

-

Communication delays with multiple parties

That’s why we offer a complete solution:

-

Opening of Demat and Bank Accounts

-

Application for PAN Cards

-

Coordination with Registrars, Companies & IEPF Authority

-

Liaison with Indian courts for succession matters

-

Tax & FEMA compliance guidance for repatriating funds

-

Full assistance without you needing to travel to India

What if There’s a Death in the Family and No Will?

When an investor passes away without a nominee or will, the process gets more complex.

We assist with:

Succession Certificate

-

Required for Intestate Succession (No Will)

-

Issued by the District Court to authorize the legal heir

Probate of Will

-

Required for Testate Succession (With Will)

-

Filed with the competent court, depending on location

Legal Heir Certificate

-

Proves the relationship between the deceased and the heir

-

Collected from local authorities or civil courts

These are all essential for the transmission of shares—the legal transfer of ownership after death. Share Samadhan coordinates this entire process for you.

NRI Assistance Beyond IEPF Claims

Our role doesn’t stop with share recovery. We also help with:

-

Dematerialization of physical shares

-

Mutual fund tracing & claim filing

-

Transmission of inherited securities

-

Apostille and legal attestation of overseas documents

-

Tax advice on repatriation under FEMA & RBI norms

Your financial legacy deserves to be reclaimed and respected—no matter where in the world you live.

Why NRIs Need Dedicated Assistance

1. Complex Indian Compliance Rules

Understanding Indian rules across IEPF, SEBI, FEMA, RBI, and tax laws isn’t easy—especially from abroad.

2. Multi-party Coordination

Recovering shares often involves multiple players: registrars, companies, courts, and government authorities.

3. Legal and Documentation Gaps

Every company and registrar has different rules. NRIs often need an apostille, notarization, or jurisdictional filings.

4. Communication Delays

From time zones to post and email lags, following up from abroad is frustrating without on-ground support.

This is where Share Samadhan steps in as your NRI support system.

Final Thoughts- Take the First Step Toward Reclaiming Your Wealth

If you're an NRI with forgotten or stuck investments in India, don’t wait any longer. These assets are not gone—they're just unclaimed.

With Share Samadhan, you don’t need to figure it all out yourself. You just need to provide us with the following information to trace your investments in India. Those are as follows:

• Shareholder’s Name

• Shareholder’s Father’s Name

• Share Purchase Address (with Pincode)

You don’t need to travel back. You don’t need to deal with confusing paperwork. You don’t need to chase multiple parties.

You just need to connect with us.

Let us help you bring back what rightfully belongs to you—your wealth, your shares, your legacy.

FAQs

1. What is NRI assistance, and why do NRIs need it?

NRI assistance is specialized support designed to help Non-Resident Indians manage and recover their financial assets in India—such as unclaimed shares, dividends, provident funds, and other investments. NRIs often face hurdles due to geographical distance, documentation gaps, or regulatory complexity. At Share Samadhan, we step in to provide clarity, take care of paperwork, and ensure rightful recovery of their investments, without them having to travel back to India.

2. How can you help with asset recovery for NRIs?

We help NRIs recover forgotten or unclaimed financial assets, including:

-

Shares and dividends transferred to IEPF

-

Mutual funds and bonds

-

EPF balances

-

Investments held by deceased relatives

Our services cover everything from identifying these assets to filing claims, coordinating with companies/registrars, obtaining legal documents, and guiding through repatriation if needed.

3. What is the process for NRI asset management with your assistance?

Our process is simple and comprehensive:

-

We begin with an assessment of the client’s case and documents.

-

We verify unclaimed investments and check the IEPF transfer status.

-

We assist with setting up PAN cards, NRE/NRO Demat accounts, and bank accounts.

-

If legal documents are needed (e.g., a succession certificate), we help arrange them.

-

We prepare and file IEPF claims or other recovery applications.

-

We handle follow-ups with companies and government authorities until resolution.

Throughout, our team keeps clients updated and involved, without the need for them to be physically present in India.

4. How do you address communication challenges faced by NRIs?

We understand the time zone differences and coordination challenges NRIs face. That’s why our team:

-

Works flexibly across time zones

-

Provides regular email updates and status reports

-

Offers virtual consultations and document checks

-

Coordinates all in-India physical follow-ups on your behalf

This ensures you stay informed and in control, without the stress of long waits or confusion.

5. What sets you apart from other NRI assistance providers?

Share Samadhan offers more than just advisory—we take ownership of the entire recovery process. What sets us apart is:

-

A strong track record in IEPF share recovery and succession-based claims

-

Dedicated documentation support for Indian and foreign passport holders

-

Coordination with registrars, courts, companies, and government agencies

-

End-to-end service—right from claim assessment to fund or share recovery

-

No need for NRIs to travel to India—we handle everything on the ground

Our approach is personal, efficient, and transparent.

6. Is NRI assistance only for individuals, or do you assist businesses too?

While most of our clients are individual NRIs or families, we do assist small businesses or HUFs (Hindu Undivided Families) in recovering unclaimed corporate investments, dividends, and securities. If there’s a clear legal linkage and valid documentation, we’re equipped to handle institutional claims too.

7. How can I get started with your NRI assistance services?

Getting started is easy. You can:

-

Reply to our email or message

-

Visit www.sharesamadhan.com and fill out the contact form

-

Schedule a call with our NRI support team

Once we understand your situation, we’ll guide you step by step—starting with a checklist of required documents and actions.

8. What do I need to have ready when seeking NRI assistance for asset recovery?

Here are a few basic documents that help us begin:

For Indian passport holders:

-

PAN Card

-

Indian Passport

-

NRE/NRO Bank Account

-

NRE/NRO Demat Account

For foreign passport holders:

-

PAN Card

-

Foreign Passport

-

OCI/PIO Card (if applicable)

-

NRE/NRO Bank & Demat Account

If the investment belongs to a deceased family member, documents like the Death Certificate, Legal Heir Certificate, Succession Certificate, or Probate of Will may be needed.

9. I don’t have the original share certificates or account details for my Indian investments. Can you still help trace and recover my lost shares?

Yes. Even without original certificates or specific account details, lost shares can often be traced using your name, father's name, and past purchase address. Share Samadhan works with company registrars and historical shareholder records to help NRIs identify and recover such dormant or misplaced investments.

Don’t worry—our team will walk you through exactly what’s required for your case.

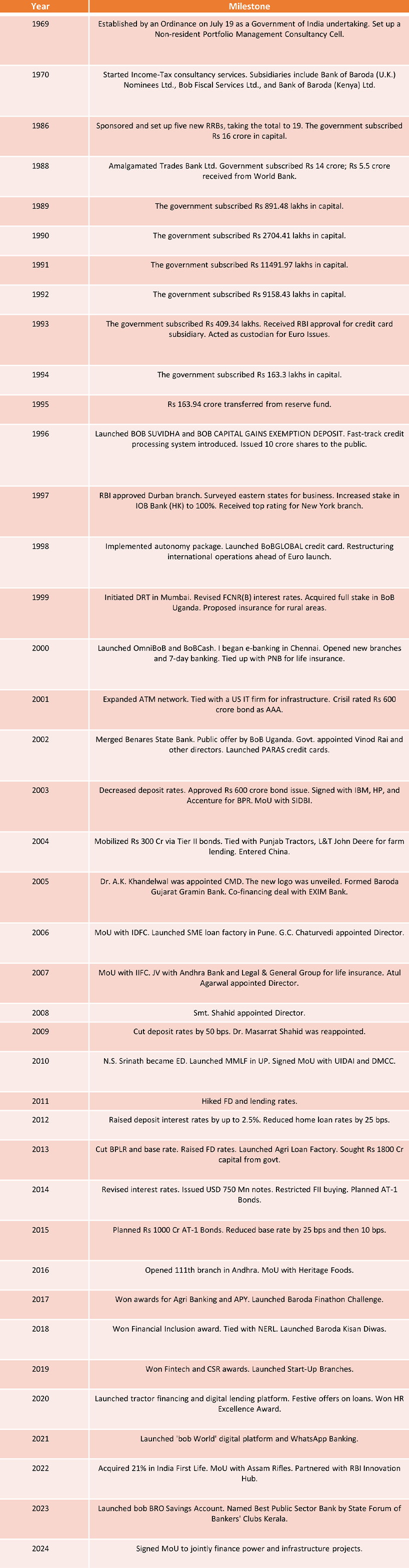

Bank of Baroda Milestones: A Century of Growth

Bank of Baroda Milestones: A Century of Growth

Source:

Source:

.jpg) How to Claim Unclaimed IOCL Shares and Dividends from IEPF

How to Claim Unclaimed IOCL Shares and Dividends from IEPF