The Process of Reclaiming Your Tata Steel Limited Shares from IEPF

If you've lost or misplaced your shares of Tata Steel Limited, one of India's premier steel manufacturers with a significant global footprint, don't worry—you can recover them from the Investor Education and Protection Fund (IEPF) Authority. This blog will walk you through the step-by-step process of claiming your shares of Tata Steel Limited from the IEPF Authority.

Tata Steel: A 115-Year Legacy from Jamshedpur to the Global Stage

Steel, a vital man-made resource, is indispensable in any nation's development. Tata Steel Ltd., a subsidiary of the Tata Group, boasts a rich history and a strong global presence.

- August 1907:Â Tata Steel was established.

- November 1994:Â The company was listed on the National Stock Exchange.

- August 2005:Â It was renamed Tata Steel Ltd.

- 1937: The company was listed on the Bombay Stock Exchange.

By 1939, Tata Steel had grown to become the largest steel plant in the British Empire. Due to its national importance, the Government of India made two unsuccessful attempts to nationalize the company. Over time, Tata Steel has expanded its reach to over 100 countries across six continents through acquisitions and joint ventures.

Tata Steel operates in diverse industries, including steel, iron, mining, engineering, construction, automotive, aerospace, defense, energy, and consumer goods. It is a key component of various indices like the Nifty 50, Sensex, and Nifty Metal. The company has garnered numerous awards for its excellence in quality, innovation, sustainability, and corporate governance.

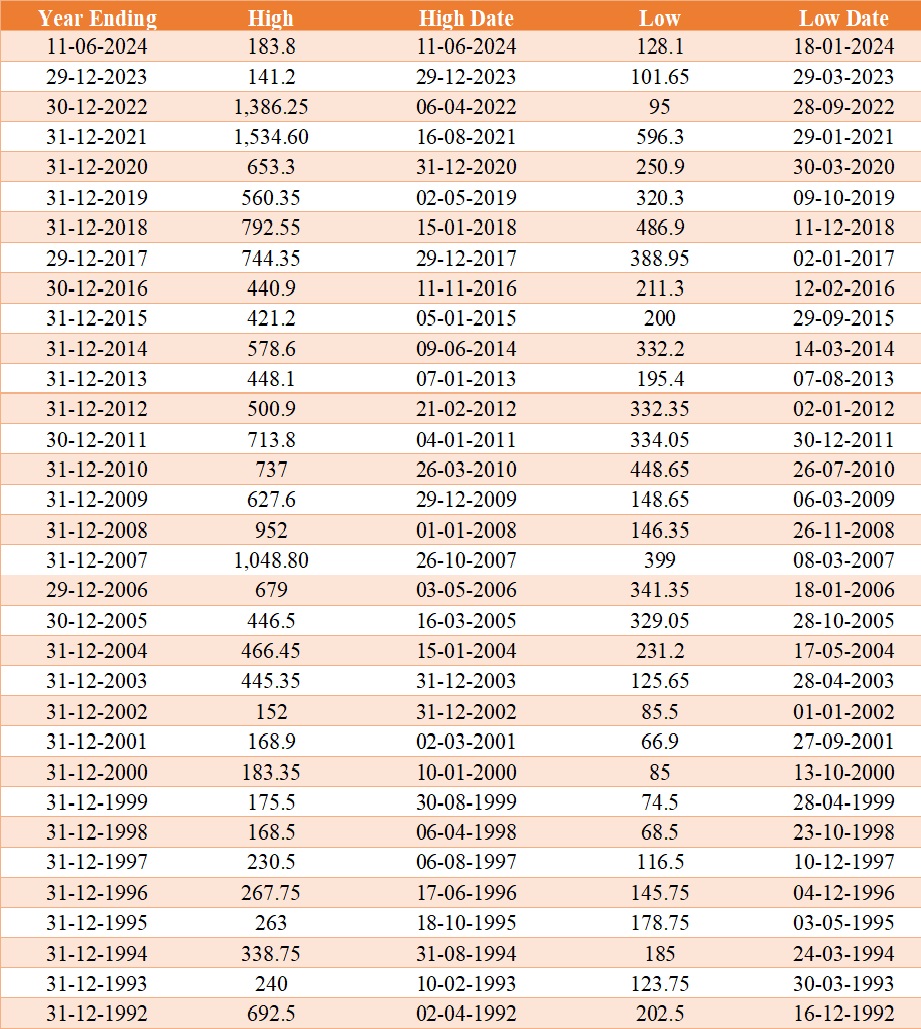

The steel industry is cyclical, reflected in the fluctuating returns of Tata Steel Ltd.'s shares. Let's explore the historical share price of Tata Steel to understand the journey it has offered its investors.

Tata Steel Stock Split of Equity Shares

On May 3, 2022, Tata Steel's Board of Directors proposed a stock split to enhance market liquidity and make shares more accessible to small investors. The proposal, approved by shareholders on June 28, 2022, involves subdividing each ₹10 equity share into ten ₹1 equity shares. The ex-date for this subdivision is July 28, 2022, and the new shares will begin trading on this date. Tata Steel, a globally diversified steel producer with an annual crude steel capacity of 34 million tonnes and a consolidated turnover of $32.83 billion in FY 2022, aims to broaden its shareholder base through this initiative.

The Amalgamation of Strategic Businesses into Tata Steel

In September 2022, Tata Steel announced its plan to amalgamate nine strategic businesses as part of its long-term strategy to simplify its business portfolio. To date, the company has successfully merged five of these businesses, including Tata Steel Mining Limited, Tata Steel Long Products Limited, S&T Mining Company Limited, The Tinplate Company of India Limited, and Tata Metaliks Limited, achieving a combined annual turnover of approximately ₹19,700 crore in FY23. This consolidation aims to enhance downstream operations, leverage Tata Steel’s extensive marketing and sales network, and drive synergies through improved raw material security, centralized procurement, optimized inventories, reduced logistics costs, and better facility utilization. The merger process for Bhubaneswar Power Private Limited, Angul Energy Limited, and The Indian Steel and Wire Products Limited is in advanced stages and expected to be completed by Q1FY25. However, the merger with TRF Ltd. will not proceed, although Tata Steel continues to support TRF's business performance turnaround. Tata Steel remains committed to its portfolio simplification journey and will seek further opportunities in the future.

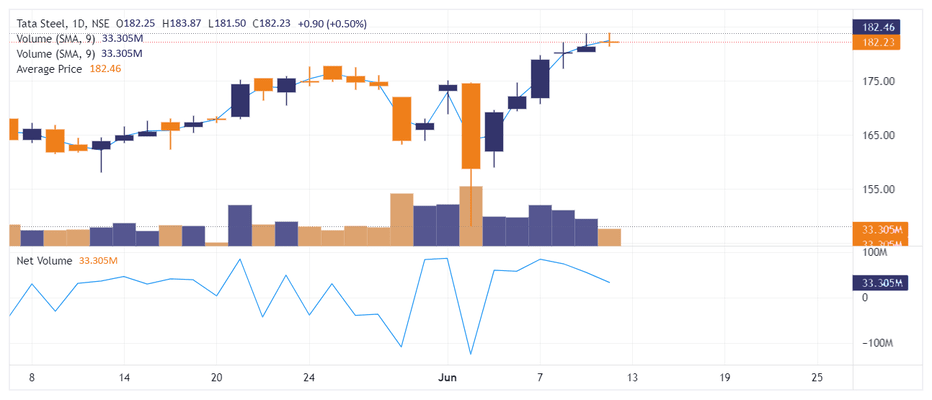

The Recent Performance of Tata Steel

Over the past 26 trading days, Tata Steel's stock value has risen by ₹12.68, marking a 7.57% increase. On May 6, 2024, a single share was valued at ₹167.60, and by June 10, 2024, the price had climbed to ₹180.28. During this period, the stock reached a high of ₹182.10 and a low of ₹148.14.

The following image displays a line chart of Tata Steel's daily closing prices [8th May-12th June], allowing you to visualize the day-by-day price fluctuations.

Tata Steel Share Price History

Â

Source: https://www.tatasteel.com/investors/investor-information/share-prices-charts/

Â

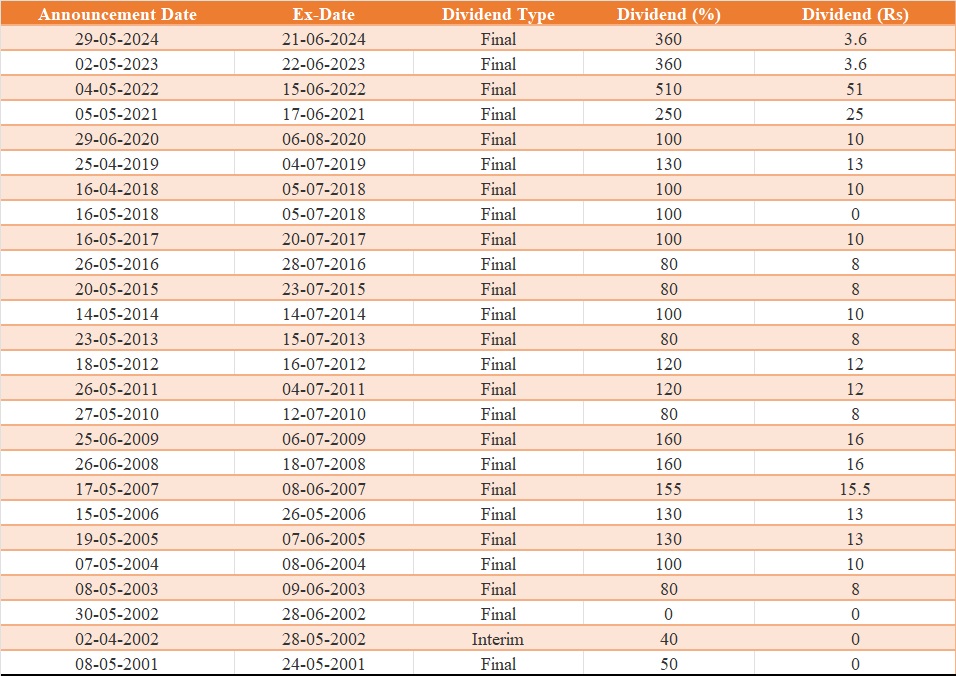

Dividend Summary

For the fiscal year ending March 2024, Tata Steel announced a dividend payout of 360.00%, totaling Rs 3.6 per share. At the current share price of Rs 181.35 this results in a dividend yield of 1.99%.

The company has a strong history of dividend payouts, consistently declaring dividends for the past 5 years.

Â

Source: https://www.moneycontrol.com/company-facts/tatasteel/dividends/TIS

What does the Investor Education and Protection Fund (IEPF) Authority entail?

The Investor Education and Protection Fund (IEPF) Authority is a statutory entity created by the Indian government under the Companies Act, 2013. Its primary mission is to safeguard investors' interests and promote investor education. The Ministry of Corporate Affairs oversees the fund, which is utilized to compensate investors who have lost their investments due to unclaimed dividends or shares.

How to Claim Your Shares from the IEPF Authority

Before understanding the process of recovering your lost shares of Tata Steel Limited, it is crucial to understand the eligibility criteria for claiming shares from the IEPF Authority. According to the IEPF rules, the following categories of shareholders are eligible to claim their shares:

- Shareholders who have not claimed their dividends for 7 consecutive years.

- Shareholders who have not exercised their voting rights for seven consecutive years.

- Shareholders whose unclaimed shares have been transferred to the IEPF Authority after being declared unclaimed or abandoned by the company.

- Legal heirs or successors of deceased shareholders.

If you meet any of these criteria, you can proceed with the necessary steps to search and recover your lost shares of Tata Steel Limited from the IEPF Authority.

Step-by-Step Guide to Recover Your Tata Steel Limited Shares from IEPF Authority

Step 1: Gather the Necessary Documents

To recover your lost shares of Tata Steel Limited from the IEPF Authority, you will need to prepare and submit several documents, including:

1. A copy of your PAN card

2. A copy of your Aadhaar card

3. A canceled cheque leaf or a bank statement

4. Proof of ownership of the shares (such as a share certificate or demat statement)

5. Any other documents as required by the IEPF Authority

Ensure that you have all these documents ready before proceeding to the next step.

Step 2: File an Online Application

Next, you need to file an online application on the IEPF website (www.iepf.gov.in). The process is straightforward; you'll need to provide personal details such as your name, address, and contact information, as well as specifics about the shares you wish to recover.

Upon submission, you will receive an acknowledgment receipt with a unique IEPF claim ID. Keep this receipt safe for all future correspondence with the IEPF Authority.

Step 3: Verification of Your IEPF Claim

After filing your online application, the IEPF Authority will begin verifying your claim. This verification process may take some time as they need to ensure that all submitted documents are accurate and that you are eligible to reclaim your lost shares.

Step 4: Publication of the List of Shareholders

Post verification, the IEPF Authority will publish a list of shareholders whose shares or dividends have been transferred to the fund. You can check this list on the IEPF website to confirm that your shares have indeed been transferred.

Step 5: Filing of Indemnity Bond

If your name appears on the list, you must then file an indemnity bond with the IEPF Authority. This bond is a legal document stating that you will indemnify the IEPF Authority against any future claims related to the lost shares. The bond must be signed by you and two witnesses and then notarized.

Step 6: Verification of the Indemnity Bond

Once submitted, the IEPF Authority will verify the indemnity bond. If the bond meets all necessary requirements, the IEPF Authority will proceed with the process of transferring the shares back to you.

Step 7: Transfer of Shares

After the indemnity bond is verified, the IEPF Authority will transfer the shares back to you. Depending on how you originally held the shares, they can be transferred in dematerialized form. You will receive a confirmation letter from the IEPF Authority once the shares have been successfully transferred to you.

Conclusion

Recovering your lost shares of Tata Steel Limited from the IEPF Authority requires patience and diligence, but it's crucial to safeguard your investments and secure the benefits you deserve. By meticulously following the outlined steps, you can efficiently reclaim your unclaimed shares and obtain the refunds owed to you. Remember, while the process may entail some waiting time and thorough document preparation, staying organized and persistent is key. Share Samadhan, India's Largest Unclaimed Investments Retrieval Advisory, can offer expert assistance for support and guidance throughout the lost share recovery process. Our specialized services can streamline the retrieval process and provide invaluable insights to ensure a smooth reclaiming experience. Don't hesitate to reach out to Share Samadhan for any queries or concerns you may have regarding your lost shares recovery journey.

.jpg)