- Sign In

- 8800 33 2200

- samadhan@sharesamadhan.com

- Sharesamadhan App

- Sharesamadhan App

Blog Details

Recovering Lost ITC Shares from IEPF: A Guide to Transforming Investor Wealth

Imagine owning just 100 shares of a company and earning over ₹1 crore in dividends! It sounds unbelievable, but ITC Limited has made this possible for its long-term investors. If your father or grandfather had purchased 100 shares of ITC during its IPO, reclaiming those shares from the Investor Education and Protection Fund (IEPF) today could make you a multimillionaire. Intrigued? In this blog, we'll explore the historical performance of ITC's share prices and explain how to claim IEPF shares so that it can lead to significant financial gains for investors.

ITC Historical Timeline

- 1910: ITC was founded on August 24th as a Private Limited Company under the name Imperial Tobacco Co. of India Ltd.

- 1953: Acquired the manufacturing business of Tobacco Manufacturers (India) Ltd.

- 1954: Converted to a Public Limited Company on October 27th.

- 1970: Renamed from Imperial Tobacco Co. of India Ltd. to India Tobacco Co. Ltd. in May.

- 1972: Entered the hotel industry in October.

- 1973: Received government approval for setting up three processing plants.

- 1974: Changed name to ITC Ltd on April 1st.

- 1975: Acquired the net assets in India of the India Leaf Tobacco Development Co. Ltd.

- 1979: Rebranded the hotel chain from "Welcome Hotels" to "Welcomgroup".

- 1983: Incorporated Gujarat Hotels under a joint agreement with Gujarat Industrial Investment Corporation, establishing a 144-room hotel in Vadodara called Welcome Group Vadodara.

- 1986: Signed a joint venture agreement with MP Audyogik Vikas Nigam to establish four hotels over five years.

- 1987: Launched new cigarette brands - Wills Flake Premium Filter and Scissors Filter, and leased Nedovs Hotel, Srinagar.

- 1988: Introduced oilseeds under the "ADARSH" brand and cooking oil under the "SUNDROP" brand.

- 1990: Launched refined mustard oil under the brand "REAL GOLD".

- 1993: Successfully introduced Hero and Classic Milds brand cigarettes.

- 1995: Introduced Capstan Menthol Filter, Capstan Standard, and Bristo Standard, redesigned Gold Flake Kings and Berkley Filter, and tested Gold Flake Lights in Kingsize.

- 1996: Launched Classic Ultra Milds and Wills Natural Lights cigarette brands.

- 1997: ITC Classic Finance Ltd. entered an agreement with ICICI Ltd.

- 1998: ITC had approximately 105 subsidiaries across various operations.

- 2000: Established the Lifestyle Retailing Business Division and launched Wills Sport, a premium wear brand for men and women.

- 2003: Launched Spriha brand of natural incense sticks (Agarbathis) on February 21st and introduced 'Aashirvaad' salt on April 4th. Also launched a new brand of agarbattis.

- 2008: Introduced eco-friendly "Paperkraft Premium Business Paper".

- 2010: Entered the Rs. 1,700-crore fairness cream market and the cigar business in India.

- 2011: Chairman Mr. Y C Deveshwar received the Padma Bhushan. Launched Classmate Notebooks and John Players.

- 2012: Introduced Vivel, a skin-nourishing range of soaps.

- 2014: Replaced TCS as India's most admired company and entered the e-cigarette market. ITC Hotels initiated a significant foreign investment in Colombo.

- 2017: Contributed to the Swachh Bharat initiative.

- 2022: Reported a Gross Sales Value of ₹90,104 crores and Net Profit of ₹15,058 crores on March 31st, positioning ITC as one of India's most profitable FMCG companies.

Source: https://groww.in/blog/history-of-itc-group

ITC Share Price Graph from the Beginning:

Source: https://www.moneycontrol.com/india/stockpricequote/diversified/itc/ITC

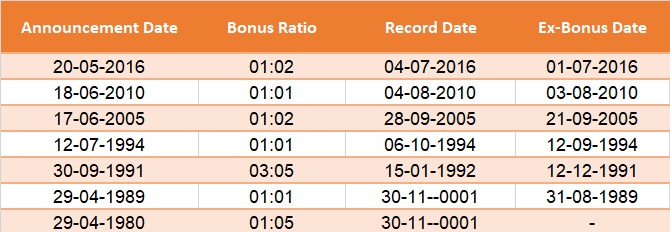

Bonus History:

Source: https://www.moneycontrol.com/company-facts/itc/bonus/ITC

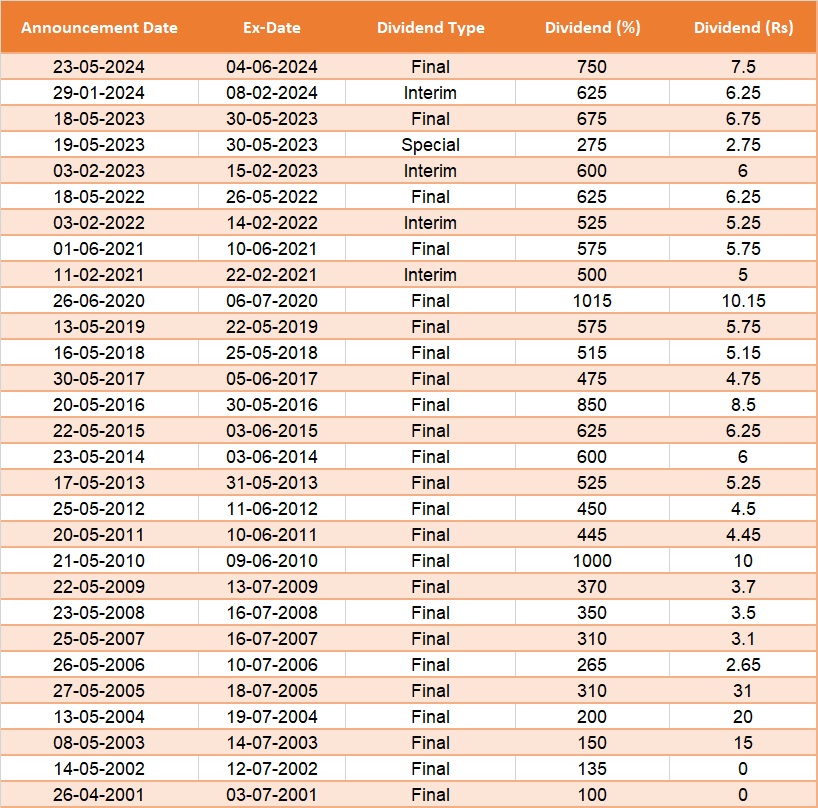

Dividend History:

Source: https://www.moneycontrol.com/company-facts/itc/dividends/ITC

About IEPF:

The Government of India established the Investor Education and Protection Fund (IEPF) to address the growing issue of investors forgetting their shareholdings in various companies. Launched to safeguard investors' interests and enhance awareness, the unclaimed dividends and lost shares get transferred to the IEPF. IEPF handles them on behalf of rightful shareholders. Often, dividends remain unclaimed for years simply because shareholders forget they own the shares. Several factors contribute to this oversight:

- No Nominee: Many investors neglect to appoint a nominee or heir to manage their shares after their death, leaving heirs unaware of the shares' existence.

- Small Investments: Minor investments are easily overlooked by investors.

- Property Disputes: Shares can become entangled in court proceedings over property disputes, rendering them ownerless until a verdict is reached.

Other reasons also contribute to investors forgetting about their shareholdings, leading to numerous companies holding unclaimed shares.

Prior to the IEPF, companies had to transfer unclaimed dividends and shares to government funds, which the government then used for public welfare and development projects. However, as the issue of forgotten shareholdings escalated, it became clear that this was resulting in significant financial losses for investors. In response, the Government launched the IEPF, providing a centralized solution where shareholders can claim their dividends and recover long-forgotten shares. This initiative prioritizes the interests of investors, ensuring the protection of their funds and increasing awareness.

The IEPF manages unclaimed dividends and lost shares for up to seven years, during which investors can reclaim their assets by applying to the fund's managing authority. The platform offers a streamlined process, allowing shareholders to claim dividends and shares from multiple companies in one place, eliminating the need to contact each company individually. This efficiency is why the IEPF is considered a comprehensive solution for investors.

Regulations Governing the IEPF

The operation of the Investor Education and Protection Fund (IEPF) is regulated by the Companies Act, 2013, along with the Investor Education and Protection Fund Authority (Accounting, Audit, Transfer and Refund) Rules, 2016. When a company declares a dividend on its shares, shareholders have 30 days to claim it. If the dividend remains unclaimed after this period, the company is required to transfer the unclaimed dividend to a special account known as the ‘Unpaid Dividend Account’.

Subsequently, within 90 days, the company must publish a list of shareholders with unclaimed dividends on its website. Additionally, the company may use other communication methods to inform shareholders about their unclaimed dividends. Shareholders wishing to retrieve their unclaimed dividends from the ‘Unpaid Dividend Account’ must apply to the company's transfer agent. However, if a shareholder does not claim the dividend for seven years, the company will transfer the unclaimed dividend to the IEPF Account. The shares on which the dividend was declared are also transferred to the IEPF, as they are deemed forgotten. Therefore, if the dividends are unclaimed for seven years, both the dividends and the associated shares are transferred to the IEPF Account.

Provisions of the Investor Education and Protection Fund (IEPF):

Transfer of Dividend:

According to the Investor Education and Protection Fund Authority Rules, 2017 issued by the Ministry of Corporate Affairs (MCA), any money transferred to a company’s Unpaid Dividend Account that remains unpaid or unclaimed for seven years (7 years and 37 days from the date of dividend declaration) must be transferred by the company to the IEPF, along with any accrued interest. The MCA updated these rules with the Second Amendment Rules on 14th August 2019, which took effect on 20th September 2019.

Additionally, all shares for which dividends have not been paid or claimed for seven consecutive years or more must also be transferred by the company to the IEPF. Over the years, many forgotten investments have resulted in the transfer of unclaimed shares to the IEPF. For individuals, the primary concern is how to reclaim their shares from the IEPF.

Process for Reclaiming Lost Shares through IEPF Services:

If you have unclaimed dividends and shares transferred to the IEPF, you can file a claim to get a refund. Here’s how to do it:

Step 1: Application by Claimant to Authority

To initiate the refund process, the claimant needs to apply to the MCA using the e-form IEPF-5. The form requires the following details:

- Applicant and company information

- Details of shares and amount claimed

- Year-by-year details of deposits/securities

- Identity proof (Identity card, Aadhaar Number, Passport, OCI, or PIO Card No.)

- Bank account details linked to Aadhaar

Â

Note: You can download the form from the IEPF Services website at http://www.iepf.gov.in/

Step 2: Sending Documents to the Company

After submitting the e-form IEPF-5 online, the investor must send all required documents, along with necessary attachments, to the designated Nodal Officer (for IEPF services) at the company’s registered office to start the verification process.

Step 3: Appointment of Nodal Officer and Company Compliance

Every company that has transferred shares to the IEPF must appoint a Nodal Officer to handle the claims verification process. This officer should be a Director, Company Secretary, or Chief Financial Officer of the company. The Nodal Officer will verify claims and coordinate with the IEPF Authority. Companies can appoint multiple Nodal Officers to manage various claims.

Step 4: Verification Details Sent by Company to Authority

The company’s Nodal Officer must send a verification report to the IEPF Authority within 30 days of receiving the claim form, using the format specified by the Authority, along with all documents submitted by the claimant.

Step 5: Authority Approval or Disapproval

The IEPF Authority will verify the documents and decide whether to approve or reject the claim. If approved, the Authority will issue an order to transfer the claimed amount to the claimant’s bank or Demat account. The Authority is required to process the application within 60 days of receiving the verification report from the Nodal Officer.

Why Should You Opt for Legal Help

The process of unclaimed dividends and lost shares recovery is complex and requires meticulous attention to detail. A legal expert can handle all the formalities and paperwork necessary for filing a refund application, leveraging their expertise to ensure everything is completed accurately. Mistakes in the application can lead to immediate rejection by the IEPF authority, necessitating the entire process to be repeated. By hiring a legal professional, you can avoid this tedious task and ensure your application proceeds smoothly. A lawyer will manage everything from contacting the nodal officer to gathering the required information for the application.

Legal assistance is especially crucial if your shares are entangled in a family dispute. Often, shareholders pass away without naming a nominee or including shares in their will, leading to multiple family members claiming rights to the deceased’s property, such as ITC shares. Without legal expertise, you risk losing out on valuable assets as others may exploit the situation. A skilled lawyer can understand the legal complexities, protect you from potential pitfalls, and secure the best possible outcome.

In addition, Share Samadhan, India's largest unclaimed investment retrieval advisory, can provide invaluable support. Their extensive experience in managing unclaimed investments can simplify the retrieval process and maximize your chances of successfully reclaiming your assets.

India's largest & most trusted platform for recovery of unclaimed investments

Submit Your Query

Recent Posts

- Lost Your Bajaj Auto Limited Shares? A Guide To Lost Share Recovery!

- Recover Your Godrej Consumer Products Shares from IEPF – A Complete Guide

- Lost PGCIL Shares to IEPF? Here’s a Step-by-Step Recovery Guide with Share Samadhan

- How to Recover Unclaimed HDFC Life Shares from IEPF

- Recover Lost Shares of DLF Limited from IEPF

- Have You Lost Your Tech Mahindra Shares? A Guide To Lost Share Recovery!