- Sign In

- 8800 33 2200

- samadhan@sharesamadhan.com

- Sharesamadhan App

- Sharesamadhan App

Blog Details

Recover Unclaimed Shares of Kotak Mahindra from IEPF

Before diving into the process of claiming unclaimed shares and dividends from the Investor Education and Protection Fund (IEPF) for Kotak Mahindra Bank Ltd, let's understand why this is significant. Since its listing on the stock exchanges, Kotak Mahindra Bank Ltd has consistently been a top performer in the stock market. Back in the year 2000, the price per share was approximately Rs. 5. As of November 7, 2022, the price per share has soared to Rs. 1884, without accounting for any bonuses or stock splits.

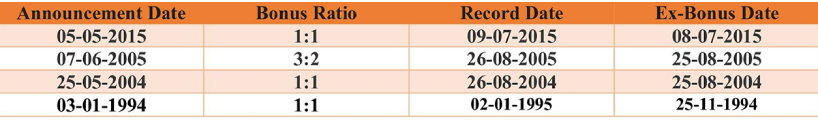

Bonus History (Kotak Mahindra Bank)

Imagine you bought 150 shares of Kotak Mahindra Bank Ltd in 2000 at Rs. 5 per share.

Total Investment = 150 shares Rs. 5 = Rs. 750

Here's how your investment would have grown over the years:

- Bonus Shares on August 25, 2004, at a ratio of 1:1

- Number of Shares post Bonus = 300 - Bonus Shares on August 25, 2005, at a ratio of 3:2

- Number of Shares post Bonus = 750 - Stock Split on September 13, 2010, at a ratio of 2:1

- Number of Shares post Split = 1500 - Bonus Shares on July 8, 2015, at a ratio of 1:1

- Number of Shares post Bonus = 3000

So, if you originally purchased 150 shares in the year 2000, you would now own 3000 shares after accounting for all the bonuses and stock splits.

Given the current market price of Rs. 1884 per share (as of November 7, 2022):

Total Value of Investment Now = 3000 shares Rs. 1884 = Rs. 56,52,000 (approximately Rs. 56.5 lakhs)

An initial investment in 150 shares of Kotak Mahindra Bank Ltd in 2000 would now be worth around Rs. 56.5 lakhs. If your unclaimed shares have been transferred to the IEPF, you could be missing out on a significant net worth including bonus shares and dividends. Considering this substantial amount, it's imperative to reclaim your unclaimed shares and dividends of Kotak Mahindra Bank Ltd. from IEPF.

Kotak Mahindra’s Rapid Expansion

An investment of 1 lakh in 1985 is today worth Rs. 1,400 crore, highlighting the Kotak Mahindra Group's rapid expansion over the past three decades. Today, the Kotak Mahindra Group stands as a leading financial services company in India. "An investment of Rs. 1 lakh in the Kotak Group in November 1985 is now worth Rs. 1,400 crore, representing a compounded growth rate of 40% over the past 32 years," Uday Kotak, executive vice-chairman and managing director of Kotak Mahindra Bank, stated recently while launching the bank's new '811' savings account scheme.

Kotak Capital Management Finance Limited, the precursor to the Kotak Mahindra group, was established in 1985 by Uday Kotak, Sidney A. A. Pinto, and Kotak & Firm. Industrialist Anand Mahindra, an early supporter, recently remarked that his investment in the Kotak Group was one of his best decisions. In 1986, industrialists Harish Mahindra and Anand Mahindra acquired a stake in the company, leading to its renaming as Kotak Mahindra Finance Limited. In 2003, Kotak Mahindra Finance transitioned into a commercial bank.

"Within less than three decades, Kotak Mahindra has grown from a small startup to one of the world's largest and most respected corporations," the company asserts.

Industry analysts note that "a thousand rupee investment in Kotak Mahindra shares in 1985 is worth crores in 2021."

What do these figures signify for the average investor? The primary takeaway is that someone who invested in stocks in 1984 could have become extraordinarily wealthy. This underscores the significance of recovering unclaimed shares. Newly revealed statistics from Kotak Mahindra indicate that it has the highest amount of unclaimed shares or unclaimed dividends among Indian companies.

What is the Source of Unclaimed Dividends?

Investors often diversify their portfolios by investing in various companies to minimize the risk of losing money. While this strategy can be beneficial, people sometimes forget about their small investments and fail to recognize their potential benefits. As a result, purchased shares may remain inactive for years without being claimed. When elderly investors buy stock, they may neglect to designate an heir for the shares before their demise. This can lead to businesses having unclaimed dividends or shares.

IEPF Unclaimed Dividend

Any individual whose unclaimed or underpaid money has been transferred by a company to the IEPF authorities can reclaim their reimbursements.

Transmission of Physical Shares

Upon a shareholder's death, there is an option to transfer shares to the heir. When a shareholder dies, their rights to the shares pass to the person who inherits them under the will or through intestate succession. The rights of the deceased shareholder are managed by the executors (if a will exists) or the estate administrators if the shareholder died intestate.

It is crucial to keep share certificate information readily available. If an investor does not have the certificate, they can apply for duplicate shares in accordance with legal regulations.

This ensures that shares and dividends are not left unclaimed and that rightful heirs or claimants can secure the benefits.

The Status of Kotak Mahindra’s Unclaimed Shares

Kotak Mahindra, one of India's largest firms, has the highest amount of unclaimed dividends according to a recent MCA study. As of 2015, Kotak Mahindra had nearly 60 crores in unclaimed dividends from investors. The company’s website provides all the necessary information on unclaimed dividends and has actively encouraged investors to claim their dividends and recover shares or refunds before the funds are transferred to the IEPF. Shareholders can find information about their unclaimed dividends at the following link:

https://www.kotak.com/en/investor-relations/investor-information.html

To understand the current value of Kotak Mahindra shares bought long ago, consider the following data:

- The market capitalization of Kotak Mahindra has increased 5000-fold from 1985 to 2021.

- The Bank’s Profit After Tax (PAT) for Q4FY21 increased to 1,682 crores from 1,267 crores in Q4FY20, a 33% rise. For FY21, it increased to 6,965 crores from 5,947 crores in FY20, up 17%.

Owning a Kotak Mahindra share from the 1980s would be one of the most profitable investments ever. Therefore, reclaiming Kotak Mahindra shares is a profitable endeavor. Considering the potential revenue from unclaimed dividends, spending a small sum to recover lost shares is worthwhile. Legal assistance is often necessary to recover these shares, especially if the original investor has passed away and the family is trying to claim the shares. Legal professionals can help resolve claims among family members and file claims with the IEPF.

Dematerialisation (Demat)

If you wish to access Dematerialisation (Demat), you can convert your physical share certificates into electronic format stored in an account with a Depository Participant. This process enables you to obtain a Kotak Mahindra share certificate electronically.

Those who own physical shares of Kotak Mahindra can choose to transfer or liquidate their holdings using this method.

Why Have Your Unclaimed Shares of Kotak Mahindra Bank Ltd Been Transferred to IEPF?

According to government regulations, dividends on shares that remain unclaimed for 7 or more consecutive years must be transferred to the Investor Education and Protection Fund (IEPF) by the respective company. The transfer of shares to IEPF becomes mandatory if dividends are unclaimed for this period. In the past, if investors failed to claim their dividends, companies could take advantage of their unawareness and keep the money. To address this issue, the government established the IEPF, requiring companies to transfer unclaimed shares after 7 years.

What is IEPF and its Purpose?

The Investor Education and Protection Fund (IEPF) was introduced by the Government of India on September 7, 2016, under the provisions of Section 125 of the Companies Act, 2013. The IEPF serves as a regulatory framework aimed at protecting and managing investors' funds.

The responsibilities of IEPF include:

- Making refunds and recovering shares:

Handling unclaimed shares, matured deposits/debentures, and unpaid dividends. - Promoting investor awareness:

Educating investors about their rights and investment procedures. - Reimbursing legal expenses: Covering legal costs incurred by depositors in pursuing action suits.

By establishing the IEPF, the government ensures that unclaimed funds are managed responsibly and that investors are protected and informed.

How to Find Unclaimed Shares & Making a Claim Through the IEPF

Previously, unclaimed investments were transferred to the government for public use according to government policy. However, the government eventually decided to create an unclaimed dividend fund where companies' lost or unclaimed shares could be placed. This allows heirs or anyone rediscovering an old investment to report it to the fund’s management authority to recover their lost money and shares. The Government of India established the Investor Education and Protection Fund (IEPF) with this purpose in mind.

Provisions of the Investor Education and Protection Fund

The Ministry of Corporate Affairs published the regulations for the Investor Education and Protection Fund in 2017. According to these rules, any money left in a company's unpaid dividend account for 7 years without a claimant must be transferred to the IEPF, along with any accrued interest. Claimants can recover their transferred funds by filing an application with the IEPF. This makes the IEPF a central resource for investors seeking to reclaim lost shares. It simplifies the process of requesting refunds for lost shares and allows investors to recover their long-forgotten investments.

Required Documents for Claiming Lost Shares

In the case of lost shares, you should provide the following documents to the company or registrars:

- Affidavit

- Indemnity and surety bond

- Original copy of the FIR for the loss of share certificates

- Copy of the advertisement announcing the loss in the government gazette publication

How to Recover Kotak Mahindra’s Unclaimed Shares or Dividends Transferred to the IEPF

The following steps outline the basic principles that an average investor can use to request a refund of shares from the IEPF:

- Identify Unclaimed Shares: Check the Kotak Mahindra website or contact the company to confirm if your shares have been transferred to the IEPF.

- Gather Required Documents: Prepare the necessary documents, including an affidavit, indemnity, and surety bond, FIR copy, and advertisement publication.

- File an Application: Submit an application with the IEPF authority, including all required documents and details of your unclaimed shares or dividends.

- Follow-up: Stay in contact with the IEPF authority and the company's registrar to ensure your claim is processed.

By following these steps, you can recover your unclaimed shares and dividends from Kotak Mahindra that were transferred to the IEPF.

Procedure for Claiming Dividends and Shares of Kotak Mahindra Bank Ltd from IEPF Authority

IEPF stands for Investor Education and Protection Fund. To claim dividends and shares from IEPF, follow these steps:

- Access the IEPF-5 Form: - Visit the IEPF website and access the IEPF-5 form on the MCA portal. - Carefully read the instructions provided in the instruction kit on the IEPF website.

- Complete and Submit the Form: - Fill out the IEPF-5 form with the required details. - Submit the completed form online. - After submission, you will receive an acknowledgment with a "Submit Request Number" (SRN). Keep this SRN for future tracking of your form.

- Print and Gather Documents: - Print the submitted form along with the acknowledgment. - Prepare the original copy of the indemnity bond, a copy of the acknowledgment, the share certificate, and the IEPF Form 5. - Include a self-attested copy of your Aadhaar card, bank account details linked with the Aadhaar card for receiving the claim, and your Demat account number.

- Submit Documents to the Nodal Officer: - Send all the above documents to the Nodal Officer (IEPF) of Kotak Mahindra Bank at its registered office. - Label the envelope with "Claim for Refund from IEPF Authority."

- Verification and Forwarding: - The Nodal Officer will verify your claim form. - Upon verification, the Nodal Officer will submit the claim to the IEPF Authority. - Based on the verification report, the IEPF authority will process the refund of unclaimed shares and dividends to your client account.

- IEPF Authority Response: - The IEPF authority is required to respond to the verification report sent by the company within 60 days.

The process of claiming a refund from IEPF can be lengthy and may take more than 8-12 months. By following these steps, you can claim your unclaimed dividends and shares of Kotak Mahindra Bank Ltd from the IEPF authority. If you don’t want to take all this headache and want your shares and dividends to be recovered smoothly, get in touch with a professional team.

Ensure Complete Applications

It is crucial not to submit an incomplete application. If the verifying authority finds that your application is missing information or requires additional documents, they will notify you via email, detailing the issues and requesting the necessary documents. You must then provide the corrected or additional documents within 15 days of receiving the notification. Failure to submit the documents on time may result in your claim application being rejected. All required documents must be sent to the verifying nodal officer of the company within the specified 15-day period.

The Value of Kotak Mahindra Shares and the Claim Process

Understanding the entire process of recovering unclaimed money or dividends from a company is essential. Kotak Mahindra's stock has significantly appreciated over the past few decades. Therefore, claiming shares that have been lost or unclaimed for a long time can yield a substantial value today, akin to discovering a hidden treasure on ancestral land.

However, recovering these funds and retrieving shares involves submitting the required evidence and adhering to all the specified procedures. A practical solution to this time-consuming task is to hire a law firm to handle the documentation and filing on your behalf. These firms can guide you through the entire process, making the recovery of shares much easier.

If you have concerns or questions about recovering or transferring shares, it is advisable to consult Share Samadhan, a reputable legal firm with experts who can assist you in reclaiming your unclaimed shares and dividends from IEPF. Don't delay; seek professional help to ensure a smooth recovery process for your valuable shares.

India's largest & most trusted platform for recovery of unclaimed investments

Submit Your Query

Recent Posts

- Recover Your Godrej Consumer Products Shares from IEPF – A Complete Guide

- Lost PGCIL Shares to IEPF? Here’s a Step-by-Step Recovery Guide with Share Samadhan

- How to Recover Unclaimed HDFC Life Shares from IEPF

- Recover Lost Shares of DLF Limited from IEPF

- Have You Lost Your Tech Mahindra Shares? A Guide To Lost Share Recovery!

- IEPF Recovery & Transmission: How To Claim Eicher Motors Shares Of A Deceased Relative?