- Sign In

- 8800 33 2200

- samadhan@sharesamadhan.com

- Sharesamadhan App

- Sharesamadhan App

Blog Details

Lost Vedanta Shares? Here’s How You Can Get Them Back

Vedanta Limited is a leading multinational iron ore company headquartered in Mumbai, India. The company primarily invests in copper, zinc, and aluminium businesses. Although Indian at its core, Vedanta has operations in countries like Australia and Zambia. It is also a part of the FTSE 100 index with an office in London, UK, and was the first Indian company to be listed on the London Stock Exchange.

Vedanta Limited’s vision is to lead with clarity and commitment. With a mission to be a million-ton-per-annum producer, the company aims to become a global leader in non-ferrous metals and mining, creating immense value for India.

Vedanta Resources is also the only manufacturing company among four Indian firms to have received the Recognition of Commitment Award from the Institute of Internal Auditors, USA, in 2005. It has also received several environmental and safety accolades.

As a company with a diverse portfolio and consistent shareholder returns, Vedanta focuses on growth at competitive pricing.

Vedanta’s Chairman, Mr. Anil Agrawal, emphasized, “India is a fast-emerging and attractive resource destination. Our strategy will harness India’s mineral wealth cost-effectively and place the country firmly on the global metals and mining map.”

The Rise of Vedanta Limited

In 2007, Vedanta Resources (now Vedanta Ltd.) acquired a 51% stake in Sesa Goa Ltd. from Mitsui & Co. Ltd. for ₹40.7 billion (US$510 million)—one of India’s largest M&A deals. In 2009, Sesa Goa acquired Dempo Group’s mining and maritime businesses for ₹17.5 billion, gaining access to 70 million tons of mineable iron ore resources in Goa.

In 2010, Vedanta acquired zinc assets from Anglo American plc, and in 2011, it secured a 58.5% controlling stake in Cairn India.

By 2015, Sterlite Industries and Sesa Goa merged under the new name Vedanta Limited, transforming the company into a global natural resources giant.

Vedanta’s Operations

From its origins in Goa and Karnataka, Vedanta expanded across India—Odisha, Rajasthan, Chhattisgarh, Tamil Nadu, Punjab, Gujarat, and Andhra Pradesh.

Key operating segments include:

- BALCO (Bharat Aluminium Company), Korba – a pioneer in aluminium for both civilian and defense use.

- Hindustan Zinc Limited (HZL) – Vedanta holds a 64.9% stake and manages this Udaipur-based company.

- Sterlite Copper – Focuses on copper cathodes and cast rods.

- Twin Star – Offshore holding firm based in Mauritius.

- Cairn India – Oversees oil and gas operations in India, Sri Lanka, and South Africa.

- Sesa Goa Mines – Iron ore operations in Goa and Karnataka.

Products Produced by Vedanta Limited

- Copper – Largest smelter in India (Tuticorin)

- Zinc-Lead-Silver – Through HZL

- Oil and Gas – Cairn India contributes 25% of India’s oil output

- Iron Ore – India and Liberia-based operations

- Aluminium – Via BALCO with 345 ktpa smelter capacity

- Power – 3,900 MW commercial capacity

- Metallurgical Coke & Pig Iron – Used in domestic steel mills

Latest Venture

Vedanta and Foxconn have announced a $20 billion investment to establish India’s first semiconductor and display manufacturing hub in Gujarat. Vedanta holds 60% equity in this joint venture. The facility is expected to create over 100,000 jobs and make India self-sufficient in chip manufacturing.

Rs 12,500 Crores as Dividends to Shareholders

In 2022, Vedanta proposed distributing ₹12,500 crores from its general reserves to shareholders—₹33 to ₹35 per share—pending board approval.

Vedanta believes these reserves exceed its operational needs and aims to enhance shareholder value.

Vedanta Limited Share Analysis

Despite recent fluctuations, brokerage firms are optimistic, predicting up to a 20% rise in Vedanta shares. The company also won bids for coal mines in Odisha and remains one of the highest corporate tax contributors in India.

A recent correction due to its semiconductor venture led to a 9% drop in share prices, but analysts maintain a bullish view with a revised target price of ₹355 (up from ₹265).

Vedanta Limited Share Price Graph

Source: https://www.moneycontrol.com/india/stockpricequote/miningminerals/vedanta/SG

Source: https://www.moneycontrol.com/india/stockpricequote/miningminerals/vedanta/SG

Shareholding Pattern (Latest Quarter)

|

Category |

No. of Shares |

% Change QoQ |

|

Promoters |

7,77,10,49,847 |

+139.38% |

|

Pledge |

7,77,05,67,879 |

+199.98% |

|

FII |

1,95,54,30,810 |

+34.11% |

|

DII |

30,25,15,221 |

+5.64% |

|

MF |

23,45,39,721 |

+4.37% |

|

Others |

1,12,26,01,239 |

-179.13% |

Vedanta Share Recommendations

Brokerages suggest Vedanta stock as a "Strong Buy," considering its diversified portfolio, upcoming projects, and consistent dividends.

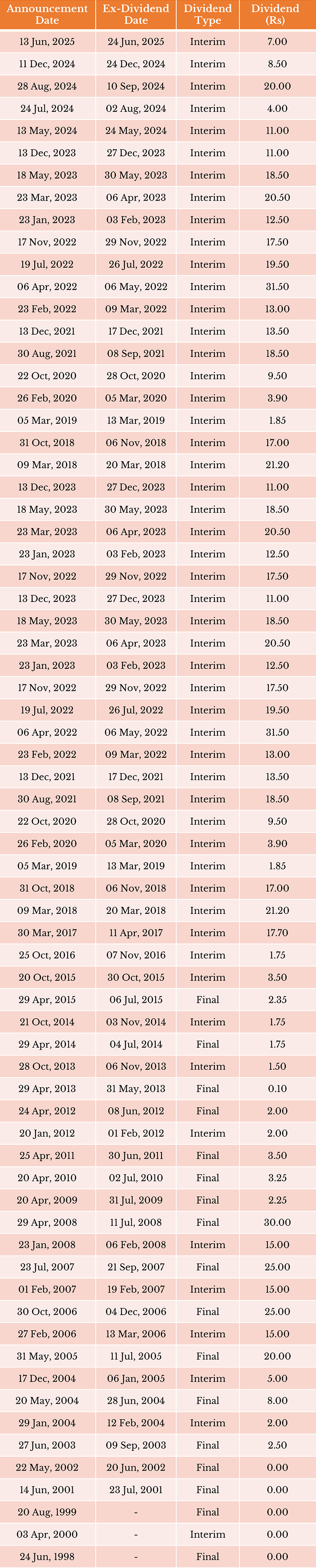

Dividend History of Vedanta Limited

Source: https://www.moneycontrol.com/company-facts/vedanta/dividends/SG/

Source: https://www.moneycontrol.com/company-facts/vedanta/dividends/SG/

Recover Shares of Vedanta Limited from IEPF

Many shareholders have lost access to their Vedanta shares due to unclaimed dividends and dormant accounts. Over time, such shares are transferred to the IEPF Authority.

This is where Share Samadhan steps in as India’s most trusted recovery partner.

Whether you’re an individual investor, legal heir, or NRI, Share Samadhan helps you reclaim your:

- Unclaimed dividends

- Transferred shares from IEPF

- Forgotten investments

Step-by-Step: How Share Samadhan Helps Recover Vedanta Shares

- Eligibility Check – Share Samadhan verifies your investor records.

- Document Preparation – They handle legal documentation, including indemnity bonds, affidavits, and KYC.

- Filing IEPF Form 5 – Accurate online submission through the MCA portal.

- Liaison with Company Nodal Officer – Share Samadhan communicates directly with Vedanta’s Nodal Officer.

- Track & Follow-up – Complete tracking and escalation until recovery.

Share Samadhan ensures end-to-end transparency and zero hidden fees.

Why Share Samadhan is Essential

- 18+ years of domain expertise

- 100% legal and compliant process

- 5000+ corporates & NRIs served

- Custom solutions for deceased/inherited claims

FAQs on Lost Shares of Vedanta Limited

Q1: How do shares get transferred to IEPF?

If dividends on your Vedanta shares remain unclaimed for seven consecutive years, both the unpaid dividends and the corresponding shares are transferred to the Investor Education and Protection Fund (IEPF), a government body established under the Companies Act. This is done as a safeguard to protect dormant investments and ensure proper record-keeping. Unfortunately, this means the original shareholder loses direct access until a formal claim is made. Share Samadhan specializes in helping investors retrieve their shares from IEPF by managing the entire legal and compliance process, saving time and reducing the stress of doing it alone.

Q2: Can legal heirs claim lost shares of a deceased holder?

Yes, legal heirs or nominees can recover Vedanta shares transferred to IEPF upon the shareholder’s death. However, this requires valid legal documentation such as a succession certificate, will, legal heir certificate, or probate order. If you’re unsure where to begin, Share Samadhan offers expert legal and documentation support tailored for such scenarios. We assist you with every step—from collecting old records to coordinating with registrars and the IEPF Authority—so that rightful heirs can regain access to long-forgotten or inherited assets without unnecessary delays or confusion.

Q3: What if I don’t have old share certificates or folio numbers?

Losing original share certificates or not knowing your folio number is not the end of the road. At Share Samadhan, we specialize in reconstructing your shareholding history through our back-office search services and liaison with company registrars. Even if the shares were physical and documents are lost, we can trace and validate your holdings using financial trails, old demat statements, dividend records, or other identifiers. Once located, we initiate the process to retrieve both the shares and any unpaid dividends, restoring your ownership through legally sound, SEBI-compliant channels.

Q4: Is it safe to recover Vedanta shares via Share Samadhan?

Yes, it is completely safe. Share Samadhan follows stringent legal and regulatory protocols governed by SEBI, MCA, and the IEPF Authority. All personal data, financial records, and documents you share with us are encrypted and stored securely. We do not share your details with third parties, and our recovery process includes regular updates, legal due diligence, and authorized coordination with registrars and official bodies. Our team includes expert CAs, CSs, and legal professionals who ensure that every case is handled with professionalism, accuracy, and confidentiality, so your legacy is recovered, protected, and passed on securely.

Q5: How long does the recovery process typically take?

Recovering Vedanta shares from IEPF is a detailed process that usually takes 8 months to 1.5 years, depending on case complexity. The timeline depends on factors like document availability, verification by the company’s RTA, approvals from the IEPF Authority, and legal heir validation (in case of inherited shares). Share Samadhan expedites this timeline by ensuring all paperwork is complete and accurate from the start. Our experience handling thousands of such cases allows us to foresee challenges and avoid delays. With us, you're not just waiting—you’re progressing.

Q6: I’ve found old Vedanta shares in my family papers—what now?

Finding old Vedanta share certificates can be exciting, but reclaiming their current value requires professional guidance. These shares may have undergone corporate restructuring, been dematerialized, or transferred to the IEPF if dividends were unclaimed. Share Samadhan conducts thorough due diligence—verifying your entitlement, tracing the shares across registrar databases, and checking if any action (like IEPF transfer) has occurred. Once the trail is confirmed, we handle the entire recovery process, including duplicate certificate issuance (if needed), name correction, and demat conversion. Don’t let valuable family wealth sit dormant—act today with Share Samadhan’s expert help.

Conclusion

Vedanta Limited’s expansive journey from iron ore mining to global semiconductor ambitions highlights its agility and vision. For shareholders, its consistent dividends and robust financials make it an attractive investment.

However, if you or your family have lost track of Vedanta shares or dividends, don’t let them remain idle in IEPF.

Connect with Share Samadhan today and reclaim your rightful wealth with the help of India’s most reliable IEPF recovery experts.

Visit www.sharesamadhan.com or call now to begin your recovery journey.

India's largest & most trusted platform for recovery of unclaimed investments

Submit Your Query

Recent Posts

- Lost Your Bajaj Auto Limited Shares? A Guide To Lost Share Recovery!

- Recover Your Godrej Consumer Products Shares from IEPF – A Complete Guide

- Lost PGCIL Shares to IEPF? Here’s a Step-by-Step Recovery Guide with Share Samadhan

- How to Recover Unclaimed HDFC Life Shares from IEPF

- Recover Lost Shares of DLF Limited from IEPF

- Have You Lost Your Tech Mahindra Shares? A Guide To Lost Share Recovery!