- Sign In

- 8800 33 2200

- samadhan@sharesamadhan.com

- Sharesamadhan App

- Sharesamadhan App

Blog Details

Claim Your Mahindra & Mahindra Limited Unclaimed Investments from the IEPF Authority

Mahindra & Mahindra Limited, an influential Indian multinational corporation headquartered in Mumbai, India, boasts a storied history beginning in 1945. Initially established as a steel trading firm, the company has since undergone significant growth and diversification. Today, Mahindra & Mahindra operates across multiple sectors including automotive, aerospace, agribusiness, and financial services. This article is all about the company's journey from its inception to its current status as a key player in both the Indian and global markets. In recent years, many investors have discovered that their Mahindra & Mahindra unclaimed shares and dividends have been transferred to the Investor Education and Protection Fund (IEPF). This situation often arises due to unawareness or oversight, but recovering these assets is crucial for securing your financial investments. Understanding the IEPF claim process, the procedure for the issue of duplicate share certificates, and the transfer of unclaimed shares and dividends to the IEPF is essential.

About The Company:

Before understanding the process of claiming unclaimed investments from the Investor Education and Protection Fund (IEPF) for Mahindra and Mahindra Limited, let's discuss why it's crucial to claim your shares and dividends. Since its listing on the stock exchanges, Mahindra and Mahindra Limited shares have been top performers in the stock market. In 2000, the share price was approximately Rs. 18, which has risen to Rs. 2896 as of June 24, 2024, excluding any bonus or share splits.

Imagine you purchased 100 shares of Mahindra and Mahindra Limited in 2000 at Rs. 18 per share.

Total Investment = 100 * 18 = Rs. 1800

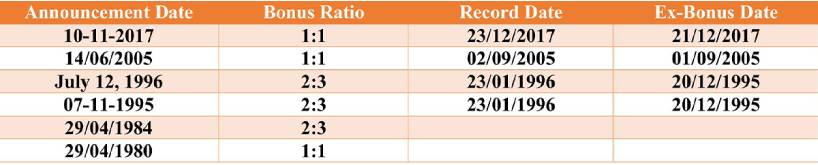

a) Bonus Shares on September 1, 2005, in a 1:1 ratio.

Number of Shares after Bonus = 200

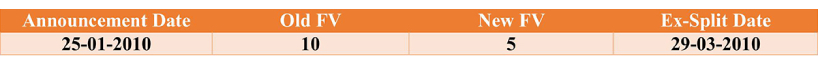

b) Stock Split on March 29, 2010, in a 1:1 ratio.

Number of Shares after Split = 400

c) Bonus Shares on December 21, 2017, in a 1:1 ratio.

Number of Shares after Bonus = 800

Therefore, if you purchased 100 shares in 2000, you now own 800 shares after the stock splits and bonuses.

Current Market Price of Mahindra and Mahindra Limited (as of June 24, 2024) = Rs. 2896 per share

Total Value of Investment Now in 2024 = 800 * 2896 = Rs. 23,168,000 (~23.17 lakhs)

An initial investment of Rs. 1800 in 2000 would now be worth approximately Rs. 23.17 lakhs in 2024. If your shares have gone to the IEPF, you could be missing out on this significant amount, which includes the value from bonuses, stock splits, and dividends. With such a substantial potential net worth, it's essential to claim your unclaimed shares and dividends from Mahindra and Mahindra Limited.

The Early Years (1945-1950s)

Mahindra & Mahindra Limited, founded in 1945 by brothers J.C. Mahindra and K.C. Mahindra, along with their partner Ghulam Mohammed, began as a steel trading company in Mumbai, India. Originally named Mahindra & Mohammed, the company capitalized on the high demand for steel during the post-war reconstruction period.

In the early 1950s, the company ventured into the automotive sector through a joint venture with Willys-Overland Corporation from the United States. This partnership, which led to the creation of Mahindra & Mahindra (M&M), enabled the production of the iconic Willys Jeep in India. The Jeep quickly became renowned for its ruggedness and durability, gaining widespread popularity across the Indian market.

Expansion and Growth (1960s-1980s)

During the 1960s, Mahindra & Mahindra expanded its product line to include light commercial vehicles, tractors, and utility vehicles. The launch of the Mahindra CJ-3B in 1961 marked the company's first indigenous product. This model, an improved version of the Willys Jeep, featured a more powerful engine and enhanced suspension.

The 1970s saw further diversification as Mahindra & Mahindra began producing heavy commercial vehicles, diesel engines, and various industrial products. The company also entered new sectors such as real estate and hospitality.

In the 1980s, Mahindra & Mahindra made its foray into the information technology sector by forming a joint venture with IBM, named Mahindra-British Telecom. This venture provided software development and IT services to both domestic and international clients.

Diversification and Global Expansion (1990s)

The 1990s were marked by a significant transformation for Mahindra & Mahindra as it diversified into new business areas and expanded its global footprint. The company entered the financial services sector through a joint venture with BNP Paribas, creating Mahindra-BNP Paribas, which offered a range of financial services including asset management, insurance, and investment banking.

In 1996, Mahindra & Mahindra introduced its first passenger vehicle, the Mahindra Armada, a robust SUV tailored for the Indian market. Subsequent models like the Bolero, Scorpio, and XUV500 further cemented the company's reputation in the passenger vehicle segment, achieving success both domestically and internationally.

By the late 1990s, Mahindra & Mahindra had begun to establish a global presence with subsidiaries and joint ventures in countries such as the United States, China, and South Africa. Strategic acquisitions both within India and abroad allowed the company to expand its product range and enter new markets.

Recent Developments (2000s-2020s)

Throughout the 2000s and into the 2020s, Mahindra & Mahindra has continued its trajectory of growth and expansion, emphasizing innovation, sustainability, and a customer-centric approach.

Mahindra & Mahindra Limited Share Price Chart:

Source: https://www.moneycontrol.com/india/stockpricequote/auto-carsjeeps/mahindramahindra/MM

Bonus History:

Source: https://economictimes.indiatimes.com/mahindra-mahindra-ltd/infocompanybonus/companyid-11898.cms

Split History:

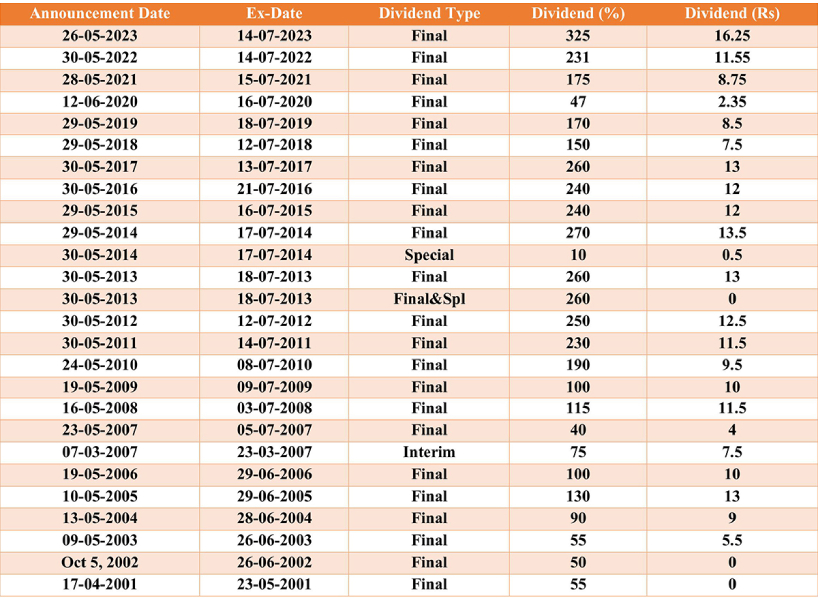

Dividend Summary

For the fiscal year ending March 2024, Mahindra & Mahindra announced an equity dividend of 422.00%, equating to Rs 21.1 per share. With the current share price at Rs 2915.80, this results in a dividend yield of 0.72%.

Source: https://www.moneycontrol.com/company-facts/mahindramahindra/dividends/MM

Why Have Your Mahindra and Mahindra Limited Unclaimed Shares and Dividends are transferred to IEPF?

According to government regulations, any dividends on shares that remain as unclaimed investments for seven consecutive years must be transferred to the Investor Education and Protection Fund (IEPF) by the respective company. This mandate ensures that if a shareholder does not claim their dividend for seven consecutive years, the associated shares are also transferred to the IEPF. In the past, if investors failed to claim their dividends, companies would retain the funds, often exploiting the investors' lack of awareness. To address this issue, the government established the IEPF, which requires companies to transfer unclaimed shares after seven years.

What is IEPF and Its Purpose?

The Investor Education and Protection Fund (IEPF) was introduced by the Government of India on September 7, 2016, under the provisions of Section 125 of the Companies Act, 2013. The IEPF serves to regulate and protect investor funds. Its responsibilities include making refunds and recovering shares, matured deposits/debentures, and unpaid dividends. Additionally, the IEPF promotes investor awareness and reimburses legal expenses incurred by depositors in pursuit of legal actions.

Recovery of Unclaimed Shares

To claim unclaimed shares of Mahindra & Mahindra Limited from the Investor Education and Protection Fund (IEPF) authority, follow these steps:

- Visit the IEPF Website: Go to the official IEPF website at www.iepf.gov.in.

- Claim Refund: Click on the 'I Want to' tab and select 'Claim Refund' from the drop-down menu.

- Initiate the Application: You will be redirected to a new page and then you will have to click the 'Click Here to Apply' button.

- Read Instructions: Carefully read the instructions provided and then click the 'OK' button.

- Select Company: On the following page, choose 'Mahindra & Mahindra Limited' from the drop-down menu.

- Enter Identification Details: Input the Permanent Account Number (PAN) or the Folio Number associated with the shares you wish to claim.

- Search for Shares: Click on the 'Search' button. If unclaimed shares are found, you can proceed. If not, the website will display 'No records found.'

- Download IEPF-5 Form: Click on the 'Generate Challan' button to download the IEPF-5 form.

- Complete the Form: Fill in the form with all required details, attach necessary documents, and sign it.

- Submit the Application: Submit the completed form along with the required documents to the nearest IEPF office.

- Verification and Processing: After the documents are verified, the IEPF authority will process your claim.

- Transfer of Shares: Once processed, the shares will be transferred to your demat account.

It is advisable to start this process promptly as there may be a time limit for claiming the shares. Additionally, consulting a lawyer or a financial advisor can provide guidance and ensure a smooth process.

Conclusion

The journey to reclaim unclaimed shares and dividends from the IEPF can be intricate and time-consuming, but it is a necessary step to safeguard your investments. The process involves multiple steps, from identifying whether your shares are in the IEPF to submitting detailed applications and supporting documents. Each step must be meticulously followed to ensure successful recovery. Understanding the nuances of the IEPF claim, lost share recovery, and the procedure for issuing duplicate share certificates is paramount. People who are in need of a smooth experience in recovering their financial assets, Share Samadhan stands out as the best share recovery firm in Delhi. With our expertise in handling IEPF claims, facilitating the transfer of unclaimed shares and dividends to the IEPF, and assisting with lost share recovery, Share Samadhan offers support in every possible way. Our knowledgeable team simplifies the recovery process, ensuring that investors can reclaim their rightful assets without unnecessary stress or delays. By partnering with Share Samadhan, you can confidently deal with the complexities of share recovery and secure your investments for the future.

India's largest & most trusted platform for recovery of unclaimed investments

Submit Your Query

Recent Posts

- Lost Your Bajaj Auto Limited Shares? A Guide To Lost Share Recovery!

- Recover Your Godrej Consumer Products Shares from IEPF – A Complete Guide

- Lost PGCIL Shares to IEPF? Here’s a Step-by-Step Recovery Guide with Share Samadhan

- How to Recover Unclaimed HDFC Life Shares from IEPF

- Recover Lost Shares of DLF Limited from IEPF

- Have You Lost Your Tech Mahindra Shares? A Guide To Lost Share Recovery!