- Sign In

- 8800 33 2200

- samadhan@sharesamadhan.com

- Sharesamadhan App

- Sharesamadhan App

Blog Details

How to Recover Unclaimed Shares of HCL Technologies Limited from IEPF

The Investors Education and Protection Fund (IEPF), operating under the Ministry of Corporate Affairs, plays a crucial role in managing unclaimed dividends and shares. If dividends on shares remain unclaimed for seven years or more, these unclaimed shares are transferred to the IEPF. Companies issue dividend checks to shareholders, and when these checks go uncashed for over seven years, they become unclaimed dividends. The shares associated with these unclaimed dividends are labeled as unclaimed shares. Both the unclaimed dividends and shares are then transferred to the IEPF, which manages them until claimed by the rightful shareholder.

For shareholders of HCL Technologies Limited, reclaiming their unclaimed dividends and shares involves a straightforward process. By coordinating with the company and its registrar, shareholders can ensure the efficient recovery of their assets. This proactive approach prevents the permanent loss of valuable investments and entitlements.

In the case of HCL Technologies Limited, shareholders can reclaim their unclaimed dividends and shares by coordinating with the company and its registrar. This process ensures that shareholders can recover their assets efficiently.

HCL Technologies Limited

Registered Address:

806, Sidharth, 96, Nehru Place,

New Delhi, Delhi,

Pin Code: 110019

The process involves share dematerialization, IEPF share recovery, share transfers, duplicate share certificates, mutual fund recovery, and dividend recovery. These steps are essential for retrieving unclaimed shares and dividends from the IEPF.

HCL Technologies Limited: Value Creation Over 20 Years

Since its listing on the stock exchanges, HCL Technologies Limited has been a top performer. In 2000, the share price was approximately Rs. 75. As of July 22, 2024, the share price is Rs. 1,579.90, not accounting for any bonus or split of shares.

Let's explore the growth of an initial investment:

- Initial Purchase in 2000:

- Shares Purchased: 100 shares at Rs. 75 each

- Total Investment: 100 * 75 = Rs. 7,500

- Stock Events:

- Stock Split on Nov 27, 2004 (1:1):

- New Total Shares: 200 - Bonus Shares on Mar 15, 2007 (1:1):

- New Total Shares: 400 - Bonus Shares on Mar 19, 2015 (1:1):

- New Total Shares: 800 - Bonus Shares on Dec 5, 2019 (1:1):

- New Total Shares: 1,600

- Current Market Value (as of 2024):

- Current Price per Share: Rs. 1,579.90

- Total Investment Value: 1,600 * 1,579.90 = Rs. 25,278,400

If you originally purchased 100 shares in 2000, you now have 1,600 shares worth approximately Rs. 25.28 lakhs. This significant growth highlights the importance of claiming your unclaimed shares and dividends from the IEPF.

The History of HCL:

1991-1999: Early Years and Expansion

- 1991: Founded as HCL Overseas Limited, later renamed HCL Technologies Limited in 1999.

- 1996: Formed a joint venture with Perot Systems, expanding its client base.

- 1998: Began exploring markets in Europe and Asia Pacific, focusing on cutting-edge technologies.

- 1999: Launched an IPO and created subsidiaries like HCL Technologies America.

2000-2005: Growth and Global Reach

- 2000: Established offshore centers for companies like KLA-Tencor and Conexant.

- 2001: Partnered with NCR Corp. and Toshiba Information Systems.

- In 2002, HCL acquired Gulf Computers Inc. and entered into a joint venture with Jones Apparel Group.

- 2003: Secured contracts with Airbus and AMD, strengthening its BPO services.

- 2004: Acquired full ownership of HCL Perot Systems and opened an insurance solutions center in Chennai.

- 2005: Partnered with Compuware Corporation and entered a joint venture with NEC, Japan.

2006-2010: Innovation and Acquisitions

- 2006: Signed outsourcing deals with companies like Teradyne and Celestica Inc.

- 2007: Formed alliances in the Middle East and signed contracts with Alenia Aeronautica.

- 2008: Acquired UK firm Axon, enhancing global capabilities.

- 2009: Entered into IT infrastructure agreements with Energy Future Holdings and MTV Networks.

- 2010: Partnered with nMatric for automotive solutions and signed deals with Meggitt.

2011-2015: Technological Leadership

- 2011: Launched mobility labs in Singapore and collaborated with Orion Edutechs.

- 2012: Secured strategic relationships with Statoil and State Street.

- 2013: Partnered with Nokia and Cobham Plc, expanding service offerings.

- 2014: Received multiple awards for governance and HR excellence.

- 2015: Opened new global delivery centers in Oslo and Frisco, acquiring PowerObjects.

2016-2020: Expansion and Digital Transformation

- 2016: Acquired stakes in P2P and secured major IT contracts with companies like Husqvarna.

- 2017: Acquired Butler America Aerospace and maintained top employer status in the UK.

- 2018: Launched 5G solutions and acquired C3i Solutions.

- 2019: Collaborated with IBM and Google Cloud, acquiring Strong-Bridge Envision.

- 2020: Entered Sri Lanka and opened a cybersecurity center in Europe.

2021-Present: Strategic Alliances and Recognitions

- 2021: Signed significant deals with Airbus and UD Trucks, recognized in the World Best Employers List.

- 2022: Launched a new brand positioning and partnered with Purdue Global and Google Cloud.

- 2023: Announced acquisition of ASAP Group, strengthening its presence in automotive engineering.

Source: https://www.moneycontrol.com/company-facts/hcltechnologies/history/HCL02

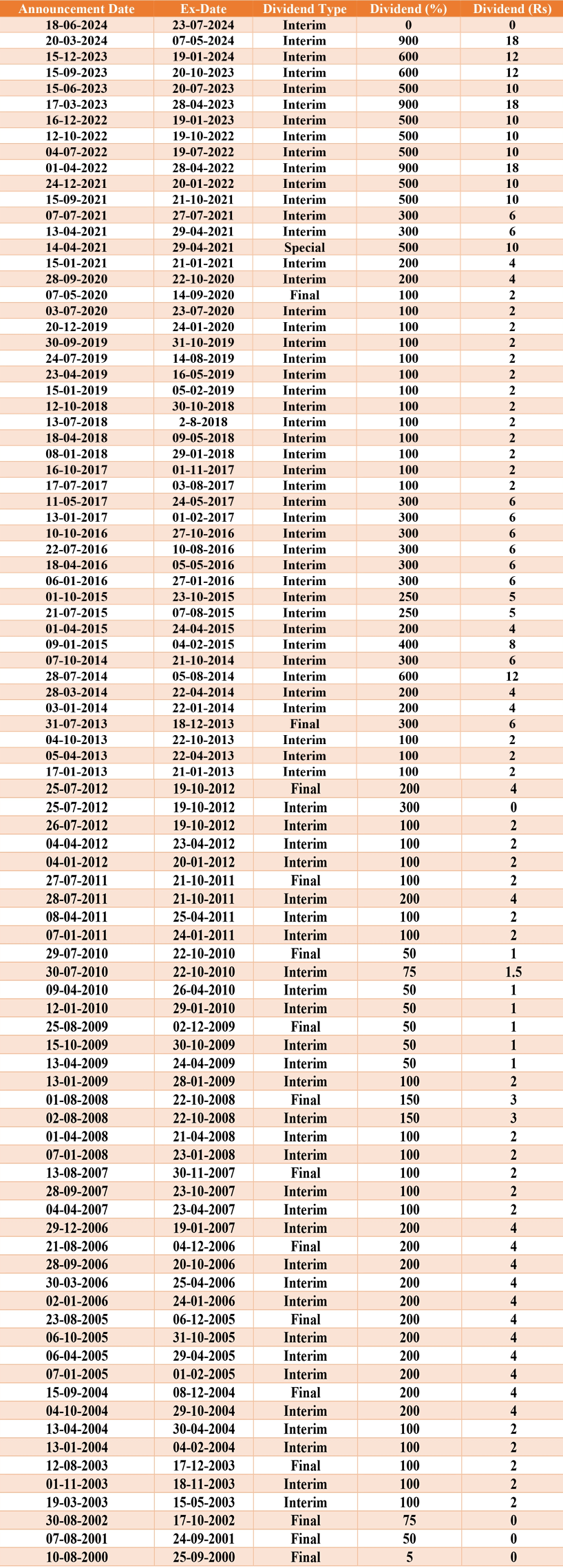

HCL Dividend Table:

Source: https://www.moneycontrol.com/company-facts/hcltechnologies/dividends/HCL02

What is IEPF and its Purpose?

The government of India introduced the Investor Education and Protection Fund (IEPF) on September 7, 2016, under the provisions of section 125 of the Companies Act, 2013. The IEPF serves as a regulatory framework designed to protect and manage investors' funds.

The IEPF's primary responsibilities include making refunds and recovering shares, matured deposits/debentures, and unpaid dividends. Additionally, the IEPF promotes awareness among investors and ensures the reimbursement of legal expenses incurred by depositors in pursuing action suits.

Procedure for Claiming Dividend and Shares of HCL Technologies Limited from IEPF Authority

To make an IEPF claim for dividends and shares of HCL Technologies Limited, follow these steps:

- Access the IEPF-5 form on the MCA portal from the IEPF website. It is advisable to carefully follow the instructions provided in the instruction kit on the IEPF website.

- Complete the form and submit it. An acknowledgment will be issued with a "Submit Request Number" (SRN). Keep this SRN for future tracking purposes.

- Print the form and acknowledgment.

- Send the original indemnity bond, acknowledgement receipt, share certificate, IEPF Form 5, self-attested Aadhaar card, bank account details linked to your Aadhaar card, and Demat account number to the Nodal Officer (IEPF) at the company's registered office. Label the envelope with "Claim for refund from IEPF Authority."

- The Nodal Officer of the company will verify the claim form. After verification, the claim will be forwarded to the IEPF authority. Based on the verification report, the IEPF authority will issue the refund of unclaimed shares and dividends to the claimant’s account.

- The IEPF authorities are required to reply to the verification report sent by the company within 60 days.

Please note that the refund process from IEPF is lengthy and may take more than 8-12 months, as IEPF has only one office located in Delhi.

How to Check Whether HCL Technologies Limited Shares are in IEPF

To perform an IEPF shares search and check whether your HCL Technologies Limited shares are in IEPF, follow these steps:

- Click on the website to proceed.

- Enter investor details, such as name, father's name, folio number, DP-ID, Client-ID, and account number.

- Click the search button.

Please note that you can perform an IEPF search using any of the following combinations:

- Investor Name and Father/Husband Name

- Folio Number (as per the certificate)

- DP-ID, Client-ID, and Account Number (entered without spaces and separated by hyphens in the format DPID-ClientID-Account Number).

Fund Recovery Company Services

As a fund recovery company, we have successfully helped clients reclaim shares transferred to the IEPF due to lost or misplaced original share certificates. We specialize in recovering shares and dividends in cases involving children, deceased shareholders, and nominees, multiple legal heirs, legal heirs, and family members.

Conclusion

Recovering shares and dividends through an IEPF claim can be challenging for shareholders. However, with Share Samadhan’s expertise as a fund recovery company, we ensure a smooth and efficient recovery process. If you need assistance with an IEPF shares search or guidance on how to find unclaimed shares, we are here to help.

FAQs

- What is the IEPF and why would shares be transferred to it?

Answer: The Investor Education and Protection Fund (IEPF) is a fund established by the Government of India to protect investors' interests and promote awareness. Shares are transferred to the IEPF if they remain unclaimed or unpaid for seven consecutive years. This can happen if dividends remain unclaimed, and the shareholder does not respond to reminders or fails to encash dividend warrants. - How can I initiate an IEPF claim to retrieve my unclaimed shares?

Answer: To initiate an IEPF claim, follow these steps:

1. Visit the official IEPF website.

2. Download and fill out Form IEPF-5.

3. Attach required documents, such as identity proof, address proof, original share certificates, and proof of entitlement.

4. Submit the form online and send a physical copy of the form along with documents to the nodal officer of the company concerned.

5. The company verifies the claim and forwards it to the IEPF Authority for final approval and disbursement. - What is involved in the IEPF shares search process?

Answer: The IEPF shares search process involves identifying unclaimed shares that have been transferred to the IEPF. You can search for your shares by visiting the IEPF website and using the online search tool. Enter details such as your name, folio number, or company name to find out if any shares are listed under your name. This search helps investors identify unclaimed shares they may be entitled to claim. - How do I perform an IEPF search to find my unclaimed shares?

Answer: To perform an IEPF search, follow these steps:

1. Go to the IEPF website.

2. Use the "Search Investor" tool available on the homepage.

3. Enter your details, such as name, father/husband’s name, and company name.

4. Review the search results to identify any unclaimed shares associated with your name.

5. Note the details for initiating a claim. - What are some tips on how to find unclaimed shares?

Answer: Here are some tips to find unclaimed shares:

1. Check your old financial records and correspondence for any share certificates or dividend warrants.

2. Use the IEPF online search tool to look up unclaimed shares.

3. Contact the companies where you held shares to inquire about any unclaimed dividends or shares.

4. Check with the Registrar and Transfer Agents (RTAs) of the companies.

5. Seek assistance from a fund recovery company specializing in locating and recovering unclaimed assets. - How can a fund recovery company assist with IEPF claims and unclaimed shares?

Answer: A fund recovery company can assist with IEPF claims and unclaimed shares by providing the following services:

1. Conducting a thorough search to identify unclaimed shares.

2. Gathering and organizing necessary documentation for the claim.

3. Assisting in the preparation and submission of Form IEPF-5.

4. Coordinating with the companies and IEPF Authority to ensure the claim is processed smoothly.

5. Providing legal and procedural advice throughout the claim process.

These FAQs aim to provide clarity and guidance on IEPF claims, unclaimed shares, and the search process to help investors recover their entitlements efficiently.

India's largest & most trusted platform for recovery of unclaimed investments

Submit Your Query

Recent Posts

- Recover Your Godrej Consumer Products Shares from IEPF – A Complete Guide

- Lost PGCIL Shares to IEPF? Here’s a Step-by-Step Recovery Guide with Share Samadhan

- How to Recover Unclaimed HDFC Life Shares from IEPF

- Recover Lost Shares of DLF Limited from IEPF

- Have You Lost Your Tech Mahindra Shares? A Guide To Lost Share Recovery!

- IEPF Recovery & Transmission: How To Claim Eicher Motors Shares Of A Deceased Relative?