- Sign In

- 8800 33 2200

- samadhan@sharesamadhan.com

- Sharesamadhan App

- Sharesamadhan App

Blog Details

How to Recover Unclaimed Shares & Dividends of Bharti Airtel Limited from IEPF Authority

The sound of a connection – that familiar ring or beep – often brings to mind the name ‘Airtel’ for millions across India. Airtel is more than just a name on your mobile screen; it has become an essential part of daily communication for countless Indians. Bharti Airtel has served as a crucial bridge connecting diverse landscapes and people. This telecom giant has profoundly influenced how India communicates, conducts business, and consumes content. However, as time passes, many shareholders may find that their dividends and shares have gone unclaimed. If you are one of those shareholders, it's important to take action. This blog will guide you on how to recover shares from IEPF and claim your IEPF unclaimed shares and dividends. Understanding the process can help you reclaim your unclaimed investments and provide you with vital information on how to find lost investments.

Overview of Bharti Airtel

Since its inception in 1995, Bharti Airtel has continually redefined the telecommunications landscape. Today, with a market capitalization of ₹5.32 trillion, it stands as one of the most valuable companies in India. As of June 2023, Airtel employs 67,774 individuals, contributing significantly to their personal and professional development.

The company’s philosophy is rooted in understanding and meeting the diverse needs of its extensive customer base. Airtel's commitment goes beyond providing seamless connectivity; it aims to revolutionize communication within India and across its borders. Airtel’s success is no magic—it is the result of strategic planning, a keen understanding of the Indian market, and an unwavering drive for innovation. Their extensive network ensures that even the remotest parts of the country are not left behind in the digital age.

History of Bharti Airtel

1995: Bharti Cellular Limited was born, marking the dawn of a new era in mobile communication in India. Operating under the brand name 'Airtel', the company launched mobile services in Delhi, laying the groundwork for India's telecom revolution.

2000: Bharti Airtel expanded its reach by acquiring Skycell Communications in Chennai.

2002: Airtel became the first telecom operator in India to surpass 2 million mobile subscribers, a significant milestone in the industry.

2005: Responding to the growing demand for data, Airtel launched its broadband and telephone services. This year also saw Airtel's entry into rural India, furthering its mission to connect every corner of the country.

2008: Airtel launched 'Airtel Live', their Value Added Service (VAS) platform. This service provided a wide range of offerings, including astrology and stock updates, directly to mobile phones.

2010: A transformative year for Airtel! The brand unveiled a new logo and signature tune and introduced 3G services, ushering in a new era of high-speed mobile internet in India.

2012: Airtel launched 4G services in Kolkata, becoming the first operator in India to do so. This technological advancement fundamentally changed how India consumed internet services. Airtel also ventured into e-commerce with 'Airtel Money', its mobile wallet service.

2015: Airtel expanded its 4G services to over 296 towns across India, ensuring its customers stayed ahead in the digital race.

2016: Airtel launched 'Payments Bank', becoming the first telecom company to enter the banking sector. This move supported the government's vision of financial inclusion and digital transactions.

2018: Airtel and Telecom Egypt announced a strategic partnership to offer end-to-end connectivity solutions, enhancing Airtel's network for enterprise customers.

2019: Airtel launched 'Airtel Thanks', a comprehensive rewards program offering exclusive benefits to its loyal customers across a range of services.

2020: Amidst the global pandemic, Airtel successfully handled a substantial surge in data usage and launched 'Airtel Secure', which provided advanced cybersecurity solutions for businesses.

2021: Airtel took a step into the future by testing its 5G network in Hyderabad, showcasing its readiness for the next generation of mobile internet and commitment to technological innovation.

2022: Airtel teamed up with Hughes for satellite broadband, collaborated with Google to boost India's digital growth, acquired a 25% stake in SD-WAN startup Lavelle Networks, and commissioned a 21 MW Solar Power Unit in Maharashtra, furthering its green initiatives.

2023: Airtel continued its expansion and innovation, launching 5G services in multiple cities across India and partnering with Qualcomm to accelerate the 5G rollout. The company also made strides in sustainability by setting up more solar power units and exploring green hydrogen solutions.

2024: In the current year, Airtel has maintained its momentum, crossing 500 million subscribers globally and further strengthening its 5G network. The company has also ventured into new areas like cloud gaming and IoT solutions, demonstrating its commitment to staying at the forefront of technological advancements in the telecom industry.

Let’s Calculate The Value of Bharti Airtel Shares:

Before knowing the process of claiming Bharti Airtel Limited's unclaimed shares and dividends from IEPF, let's explore why it's crucial to recover your shares and dividends. Bharti Airtel Limited shares have consistently been top performers on the stock market since their listing. In 2002, the share price was approximately Rs. 15, and as of 16.07.2024, it has risen to Rs. 1467.65, not accounting for any bonuses or stock splits.

Let's assume you purchased 100 shares of Bharti Airtel Limited in 2002 at Rs. 15 per share.

Total Investment: 100 * 15 = Rs. 1500

a) Stock Split on 9 July 2009 in a 1:1 ratio

Number of Shares after Split: 200

Therefore, if you bought 100 shares in 2002, you now own 200 shares after the stock split.

Current Market Price of Bharti Airtel Limited (as of 16.07.2024): Rs. 1467.65 per share

Total Value of Investment Now in 2024: 200 * 1467.65 = Rs. 2,93,530

Your initial investment of Rs. 1500 in Bharti Airtel Limited shares in 2002 would now be worth approximately Rs. 2.93 lakhs. If your shares have been transferred to IEPF, consider the significant net worth you currently hold, including bonus shares and dividends. With such a substantial amount at stake, it's crucial to reclaim your unclaimed shares and dividends from Bharti Airtel Limited.

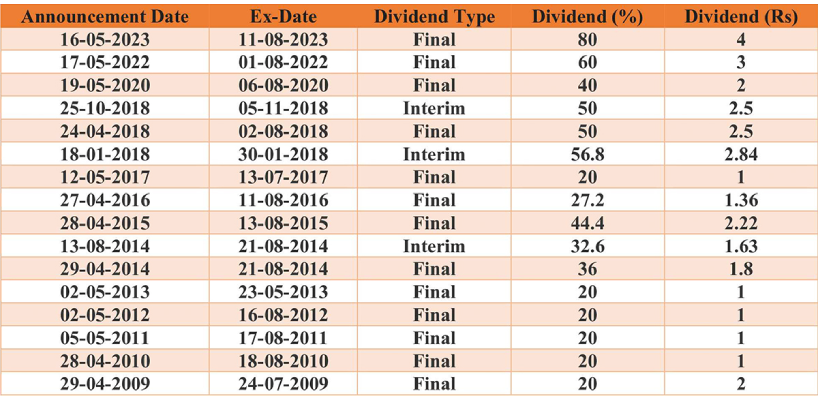

Dividend History:

For the fiscal year ending in March 2024, Bharti Airtel announced an equity dividend of 160.00%, equating to Rs 8 per share. Given the current share price of Rs 1466.65, this results in a dividend yield of 0.55%.

Source: https://www.moneycontrol.com/company-facts/bhartiairtel/dividends/BA08

Why Were Your Shares of Bharti Airtel Limited Transferred to IEPF?

According to government regulations, any dividend on shares that has not been claimed for seven or more consecutive years must be transferred by the respective company to the Investor Education and Protection Fund (IEPF). If dividends remain unclaimed for seven consecutive years, the company must also transfer the associated shares to the IEPF. Previously, companies would benefit from investors’ unclaimed dividends by retaining the funds. Recognizing this issue, the government established the IEPF, which mandates that companies transfer IEPF unclaimed shares and dividends to the fund after seven years.

What Is the IEPF and Its Purpose?

The Investor Education and Protection Fund (IEPF) was established by the Indian government on September 7, 2016, under Section 125 of the Companies Act of 2013. The IEPF serves as a regulatory framework to manage and protect investor funds.

The IEPF is responsible for refunding shares, recovering matured deposits/debentures, paying IEPF unclaimed dividends, and raising investor awareness. It also ensures that depositors are reimbursed for any legal costs incurred while pursuing legal action.

How to Claim Dividends and Shares of Bharti Airtel Limited from IEPF

Here are the steps to file an IEPF claim:

- Access the IEPF-5 Form: Visit the IEPF website and access the IEPF-5 form on the MCA interface. Carefully read and follow the instructions provided in the instruction package available on the IEPF website.

- Fill Out the Form: Complete the form and submit it online. A "Submit Request Number" (SRN) will be generated upon acknowledgment. Keep this SRN handy for future tracking of your form.

- Print the Form: Take a printout of the completed form and the acknowledgment.

- Submit Documents: Send the original copies of the indemnity bond, acknowledgment copy, share certificate, and IEPF Form 5 to the company's registered office’s Nodal Officer (IEPF) in an envelope labeled "Claim for refund from IEPF Authority." Include a self-attested copy of your Aadhaar card and the following information:

- Indemnity bond

- Acknowledgment copy

- Share certificate

- IEPF Form 5 - Verification by Nodal Officer: The company’s nodal officer will verify the claim form and forward it to the IEPF authorities. Upon verification, the IEPF authorities will refund any IEPF unclaimed shares and dividends to the claimant’s account.

- IEPF Response: The IEPF authorities are required to respond to the company's verification report within 60 days.

Important Considerations

Since the IEPF operates only one office located in Delhi, the refund process can be lengthy and cumbersome, often taking more than 8 to 12 months to complete.

To begin the process, you might want to perform an IEPF unclaimed shares search. This IEPF search will help you identify any unclaimed investments that might be due to you. Understanding how to find lost investments is crucial in reclaiming what is rightfully yours.

If you need to recover shares and dividends, understanding how to recover shares from IEPF is essential. The IEPF website provides a comprehensive guide on this process, ensuring you can reclaim your unclaimed investments effectively. The easiest option is to get in touch with Share Samadhan and the experts associated with the firm will guide you through the process and will assist you in getting back your money.

FAQs on IEPF Claim and Unclaimed Investments

1. What is an IEPF claim?

An IEPF claim refers to the process by which investors or their legal heirs can reclaim shares, dividends, or other financial assets that have been transferred to the Investor Education and Protection Fund (IEPF). This typically happens when these assets remain unclaimed for seven consecutive years.

2. How do I perform an IEPF unclaimed shares search?

To conduct an IEPF unclaimed shares search, you can visit the official IEPF website. Use the search function by entering relevant details such as your name, folio number, or the company's name to identify if any of your shares have been transferred to the IEPF.

3. What are IEPF unclaimed shares?

IEPF unclaimed shares are shares that have been transferred to the Investor Education and Protection Fund after remaining unclaimed by the shareholder for seven or more consecutive years. This transfer is mandated by the Indian government to protect investors' interests.

4. What is an IEPF unclaimed dividend?

An IEPF unclaimed dividend refers to dividend payments that have not been claimed by shareholders for seven consecutive years. These unclaimed dividends are then transferred to the Investor Education and Protection Fund, as per government regulations.

5. How to recover shares from IEPF?

To understand how to recover shares from IEPF, follow these steps:

- Visit the IEPF website and access the IEPF-5 form.

- Fill out and submit the form online.

- Print the form and acknowledgment.

- Send the necessary documents, including the indemnity bond, acknowledgment, share certificate, and IEPF Form 5, to the company's Nodal Officer.

- The company's Nodal Officer will verify the claim and forward it to the IEPF authorities.

- Upon verification, the IEPF will transfer the shares and dividends to your account.

6. What are unclaimed investments?

Unclaimed investments are financial assets, such as shares, dividends, or deposits, that have not been claimed by their rightful owners for a certain period, typically seven years. These assets are then transferred to the Investor Education and Protection Fund to ensure their protection.

7. How to find lost investments?

To understand how to find lost investments, follow these steps:

- Check your financial records and statements for any investments you may have forgotten.

- Use the search facilities on the IEPF website to look for unclaimed shares and dividends.

- Contact the investor relations department of the companies you have invested in to inquire about any unclaimed investments.

- Utilize online databases and resources provided by financial institutions to locate any lost or forgotten investments.

India's largest & most trusted platform for recovery of unclaimed investments

Submit Your Query

Recent Posts

- Recover Your Godrej Consumer Products Shares from IEPF – A Complete Guide

- Lost PGCIL Shares to IEPF? Here’s a Step-by-Step Recovery Guide with Share Samadhan

- How to Recover Unclaimed HDFC Life Shares from IEPF

- Recover Lost Shares of DLF Limited from IEPF

- Have You Lost Your Tech Mahindra Shares? A Guide To Lost Share Recovery!

- IEPF Recovery & Transmission: How To Claim Eicher Motors Shares Of A Deceased Relative?